Buy, hold or sell: MI Chelverton UK Equity Income

10th August 2016 12:18

by David Brenchley from interactive investor

Share on

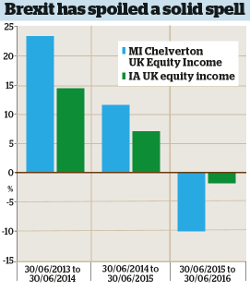

One of our sister magazine Money Observer's Rated Funds, has been a strong performer in recent years. It was the second-best performer in the Investment Association's UK equity income sector in 2012, and the third best in 2013 and 2015.

However, the small- and mid-cap specialist "encountered a perfect storm" in the weeks after the UK voted to leave the EU. The mid-cap stocks it owns were "sold with a vengeance".

Manager Dave Taylor is upbeat, however, and believes things will improve. He says: "For many years this was a very good place to be, a very good strategy, and it will be again.

"We are just going through a bit of a hiccup at the moment caused by something that none of us has been through before."

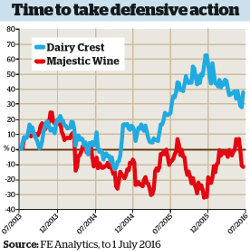

Buy: Dairy Crest

Being a small- and mid-cap-focused fund, the one sector of the market the fund cannot go to is the FTSE 100. This, says Taylor, rules out the big global branded businesses and food stocks such as .

Chelverton first bought into the firm back in 2010 at a price of 365p, and Taylor has been topping up its exposure ever since - most recently at the end of May, at around its current price of 550p.

Until recently, the firm had been partly commoditised, due to its exposure to liquid milk, which has been "a very volatile business for a long time". However, the part of the company concerned was sold to Muller in 2015 for £80 million.

"That took much of the volatility of its business away," Taylor explains. "What you have now is a business that has transformed itself from being partly commoditised to having just a nice collection of brands."

Hold: DFS

Taylor bought into furniture chain in October 2015 at a share price of 297p, which is about where it traded until 23 June, the day of the EU referendum. The next day, its share price opened 8% lower. The share price has since fallen by a further 31.5% to trade at 185p as at 8 July.

DFS has been affected by the falling pound, as the costs of making sofas are priced in dollars, whereas DFS's revenues are in sterling. Worries over the housing market haven't helped.

We'll probably be buying more DFS shares. It's about the timing being rightHowever, the firm is very cash-generative, Taylor says. "It has been through recessions before, and always generated cash and come out looking pretty good."

DFS hiked its interim dividend by 12% in March, and the current market expectation puts its yield at more than 6%.

He says: "It may not pay that, but it's still on a high 5/low 6% yield." He adds: "We will almost certainly be buying more DFS shares. We've just got to get our timing right.'

Sell: Majestic Wine

Despite having sold out completely in May 2016, Taylor still likes . His reasoning for exiting the fund's position in the stock was that, since Majestic's acquisition of Naked Wines, it has gone from being a cash-generative dividend payer to "more of a growth stock".

But the deal was mostly financed through debt, which led to Majestic scrapping its dividend for a couple of half-years. Taylor believes the new yield, when reinstated, will be relatively low and not enough for an income fund.

He explains: "If you look at the price/earnings ratio for the next couple of years, it looks up there to us. For the growth guys, it might be fantastic, but for an income fund, it's quite a highly rated, low-dividend stock.

"We held it, saw [the share price] up, watched it all the way down and followed it all the way back up again. We could then make a rational decision, and our decision was that we'd have to sell it. We like the stock, we like the people, but we just aren't going to get the sort of dividend we need in an income fund."

This article was originally published by our sister magazine Money Observer here

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.