George Osborne tries to save FTSE 100

27th June 2016 12:42

by Lee Wild from interactive investor

Share on

After the incredible events of Friday 24 June, investors have had a weekend to digest all the political and economic consequences of Brexit. Are they any the wiser? Of course not. Even professional traders and institutions have no idea exactly how this will play out, and markets will continue to gyrate wildly in time with rapidly changing events.

David Cameron has already handed in his notice, and opposition leader Jeremy Corbyn's position looks increasingly untenable following a widely-criticised and ineffective performance backing the 'Remain' campaign. Fourteen senior Labour party members have already resigned.

Now, chancellor George Osborne has broken cover with a speech aimed at propping up markets in the aftermath of the Brexit vote. There will be no emergency budget, and authorities are "ready to deal with the consequences" he tells us.

Futures prices had pointed to a drop below 6,000 until Osborne spoke. The market did steady, trading down just 16 points half-an-hour after the market opened officially, but it will take much more than this to steady the ship. Now off 102 points at 6,036, equities remain vulnerable and sterling, currently $1.3206, has hit a 30-year low.

Miners and - now valuable safe havens for investors - are up over 7% Monday, taking gains since Thursday to more than 20%. Multi-nationals with significant overseas earnings - think , and - are also capping blue chip losses.

Traditional defensive plays like drug majors and , and tobacco giant and are also doing well. Utilities like , and are bid up as a safe port in a storm.

Predictably, banks and housebuilders are taking another kicking Monday. , and have slumped 13-16% already. is off 15%, 12% and 9%. Wimpey has now lost 40% of its value since Thursday, Persimmon 36% and 30%. RBS is down 30% and Lloyds 28%.

Time will tell whether this is a great buying opportunity. One might reasonably expect prices to recover long-term, but investors will require patience and nerves of steel.

Elsewhere, budget airline has issued a profits warning. Air controller strikes and the Egyptair tragedy will hit third-quarter pre-tax profit to the tune of £28 million, while the economic and consumer uncertainty created by Brexit will affect traffic. That could wipe an extra £50 million off the bottom line, warns Numis Securities. Fuel costs and exchange rates will trigger a further £25 million hit.

In all, Numis cuts its pre-tax profit forecast for 2016 from £716 million to £612 million. Ouch.

Truer indications

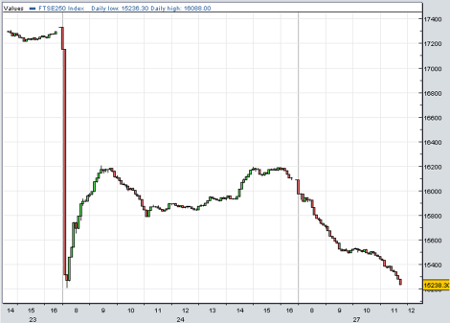

However, for a truer indication of sentiment, check out the FTSE 250. With more of its profits dependent on strength in the domestic economy, the impact on share prices has been more dramatic than for the FTSE 100.

The mid-cap index is now down 12% since Thursday compared with the FTSE 100 down a modest 5% and still 140 points better than last week's low at 5,899.

Challenger banks , and have been flattened, down 31%, 23% and 21% respectively Monday.

and are also nursing heavy losses.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.