What happens to bank sector dividends now?

27th June 2016 14:33

by Harriet Mann from interactive investor

Share on

Analysts reassured investors that we wouldn't wake up in an apocalyptic world after a Brexit vote. Well, the sky hasn't turned black and the sea hasn't submerged London yet, but the political establishment is in utter disarray. This has naturally spilled into the financial markets and both and shares were temporarily suspended Monday morning.

But this is a political crisis, not a financial one, urges Deutsche Bank analyst David Lock, who tells us what he thinks is in store for the UK banking sector in the weeks and months ahead.

The banking landscape has changed overnight: rates will now be cut, loan growth is likely to fall and loan losses will increase. Dividends and capital returns are at "greater risk or likely to be pushed back".

"For and RBS we also think that the political and economic uncertainty, and the share price performance, means the likelihood of the government selling its remaining stakes (9% in Lloyds, 73% in RBS) is remote in the near-to-medium term," writes Lock. "We have therefore reduced our dividend and capital distributions forecasts for Lloyds and RBS. For we now see increased risks that the dividend is cut."

Instead of joining the US in raising interest rates, the Bank of England will probably cut rates by 25 basis points (bp) from 0.5% in August. A further 15bp cut and a re-start of a quantitative easing (QE) programme in September "would not be a surprise to us," says Deutsche. Cutting deposits ahead of a rate move lower should help net interest margin (NIM) short-term, but there is limited scope to cut much further as deposit rates are already so low.

It's been a hard slog getting to this stage of recovery after the destructive financial crisis and management teams won't want to add risk by paying higher dividends against a challenging backdrop - especially with cuts to rates and growth forecasts. Even if they do, the regulator might not sign off any large payouts.

"With political and economic uncertainty likely to be here to stay, we expect the coming weeks and months will see significant volatility in the share prices of UK financials and those with UK operations," explains Lock. "In these volatile times, relative positioning is important."

Uncertainty was meant to vanish with last week's European referendum, but the political and financial landscape has only ushered in a new period of perhaps even greater uncertainty. Markets hate uncertainty, so don't expect any let-up turbulence across financial markets.

"Whilst we have included higher loan losses, our forecasts do not assume a recession/financial crisis. In fact, UK banks are in a far better position in 2016 to withstand a downturn today than in 2008: capital levels and quality is higher, and key exposures (such as Ireland/commercial real estate (CRE)) are lower," says Lock.

Lloyds Banking

51p

With nearly all of Lloyds' operations based in the UK, the country's economic health will direct the bank's fortunes in a post-Brexit world. But considering its lower level of risk compared to 2008, Lock reckons the lender is the most defensive from a margin perspective and think the shares look "oversold" after falling 28% to a three-year low of 52p since Friday's open.

Strong deposit pricing underpins its margin protection, which should provide some support. However, the bank is not immune to industry challenges and NIM is likely to fall by 20 basis points from 2016-2018, especially in consumer finance.

In charge since 2011, Horta Osorio's position at the helm of the bank could also be under question.

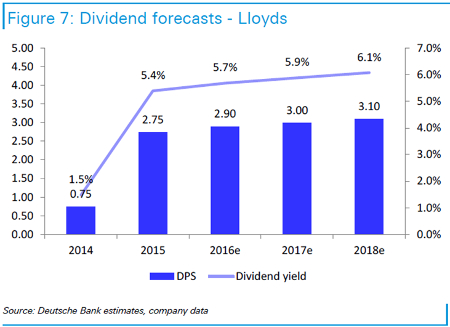

Lock has slashed his 2016 dividend forecast by 5p to 2.9p, which allows the core equity tier one (CET1) - a measure of financial strength - to climb above 14% in 2017 and 15% in 2018. That could provide a useful buffer for higher loan losses if needed.

Still offering a prospective dividend yield of 5.6%, Lloyds is well ahead of other domestic banks and supports Lock's 'buy' rating and 63p target price.

Royal Bank of Scotland

153p

The most exposed to the Brexit result, RBS is now likely to suffer from delayed capital returns, lower growth and shrinking margins. Recent performance has been underpinned by hopes of restarting dividends, so a Brexit decision has seen the shares crash a third since the referendum result.

"RBS core bank has been performing well recently and growing well. We expect this to be impacted by Brexit - in particular lending growth, as well as lower margins (RBS deposit costs already below UK average at around 58bps which gives it lower near-term benefits from a rate cut). We have therefore cut NIM forecasts, and our loan growth assumptions to 1%."

Investors should now expect dividends to restart in 2018 and the buyback programme is more likely to be worth £2 billion than the £8 billion previously slated, says Lock.

The government has shelved plans to sell its stake in RBS and Lloyds following the vote to leave. The £2 billion of retail shares in Lloyds were meant to be offered to investors, perhaps as soon as the autumn in the event of a 'Remain' vote. A 73% holding in RBS and £17.5 billion of loans issued by the now obsolete Bradford and Bingley would have gone too.

"As a pair, we would choose Lloyds vs. RBS given that the former has nearer term dividend support and stronger earnings power," says Lock.

Barclays

125p

Next in the pecking order is Barclays, which Deutsche Bank reckons will be the least-affected of the big three domestic lenders thanks to its US exposure. Still, the group's income yields are likely to fall by around 30 basis points up to 2018 and impairments are expected to rise.

The bank's market value has crashed 27% since Friday's open to a seven-year low, although the analyst reckons the shares are worth 160p.

Aldermore

115p

Challenger bank has been downgraded from 'buy' to 'hold' as concerns over the housing market continue. Net lending forecasts have been cut to £1.2 billion in 2016 and £700 million in 2017/2018, and ahead of any rate cut asset yields have been trimmed.

Crashing 45% since the UK voted 'Out' to an all-time low of 114p, Deutsche Bank thinks the shares are worth 170p.

Internationals

International banks HSBC ('hold', target price 470p) and ('sell', 480p) should not be seen as a total safe haven. The weaker pound will act as a headwind given they report financial results in US dollars, but pressure on revenues from 2017 should be more of a concern as worries about the top line have already triggered earnings downgrades.

"We remain cautious on both names given their pan-regional business models," says Lock. "Brexit raises the risks of a dividend cut at HSBC."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.