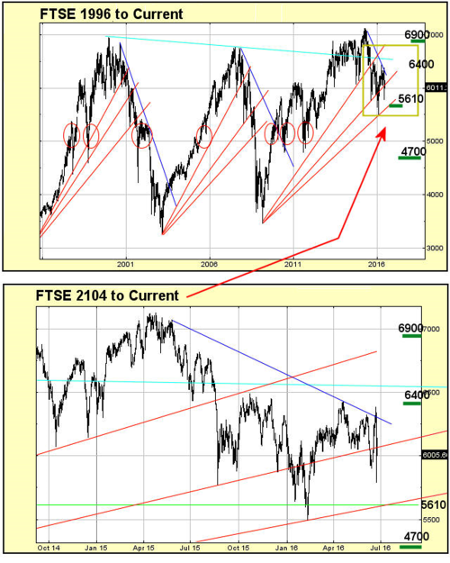

FTSE 100: 4,700 or 6,900?

29th June 2016 09:55

by Alistair Strang from Trends and Targets

Share on

I've a "chart from hell" which I sometimes need to resurrect when trying to figure out what the heck is happening with the UK markets.

To deal with the upper chart, this masterpiece from the beginning of time rather neatly highlights a market which tends not to learn from its past mistakes. Or rather it, perhaps, illustrates that humans generally behave the same when presented with a set of circumstances.

The funny thing is, currently there is a massive argument favouring the FTSE 100 making its way toward 5,610 as a hopeful bounce position. This pretty neatly coincides with the lower red trend line and, when I look at what happened historically, a second bang against this trend does indeed generally produce recovery.

And then things go pear-shaped.

In the case of the FTSE, should the market achieve my calculation of 5,610, history suggests a bounce toward the 6,000 level. And at this point, opening a short will make some sense, probably with a ridiculously wide stop as the market may fall to around 4,700 points; if history repeats itself!

What does the market need do to foul my calculations and confound historical precedent?

I'd be fairly impressed if the FTSE somehow managed to better 6,256 in the days ahead. In addition to making my brain explode, it would also provide a reasonable indication London intends growth toward the 6,400 level.

Amazingly (and the reason my brain would be decorating the ceiling), I'm able to calculate a logical secondary above 6,400 at roughly 6,908.47 points. What's interesting about such an ambition is it does not look stupid when drawn on a chart. Just highly unexpected...

Hopefully the market's tendency to repeat history fails as the current set of circumstances is fairly unusual. Unfortunately, when viewing the chart, the tech crash of 2002 was unusual, as was the banking crash of 2009.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.