Stockwatch: Buying a British success story

15th July 2016 09:48

by Edmond Jackson from interactive investor

Share on

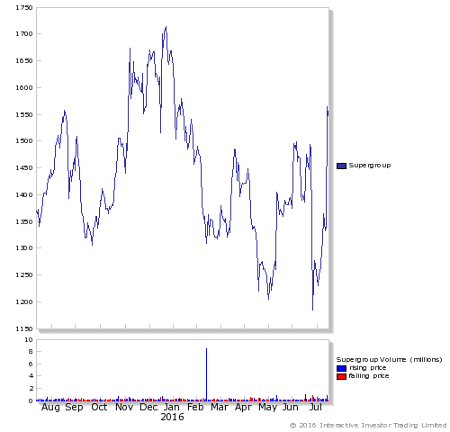

Is mid-cap fashion retailer definitively breaking out of the stock's recent consolidation phase; and what upside is in prospect? For much of this year it has traded volatile-sideways in the 1,200-1,500p range, since falling from 1,700p at end-2015 (see chart below).

There was no underlying disruption to a growth story, with a 14 January trading update citing further good progress through the peak trading period, part-reflecting a positive impact from the European store roll-out programme.

And a 12 May pre-close update had total revenues (retail and wholesale) up 21.1% despite challenging comparatives. Possibly the EU referendum held some uncertainties - one broker cut its forecasts in response to sterling's fall after the vote - although the market is responding more to SuperGroup's innovation skills and improved stores translating into shareholder returns.

Mind this is also quite a complex group financially, e.g. Company REFS asserting its own sense of normalised earnings, versus published figures. But underlying these modest variations is a theme of marketing prowess - the crux to understanding SuperGroup's higher returns and also its potential. An all-female design team is enabling Superdry-branded womenswear to perform especially well, also Superdry Sport and the premium Idris Elba range.

Consequently, prelims to end-April show earnings per share up 21.8% on revenue up 21.3%, top and bottom-line progress which is rare to find currently. That it is being achieved amid declining high street sales - if partly due to online growth up 50% - reflects compelling designs.

Premium rating for a retailing success story

The stock's jump of 16% to over 1,550p in response to these results shows alertness how the business can thrive in difficult times - recall how Next emerged as a super-stock from the 1990s recession. It happens in retailing, where a precious few Brits have superior marketing talent.

Recent earnings per share forecasts for the current year to April 2017 have ranged from 77.3p to 82.6p - i.e. a price/earnings (PE) ratio near 20 times, which looks pretty full, especially considering import costs of clothing will rise due to sterling weakness. But strength of marketing combined with effective controls can overcome headwinds. It affirms how a high profile chief executive - Euan Sutherland - was brought in just over a year ago, enabling founder Julian Dunkerton to focus on products and brands; this being my rationale for drawing attention to the stock's potential at 930p in March 2015.

Such changes can bring lasting effects especially where it appears Dunkerton has also strengthened group creative talent.

Commercial progress leads to special payout

The 2016 consolidation phase also followed from earnings appearing quite fairly priced, against which the ordinary dividend yield was just 2% and net tangible asset backing only about 300p - a positive initiative was needed to jolt the market out of a range-bound mentality.

Without a dividend record since flotation in 2010, SuperGroup has also lacked appeal to any investor serious for income. But the end-April balance sheet shows cash soaring from £67.6 million to £100.7 million, i.e. pregnant for payouts given strong organic means less need for acquisitions.

The results' financial review cites dividend policy as "progressive", aiming for earnings cover of 3.0 to 3.5 times, and if excess capital is not invested then "we will consider one-off returns to shareholders..."

Hence, the total ordinary dividend of 23.2p (beating forecasts of 20.0p to 21.7p) is being supplemented with a "first" special dividend of 20.0p, thereby increasing the yield near 3% with the stock presently around 1,550p. Altogether this represents a circa £30 million cash outflow i.e. reserves are plenty to support further £15 million special dividends unless investment needs dictate otherwise.

I've noted several times before in Stockwatch this modern habit of splitting dividends: tempting investors with the possibility of enhanced payouts while boards retain flexibility to invest if necessary - the best of both worlds. Yet a more significant yield ought to help reduce volatility, increasing the element of holders versus traders, which argues also for a higher rating. So the jump in stock price does have a rationale.

Continuing to internationalise the Superdry brand

The retail versus wholesale trading figures also make for complexity, the mainstay of revenues being UK followed by continental Europe where floor space rose 73% in the last trading year - it now represents 31% of the total retail estate. Returns on capital have been achieving an average 23-month payback after opening, against a 30-month target. Performance in Germany has been especially encouraging. This should help mitigate currency issues with regard to importing into the UK.

North America and China are touted as the two most significant future opportunities, with five trial store openings in the North-East US intended to reflect a full Superdry offering. With China forecast to overtake the US as the world's largest apparel and footwear market, SuperGroup has a joint venture agreement there with Trendy International Group, expected to be self-funding in the medium term. Three trial stores are expected to be opened during 2016 and if successful then a roll-out programme of owned and franchised stores.

A fairly priced premium outfit

I have originally drawn attention to SuperGroup in 2012 at prices of 630p to 650p when it traded on a forward PE of 12-13. It's now rated in the high teens at least and there isn't scope for the tenor of reporting to change adversely. But it would need quite a serious setback to hurt the stock, given the balance sheet can sustain further special dividends, and the chief executive's track record suggests this less likely.

The scenario, therefore, is SuperGroup building on its strengths as a British retailing success story - at home and abroad. This stock can go plenty further in the next three to five years, given the company's blend of marketing flair and managerial discipline. As a medium-term strategy: target £20 a share and buy any dips.

For more information see the website.

| SuperGroup - financial summary | Consensus estimates | ||||||

|---|---|---|---|---|---|---|---|

| year ended 25 April | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

| 53 weeks | |||||||

| Turnover (£ million) | 314 | 360 | 433 | 487 | 598 | ||

| IFRS3 pre-tax profit (£m) | 51.4 | 51.8 | 45.4 | 59.5 | 55.4 | ||

| Normalised pre-tax profit (£m) | 51.4 | 52.4 | 56.5 | 77.0 | 84.5 | 95.2 | |

| Operating margin (%) | 16.3 | 13.7 | 12.9 | 15.9 | |||

| IFRS3 earnings/share (p) | 44.7 | 44.3 | 33.6 | 55.8 | 50.6 | ||

| Normalised earnings/share (p) | 48.5 | 46.9 | 47.1 | 77.3 | 51.8 | 80.5 | 87.3 |

| Price/earnings multiple (x) | 30.2 | 19.4 | 17.9 | ||||

| Cash flow/share (p) | 55.2 | 47.7 | 85.5 | 43.2 | |||

| Capex/share (p) | 65.3 | 22.2 | 42.2 | 33.7 | |||

| Ordinary dividend per share (p) | 23.2 | 26.2 | 28.2 | ||||

| Special dividend per share (p) | 20.0 | ||||||

| Yield (%) | 2.8 | 1.7 | 1.8 | ||||

| Covered by earnings (x) | 1.2 | 3.1 | 3.1 | ||||

| Net tangible assets per share (p) | 179 | 226 | 263 | 297 | |||

| Source: Company REFS | |||||||

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.