Brexit swings and roundabouts for Model Portfolios

7th July 2016 18:19

by Andrew Pitts from interactive investor

Share on

The period since our last review of the Model Portfolios has been dominated by the European referendum and the fallout from the UK's decision to quit the EU. We did not make any modifications to the model portfolios in the run up to the referendum and those we are making at this review are not directly related to the result.

It was impossible to second-guess the result beforehand and it is equally difficult to predict precisely how stockmarkets will perform in the coming months until a new prime minister is appointed and government policy becomes clearer.

Making decisions on the basis of short-term movements is, in any case, often ill advised, especially as the majority of our portfolios are designed for long-term investment.

The best strategy in times of volatility is usually to remain focused on your objectives. We do have two short-term growth portfolios but we hope the diversity of their holdings will keep them reasonably stable in the months ahead.

The switches we have made this quarter relate to manager changes and risk reduction, and they would have been carried out regardless of the 'leave' vote.

However, as time goes on, and the full impact of Brexit becomes apparent, we may need to reconsider the make-up of the portfolios. If the UK does start heading towards recession as some experts have predicted, we may, for example, re-examine the UK bias of the income portfolios.

In light of the recent suspension of dealings in many open-ended property funds, we will also be reconsidering exposure to this asset class in the income-oriented and portfolios once dealing resumes. Our growth portfolios are already relatively internationally diversified.

All the Model Portfolios are available for purchase on the Interactive Investor platform for just £10.

Growth portfolios

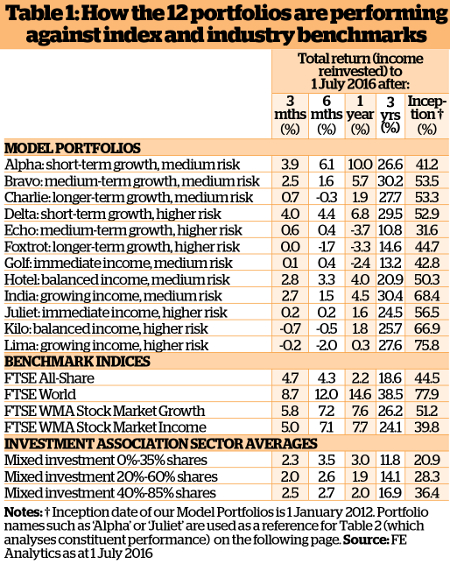

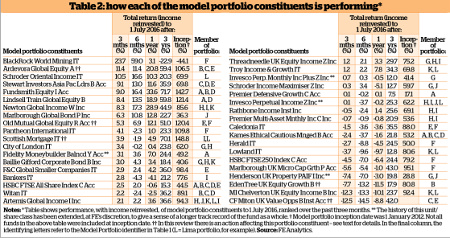

On average, the growth portfolios have performed better than the income portfolios over the past three months, mainly due to their higher overseas exposure. None of the growth portfolios lost ground over the period.

We were particularly pleased that the two best-performing portfolios overall were the short-term growth portfolios, and . Our aim with these portfolios is always to keep volatility to a minimum because investors have less time to recover from market fluctuations.

Both of the short-term growth portfolios contained holdings in one of our strongest-performing individual holdings over the period - , which invests globally and gained 9%.

It was complemented by two other strong performers - in the medium risk Alpha portfolio, and in the higher-risk Delta portfolio.

The third best-performing growth portfolio was , which is designed to produce medium risk, medium-term growth. It also benefited from its holding in Fundsmith Equity, but even more so from , the second best-performing fund across all the portfolios.

However, it was held back by the negative performance of two of its holdings, and . We have now decided to replace the EdenTree fund with a stake in , a UK-focused investment trust.

The worst-performing growth portfolio over the review period was , the higher risk, longer-term portfolio. Fortunately, it did not suffer a loss over the quarter, but it did not produce a gain either and it still has to recover from losses over the last year.

At the beginning of this year, we brought into this portfolio to provide some more stable growth and it has contributed 5% over the past quarter. It also contains which continued its strong recovery.

However, four of Foxtrot's holdings went down in value, led by , which fell over 5% during the quarter as sentiment turned against small and medium-sized UK companies after the Brexit vote.

The second-weakest performer was , the higher-risk, medium-term portfolio. Unfortunately, this portfolio also has one of the weakest longer-term records.

In an effort to reverse this trend, two switches were made at the beginning of 2016, bringing in Ardevora Global Equity and Old Mutual Global Equity, which have made good progress.

However, during the past quarter its returns were dragged down by the poor performance of its largest holding, .

As a result of this, and a change of managers at this fund, we have decided to reduce the size of this holding and use the proceeds to top up Ardevora Global Equity and Old Mutual Global Equity.

Income portfolios

The two worst-performing portfolios since the last review are income-oriented. They are and , the higher-risk versions of the balanced and growing income portfolios.

We have always warned about the risks inherent in any equity investment and in the higher-risk portfolios, the danger of volatility tends to be greater. However, both portfolios are still showing good long-term performance records.

Nevertheless, it was disappointing to see that the portfolios had both suffered negative total returns over the quarter. Kilo saw three of its holdings lose ground, while Lima saw two holdings decline in value.

Both contained stakes in our poorest-performing income holding, , which focuses on small and medium-sized companies.

The share prices of these companies were most affected by the vote to leave the EU as they are seen as most vulnerable to the expected downturn in UK economic growth.

Golf, the immediate income, medium-risk portfolio, also made very little progress over the quarter. The holding that held it back most was .

Its value slipped as investors became increasingly concerned about the uncertain outlook for the UK commercial real estate market following the EU referendum result. The Henderson fund is also included in Juliet, the immediate income, higher-risk portfolio.

Along with other open-ended property funds, Henderson UK Property suspended dealings on 6 July and it is likely to be some months before investors can buy or sell units in them again.

However it is important to remember that existing investors will continue to receive the income that these funds generate. The Henderson fund distributes income quarterly.

Although we still believe that property has a place in these income portfolios, providing diversity and a relatively steady income, we will reassess our exposure to this asset class at the next review.

The obvious alternatives to open-ended property funds that invest in illiquid bricks and mortar are closed-ended investment companies such as , a Money Observer Rated Fund.

, which currently trades at a discount of 25% and yields 5.9%, is another closed-ended alternative.

At the time of writing the trust was trading at a 15% discount to its net asset value, and with the shares at 70.6p it yields 5.7%. According to Numis Securities the dividend cover is 118%, the highest in the closed-ended UK property sector.

Both Golf and Juliet also contain bond funds, which helped to stabilise the portfolios with modest gains as investors sought out safe-haven fixed income securities.

All three of the higher-risk income portfolios also include holdings in , as do and , the medium-risk, balanced and growing income portfolios.

Though it made positive progress over the quarter, we expected the fund to hold up better in view of its global exposure. However, its performance against its peer group has flagged on a one-year view.

The fund's manager, Jacob de Tusch Lec, admitted recently that the portfolio's composition has not been good for its performance in the run-up to and post the EU referendum result: it is 'overweight' Europe versus the US; 'overweight' cheaper "value" as opposed to higher quality "growth" stocks; and has greater mid-cap exposure than some of its peers.

However, we still believe in this manager's capabilities and plan to continue holding the fund for the time being, much as we did with when it went through a difficult phase, in the expectation that the performance of the Artemis fund will improve. If not, we will have to reconsider.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.