Share of the week: Insatiable appetite for this share

29th July 2016 15:44

by Harriet Mann from interactive investor

Share on

Sales have surged by more than half, earnings have doubled and full-year forecasts have been upgraded, no wonder insatiable appetite has pushed shares in fast-food delivery group to all-time highs.

Leaping 59% to £171.6 million, revenue growth was driven by a 55% increase in orders to 64.9 million as the group loosened its belt into Italy, Mexico, Brazil and Spain. Not only are more people active users on the fast-food portal, but 70% of the £1.1 billion value of first-half takeaway orders came from mobiles. The app was downloaded over five million times in the first half.

Underlying cash profit leapt 107% to £53.4 million as its margin surged by an impressive 720 basis points to 31.1% on cost efficiencies. While basic earnings per share rocketed 118% to 3.7p, this eased back to 81% growth when stripping out one-offs.

Crucially, Just Eat is incredibly cash generative, with a net cash inflow of £47.8 million representing conversion of 97%.

After Britain's shock decision to leave Europe last month the UK economy has been creaking under the pressure of heavy whispers that a recession is on the cards. While a company like Just Eat looks exposed to this risk, tighter purse strings could actually drive more users to the group.

"We remain confident in Just Eat's ability to deliver sector-leading earnings growth. In the UK, Brexit is likely to have minimal impact - takeaway is a resilient industry in economic downturns, and we suspect any Brexit-induced consumer weakness will have a negligible effect on JE," says Canaccord Genuity analyst David Amiras. "In fact, it may lead better-off consumers to trade down and opt for takeaway rather than an out-of-home meal."

If exchange rates are maintained, management reckons revenue will reach £368 million this year, which would £10 million more than previously expected. This is 70% down to improved trading, while the rest is the result of currency. Underlying earnings before interest, tax, depreciation and amortisation (EBITDA) should now reach £106-108 million, 4% higher than previous guidance.

"Given JE's geographic diversity and scale, the strength of its brand (it has 100% greater awareness in the UK than its nearest competitor, according to the company), and the stickiness of app users, we think the group occupies a strong competitive position," adds Amiras.

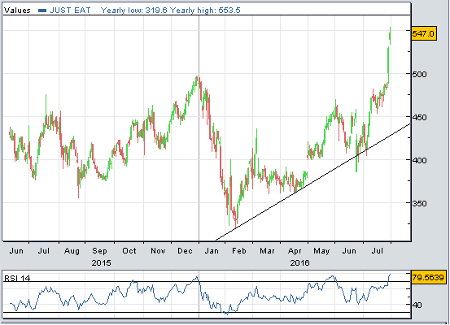

Leading the pack of FTSE 350 top performers this week, Just Eat surged 17% to a high of 554p on Friday. The group's market value is now nearly three-quarters higher than February's 2016 low of 320p, but there could still be a lot of upside, if Amiras is correct.

The analyst reckons the shares are worth 625p, which represents 13% further upside from here. With a bullish undercurrent of support underpinning the shares and another knock-out period in the bag, delivery is certainly possible.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.