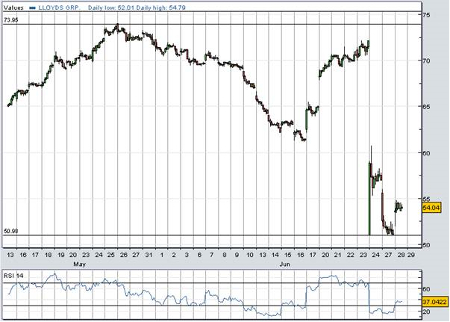

Lloyds still favourite despite dividend threat

28th June 2016 14:19

by Lee Wild from interactive investor

Share on

Leaving the European Union will undoubtedly make it more difficult for UK banks to make decent money. Low economic growth and cuts in interest rates will put pressure on so-called net interest margins and crimp profits. However, although headwinds are industry-wide, the analysts at UBS have a list of favourites picked for their simplicity.

"Though on Friday there were few defensive bank stocks in evidence we retain a preference for high capital ratio simple banks which are low in capital markets exposure," writes banks analyst Jason Napier.

"A flight to safer assets is likely to leave yield curves in Europe and elsewhere depressed for longer, putting pressure on net interest margins, while lower confidence by borrowers to invest and tighter credit criteria from banks could hit loan growth and perhaps property prices too."

That does not bode well for many lenders. There is also a clear risk that equity-linked capital market revenue will suffer as deals are pulled or priced lower. And mortgage banks could be in trouble if house prices fall, even by a comparatively modest 10%.

However, it's the less seasoned, faster-growth challenger bank loan portfolios with higher average loan-to-values (LTVs) that are more at risk from a near-term slowdown, argues UBS.

"On our current estimates European banks are trading at 8.1 times 2017 earnings per share and 0.7 times 2016 tangible net asset value for a 10% 2017 forecast return on tangible equity," it says.

UBS does not think that's cheap enough to jump into the sector, and expects more cautious dividend payout profiles given the outlook for the economy uncertain. But, as with Deutsche Bank yesterday, the Swiss broker picks the UK-focused lender as one to survive the chaos.

"Even if dividend payouts are reduced we'd see healthy distributions from the likes of , Lloyds Banking Group and ."

David Lock at Deutsche Bank yesterday slashed his 2016 dividend forecast for Lloyds by 5p to 2.9p, which allows the core equity tier one (CET1) - a measure of financial strength - to climb above 14% in 2017 and 15% in 2018.

Still, the shares still offer a prospective dividend yield of 5.6%, and Lock has a 63p target price. Napier still has an 86p price target on Lloyds.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.