Insider: Two well-timed trades

4th November 2016 11:45

by Lee Wild from interactive investor

Share on

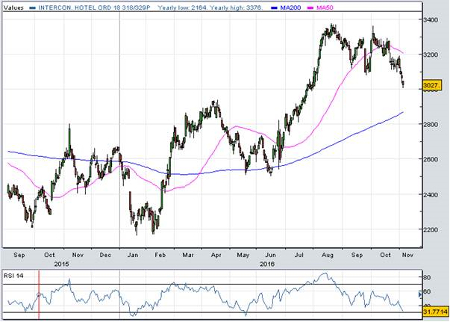

Intercontinental Hotels Group

Bosses at waited until third-quarter results were out of the way before hitting the 'sell' button. A week after Americas HR boss Lori Gaytan trousered £456,605 from a major share sale, the wife of chief executive Richard Solomons has banked a seven-figure sum.

In a quiet week for director deals of any size, the sale by Karin Solomons of 37,340 Intercontinental shares at a little under 3,157p certainly stood out. The well-timed trade landed her almost £1.2 million. Following this week's market crash, the same deal now would make almost £50,000 less.

Quarterly results were nothing to get excited about.

Growth in revenue per available room (RevPAR) - a key industry performance metric - slowed to 1.3% during the three months to September. That's down from 2.5% in the previous quarter and 4.8% a year ago.

However, that is made up for in part by more rapid room growth. IHG opened 7,000 rooms in the third quarter and removed 3,000, raising the so-called "net system" size by 3.8% year-on-year to 754,000. It signed for a further 19,000 rooms in hotels under development, the highest for a third-quarter since 2008, taking the total pipeline to 230,000.

"While industry RevPAR growth has slowed, the fundamentals for the sector, and particularly for IHG, remain compelling," Mr Solomons told investors.

"This, combined with our winning strategy and the strength of our cash generative business model, will enable us to drive sustainable growth into the future. Despite the uncertain environment in some markets, we remain confident in the outlook for the remainder of the year."

Currently, Anna Barnfather, an analyst at Panmure Gordon, pencils in RevPAR growth of 2% in 2016, and 3% net system growth, giving total operating profit of $700 million (£561 million), pre-tax profit of $601 million and earnings per share (EPS) of 189.7 cents.

That puts IHG on a forward price/earnings (PE) ratio of about 20 times and enterprise value/cash profit multiple of 12.5 times.

"While the 'fee-based' business model makes IHG less operationally geared than other asset heavy hotel companies, the medium term outlook for the industry is deteriorating, with consumer confidence and security concerns weighing on corporate/leisure travel spending," warns Barnfather, who rates the stock a 'hold' with price target of 2,800p.

"As such, we struggle to see any upcoming catalysts (absent a bid or further $/£ movement) for further share price appreciation."

Curtis Banks

SIPP provider reported in September that operating profit grew less than expected during the first half, from £2.6 million to £2.9 million. Including acquisitions, revenue was up 44% at £10.8 million.

Brexit would have "minimal effect" on the business, chairman Chris Curtis said, but he did warn that lower interest rates would put pressure on income: "Whilst we are hopeful of retaining margins close to those that we are currently enjoying through a co-ordinated central treasury function, there will be an impact on revenues going forward." Costs rose too.

Floated on AIM 18 months ago at 190p, Curtis shares quickly became a star performer.

Earlier this year the company paid £45 million for Suffolk Life and its 26,500 SIPPs under administration. That deal was transformational, and launched Curtis shares to a record high at 417p a few months later.

But market conditions have been more difficult since, and the shares last week traded down at 172p. "Too low," screamed directors, before piling in at rock-bottom prices.

Between them, Banks, chief executive Rupert Curtis, finance boss Paul Tarran and chief information officer Kristian Morgans spent £267,594 on 143,814 shares at a little over 186p.

Banks bought 79,900, Curtis and Tarran 26,631 each, and Morgans 10,562, meaning that the four now own almost 61% of the company, with Banks sitting on 38.43% of the business, currently worth a cool £41 million.

Stuart Duncan, an analyst at house broker Peel Hunt, downgraded forecasts for 2016 adjusted pre-tax profit from £9.7 million to £7 million, giving EPS of 10.8p. For 2017, it's £9.9 million and 14.7p respectively.

"To a large extent, the reduction in interest income is outside management’s control, with little mitigation possible in the short term," he says.

"This challenge should not detract from the continuing growth potential (both organic and non-organic), earnings visibility and strong cash generation supporting attractive dividend payments."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.