The stockmarket in July: Don't wait until St Leger's Day

29th June 2016 17:40

by Stephen Eckett from ii contributor

Share on

The old stockmarket adage, "sell in May and go away", continues: "don't come back until St Leger's Day".

However, analysis of the historic data shows that the worst returns over this period occur in May and June. After June, returns up to St Leger's (in September) tend to be quite flat.

In fact, after traditional weakness in June, prices quite often bounce back in July - making this month a small island of strength in an otherwise weak six-month period.

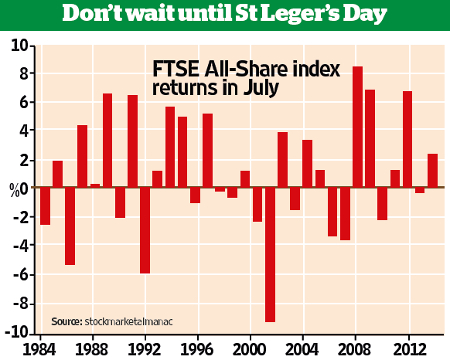

Since 1970 the FTSE All-Share index has seen an average return of 0.8% in July, with 52% of years seeing positive returns in this month, making it the fourth-strongest month of the year for shares.

As can be seen in the chart below, in recent years shares have been particularly strong in July. Indeed, the market has returned over 6% in three years out of the past seven.

On average the start of the month tends to be strong: July is one of only three months (the others being September and October) when the FTSE 100 tends to outperform the mid-cap FTSE 250, although the outperformance in July is not significantly large (an average of 0.3 percentage points since 1986).

Better is the performance of the FTSE 100 relative to the S&P 500; in sterling terms July is the second-best month in this respect.

Historically, the strong sectors in July are chemicals, personal goods and real estate investment trusts, while weak sectors have been gas, water & multiutilities, support services and beverages.

July is a busy month for companies announcing interim results - 67 in all.

This article was originally published by our sister magazineMoney Observer here.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser