Property funds: the good, the bad and the reality check

15th July 2016 16:34

by Andrew Pitts from interactive investor

Share on

For private investors with a significant stake in UK PLC, the country's decision to leave the EU has been a brutal shock, and one that is particularly amplified for those seeking an income from their UK-focused savings and investments.

The country now faces a bleak economic future in the short-to-medium term, with policymakers unanimous that a downturn, if not a recession, is inevitable.

Investors in open-ended commercial property funds stand out as the most high-profile losers: more than half of the £25 billion invested in the sector is now "gated".

That means investors cannot buy or sell units in these funds until managers can revalue their property portfolios and provide what they believe is a fair price at which they will allow investors to trade.

A taste of what's to come

On 6 July, barely two weeks after the referendum, two funds provided a taste of what this will mean.

(one of Money Observer's Rated Funds in the property asset group) announced that on its "fair value pricing" basis it had cut the net asset value (NAV) of its £2.5 billion portfolio by a further 10% - taking it 15% lower since Brexit - and that the price of units will continue to be monitored on a weekly basis.

Importantly, however, at the time of writing, investors were still able to buy and sell units in this fund and its associated .

The £3.4 billion took a different approach by imposing a 17% dilution levy (essentially an exit fee). The fund planned to open for business again on Wednesday 13 July with that NAV dilution reflected in the unit price.

Unfortunately it is highly likely that these valuation reductions have further to go, because the wave of selling will feed into weaker property prices, further spooking investors. Funds with high weightings to office space in London will be most exposed to these pressures.

Don't panic

However, the gating of property funds is one of the few instances when I agree with those annoying protestations such as "don't panic" and "focus on your long-term goals" that many commentators in the financial services industry churn out at times of market stress.

As was first made brutally clear in the run up to the 2008 financial crisis, open-ended funds that invest in an illiquid asset class such as property cannot meet a wave of redemption requests, once their cash reserves are exhausted, without imposing some form of dilution levy on sellers.

But it is income that has been the primary reason behind the commercial property sector's popularity in recent years, as the rate of return on cash deposits has plummeted.

So it is important to remember that while many property funds are closed for business, they will continue to pay investors the income they receive from their tenants.

In this respect you should probably only sell (if you can) if you've reached the point when you need the money, rather than taking a capital loss and forgoing the income that your investment generates.

With the Bank of England signalling an interest rate cut to 0.25% or lower, the income that an investment in commercial property provides, albeit likely lower in the near future, will continue to beat what is generally available on cash deposits.

Property funds that are open for business

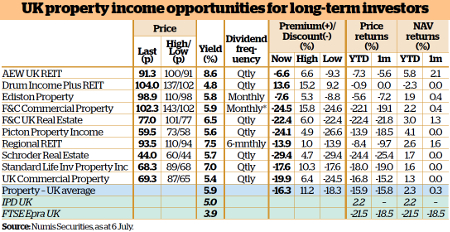

That sentiment also applies to closed-ended property investment companies, most of which have been savagely derated over the course of the year, and particularly over the past month.

Although most investment trusts have yet to report their half-year NAV figures, many investors have already headed for the exits, driving share price discounts to NAV into bargain territory, as the table below shows.

is just one of several trusts (, a Money Observer Rated Fund, is another) that warrant interest for the long-term income investor. A year ago the trust's shares were trading at a premium of 9% to NAV, compared to a 25% discount today.

There are no guarantees that discounts won't fall further - on this trust it hit more than 40% in the depths of the financial crisis, when sentiment towards the sector had never been worse.

Prospective investors have to ask themselves if that is where the sector is heading - but as a whole NAVs are still below pre-crisis levels.

Although prospects for an uplift in rental income have diminished post-Brexit, the rental income from F&C Commercial Property's diverse portfolio looks reasonably secure, and with the shares currently at 102.3p it translates into a yield of 5.9%.

Analysts at Winterflood Securities point out that since its launch in 2005, the trust's portfolio has outperformed the UK property market in nine out of 10 years - and unlike its peers, it has never cut its dividend.

It has a strong balance sheet with a net loan-to-value ratio of 19.2%, which is about the best in the sector.

Winterflood reckons this gives it the financial flexibility to take advantage of "opportunities that may arise as a result of current market conditions".

That might mean picking up bargains that open-ended funds have had to sell to meet redemptions. Having taken a closer look at the trust and its prospects, I am adding a slug of its shares to my Isa portfolio.

Brexit update on investing ideas

Last month I suggested that investors should prepare for either a 'leave' or 'remain' vote by increasing their exposure to overseas assets, in the expectation that sterling will fall whatever the outcome.

That has since proved to be a good strategy, particularly the suggestion to buy Japanese funds and the exchange traded currency . It rose 15% on the day after the referendum and made further gains in the days that followed.

Although further bouts of risk aversion and flights to safety are extremely likely in the months ahead, I would advise investors not to pursue that particular strategy further, on the grounds that central banks such as the Bank of Japan will likely take measures to weaken their currencies.

However, two of my three fund suggestions - and - have rewarded investors well and I expect them to continue to do so.

I'm less sure about , given our currency's poor prospects, although its strategy of investing in the subordinated debt of large companies with strong balance sheets should continue to provide a decent yield as well as portfolio diversification.

There have been good opportunities to take profits in my earlier high-risk and speculative idea to buy the US-listed exchange traded fund (ETF) .

The CBOE Volatility index on which it is based - Wall Street's so-called "fear index" - did rise above 25 post-Brexit (from a level of 17 on the previous day) but has since dropped below 15 again.

Although this is a highly speculative idea, I do worry that the strains on the financial system (particularly for European banks) caused by Brexit, negative bond yields and zero-bound interest rates will see the Vix rise to that sort of level again before autumn is out.

Dividend growth concerns coming true

Unfortunately it seems the concerns I raised in October last year on the prospects for UK dividend growth have borne fruit.

Research by The Share Centre and Capita Registrars confirms that the UK's biggest companies are paying out more in dividends than they make in profits for the first time since the financial crisis.

Back in October the historic dividend cover ratio (a company's earnings divided by dividends paid) was 1.8 times, the lowest since the financial crisis, and since 1999 before that. Clearly investors and fund managers will need to be on their toes if they are to avoid dividend cuts.

Equity income investment trusts are better able to serve the needs of investors requiring that income, as many of them have a year's worth (and more) of income reserves that will allow them to maintain their payouts.

Although the international nature of the FTSE 100 index has helped it to hold up remarkably well post-Brexit, more sustainable income opportunities for sterling investors lie further afield.

Two Rated Funds with globally diversified portfolios that I expect to do well in the near future are the investment trust (4.5% yield) and (3% yield), which has been having a cracking year.

Finally, an obvious theme to pursue from the perspective of portfolio protection and further weakness in sterling is gold: three avenues to explore are the exchange traded fund and the wider precious metals fund (both up 48% year to date).

However, there is one Money Observer Rated Fund that beats both: is up 146% in 2016 and likely has further to rise as more speculative investors rekindle their love affair not just with the yellow metal but with the mining companies themselves.

Andrew Pitts was editor of Money Observer 1998-2015.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.