Five expert views on FTSE 100 at 6,900

19th August 2016 15:56

by Lee Wild from interactive investor

Share on

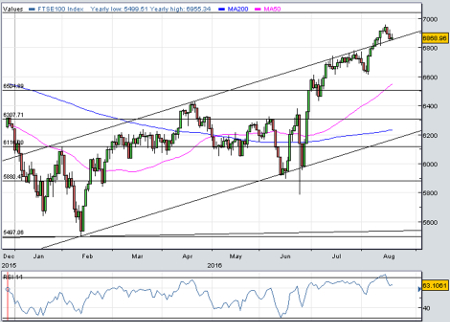

I arrived back in the office from my summer break to find the FTSE 100 at 6,955, a 14-month best and less than 200 points from a record high. It's one of the most remarkable rallies of recent stockmarket history, but, as always when markets break new ground, investors want to know how long the good times will last.

Low interest rates, massive monetary stimulus and a distinct international flavour have ignited interest in the blue-chip index. But attractive yields have increased the popularity of our mid-cap stocks, too, and share prices there have risen sharply.

And equities remain the only show in town. We ran a poll this week asking users about their approach to investing in equities right now. Twice as many (41%) told us they were buying equities compared to 20.5% who believe the market is overpriced. The other 38% think the market will remain rangebound over the coming weeks.

"Behind the headlines it's a real stockpicker's market," says Rebecca O'Keeffe, head of Investment at Interactive Investor. "The dramatic difference in sector returns is providing significant opportunities for engaged investors. This is also providing active fund managers the chance to outperform their passive counterparts."

But equities are more expensive and the future remains uncertain. My view on the market appeared here this week, but I was interested to hear what Interactive Investor's regular contributors think about a FTSE 100 index over 1,100 points, or 20% higher than it was in the dark days immediately after the Brexit vote. The rally stretches to almost 1,500 points from the February low!

Is the FTSE 100 still a buy at 6,900? What should investors do now?

Here are their answers.

II's resident stockpicker Edmond Jackson

The FTSE 100 is quite a tropical anomaly: dollar-earners and multi-nationals, also mining stocks benefiting from renewed confidence over China. Yet the latest action is more speculative than based on historically attractive earnings and dividend values; it's a knee-jerk response to dwindling cash/bond returns. If you're disciplined you'll not take another swig at this party, even though it can run a while yet. Continue to hold - FTSE 100 consumer staples, drugs and tobacco will remain seen as "safe havens" despite full valuations.

Stockbroker Justin Urquhart Stewart at Seven Investment

Yes, the FTSE 100 is high but, despite our domestic worries and Brexit nerves, we should remember that this index has two key characteristics. Firstly, it is predominantly a global index of international businesses and thus not tied to the frets of the UK economy, and, secondly, many are firmly related and linked to the US dollar and other currencies and have thus benefitted from the weakness in the pound.

If we then consider that the global economy is still growing at around 3% per annum, these companies are going to be reflecting that strength and then enhanced by a weaker sterling.

With a current yield of 3.74%, this is still an attractive investment, but be aware that there will be some volatility to shake our nerves. Take a longer view, benefit from the compounding and invest in an asset class which has underlying growth.

Are there any other areas of comfort? Our "risk free" government debt is now really quite risky! Cash is effectively negative.

David Buik, City commentator at Panmure Gordon

At 6,900 the FTSE looks very rich to me. I am really worried about the banking sector, which I think will take months if not years to recover. But for banks the FTSE would probably be at 7,100 now. I don't think the FTSE will drift much, as alternative asset classes are unattractive against dividends.

Investors should look to technology and any dollar-earning stocks. The FTSE has rallied 14% since its recent low, but dollar earnings could be key for the next six months whilst the Brexit cloud prevails. Think drugs, tobacco, wholesale goods: , etc.

Tom Elliott, strategist at De Vere Group

Is the FTSE 100 still a buy at 6,900? No, but it's not a sell either. It's a "sit tight and don't be clever" time for investors. Markets are indeed supported by central bank policies that flatter high dividend yield markets such as the FTSE 100. But these policies may yet blow up in investors' faces, if ultra-low and negative interest rates end up destroying consumer demand, as it forces people to save more for retirement income.

This is a new and unsettling understanding of how very low interest rates may lead to contracting demand, or, conversely, it leads to inflation. Also be aware that the largest FTSE 100 dividend payers are not generally in a strong position regarding dividend cover.

What should investors do now? Keep their investment portfolios as widely spread as possible, by geography, sector and asset class. Don't take concentrated bets unless you are in possession of a crystal ball.

Alistair Strang, technical analyst who correctly called the market rally to 6,900

I've a problem with this. My gut says "no, the market must retrace". The computer says "yes, it's going to around 7,350". The problem comes with the unpleasant detail that virtually every time I've said "The software must be wrong", I've ended up swinging in the wind.

If I break it down by index, the AIM firstly has commenced a strong recovery and we've seen evidence of this largesse spread amongst many shares. The FTSE 250, similarly, has enacted a brilliant recovery. Slight concern is - unlike the FTSE's magic number of 6,903 - it has not closed a session above the magic number of 17,961. If it does so, I'm looking for amazing growth to around 19,700 or so.

The elephant in the room is the banking sector - and to a lesser degree the miners. The big three retail banks remain trapped in a hole of their own making with the market forcefully restraining upward travel. I think, when we see the retail banks break free, the FTSE shall start upward movement quite sharply and the prior high of the 7,100s will be left in the dust.

The key signal shall be above 67p, above 218p and above 178p. This should provide the perfect storm to, essentially, go long on anything which has been floundering.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.