Insider: Perfect timing nets quick profit

22nd July 2016 13:47

by Lee Wild from interactive investor

Share on

Follow the wives of St Ives

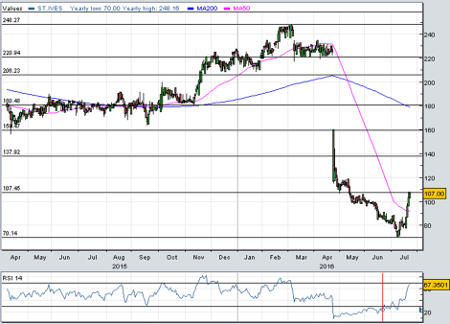

An April profits warning sent shares in crashing by over two-thirds. The printer warned that while trading in the eight months to April had been decent enough, the near-term outlook was horrendous.

Companies nervous about the economy are withholding marketing budgets and "a number of significant projects" have either been deferred or cancelled. This will impact the rest of this financial year and at least the beginning of 2016/17.

Pricing pressure amid weakness in the grocery industry is also squeezing margins at St Ives' marketing activation business. With the books business also running behind last year, group underlying profit before tax will be "materially" below management's expectations.

Numis Securities analyst Paul Richards slashed his pre-tax profit forecast for the year ending July 2016 by 19% to £30.4 million, giving earnings per share of 21.6p. For 2017 they’re down by 22% to £32.4 million and 17.8p respectively.

St Ives shares kept falling until two weeks ago when investors decided the shares were too cheap. They've rocketed over 50% since from 70p to 107p. And the wife of chairman and former ICI executive Richard Stillwell has proved a canny investor. Snapping up 23,000 shares a week ago at 80.17p per share has also netted a paper profit worth over six grand.

Now, we hear that the wife of chief executive Matt Armitage has followed suit. Even on Tuesday, Jill Armitage managed to pick up 100,000 St Ives shares at 83.875p, which at current prices makes her £23,000 richer!

Clearly, top brass are betting their cost saving measures will have the desired effect and that any project deferrals will only be short-term in nature. The dividend, put by Numis at 7.8p, is thought to be safe, too.

BCA has plenty of buyers

(British Car Auctions) has done very little to excite investors for the past 12 months, certainly in terms of share price performance. After a quick rally, shares in the £1.4 billion used car auctioneer, which reversed into Haversham Holdings in 2015, have traded sideways largely between 160p and 180p.

It was unfortunate in that the EU referendum brought a promising rally to an abrupt end, and maiden full-year results, while better-than-expected failed to drum up much enthusiasm among investors.

The firm behind the catchy "We Buy Any Car" TV ads sold 783,000 vehicles in the UK during the 15 months to 3 April and 333,000 abroad. That generated revenue of £1.15 billion, an adjusted cash profit of £98.5 million and a pre-tax profit of £3.9 million.

And, just a few days ago, BCA said it will pay as much as £135 million for Paragon Automotive, a provider of outsourced services to car manufacturers and the big major fleet operators.

To celebrate, directors have been piling in. Non-execs Stephen Gutteridge, Piet Coelewij and David Lis spent a total of £234,000 on 136,000 shares at between 170.5p and 172.7p.

Soon after, executive chairman Avril Palmer-Baunack snapped up 13,626 at 176.1p, taking her stake to 680,293, currently worth more than £1.2 million. We also hear that funds managed by Marwyn Asset Management have hoovered up 2.4 million shares at the same price. Marwyn founders Mark Brangstrup Watts and James Corsellis also sit on the BCA board.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.