Dogs of the Footsie: big gains as high-yielding shares rally

24th August 2016 12:33

by Kyle Caldwell from interactive investor

Share on

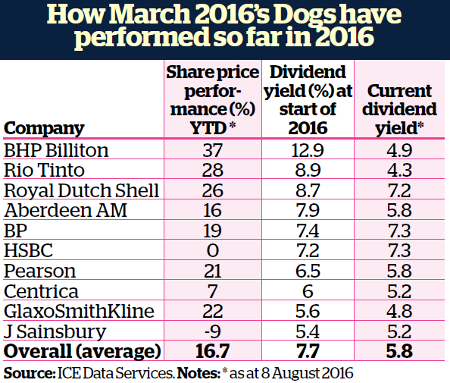

As at 8 August, the "Dogs" portfolio of unloved companies that our sister magaizine Money Observer lined up in March had made total returns of 16.7% in 2016 - comfortably ahead of both the FTSE 100 and the FTSE All-Share indices (up 9.5% and 7.8% respectively).

This is a marked improvement compared with the performance of the 2015 Dogs, which lost 17.8% over the 12 months to 1 February 2016.

The portfolio, which is revised each March and comprises the 10 highest-yielding companies in the FTSE 100 index (often because their share price has slumped relative to the dividend payout), has benefited from a reversal in fortunes for the oil and mining sectors.

Miners and oil companies are not out of the woods - in fact far from it - but in 2016 their share prices have enjoyed a purple patch.

Confident dividends will be paid

leads the pack, gaining 37% year-to-date, followed by , up 28%, while and have advanced 26 and 19% respectively.

There are various factors behind the rally but one driver has been valuations, which had fallen to depressed levels, whetting the appetite of value investors.

Fundamentally, however, both sectors remain challenged. The miners have high debt levels that will put dividends under pressure, while the two big oil majors are banking on an oil price recovery.

Martin Cholwill, manager of , holds oil majors Shell and BP. He is confident dividends will continue to be paid, but is avoiding the miners, due to the "high levels of debt on their balance sheets".

"The last thing the management teams want to do is cut dividends, which gives me confidence. But the main reason I am optimistic is the five-year forward oil price has been holding up well, something which I think has been overlooked," says Cholwill.

"I also think that during tough times there is always a last man standing, or in this case two - Shell and BP - and both businesses will have the chance to buy undervalued assets from distressed sellers."

Outside of the two sectors, other shares that have performed well so far in 2016 include (up 22%), a beneficiary of weaker sterling, and education group (up 21%), which is recovering from a difficult 2015 as its share price shed 38%.

Brexit shake-up

Anyone starting a "dogs of the Footsie" portfolio now will find the highest yielders have completely changed - just Royal Dutch Shell remains in the top 10 by the skin of its teeth.

The rest of the line-up comprises (yielding 8.2%), (7.5%), (7.1%), (7%), (7%), (6.8%), (6.8%), (6.5%) and (6.5%).

Yields in the banking and housebuilder sectors have risen in response to their share prices being hit hard since the EU referendum.

As always, income-hunters need to do their homework and assess whether a stock has a dividend that looks sustainable, and therefore represents good value, or whether it is a "value trap" with a future dividend cut on the horizon.

William Meadon, manager of the , is cautious on both sectors.

He says: "In this new world, the dividend outlook for the banks does not look very encouraging as the yield curve flattens, demand for loans falls and bad debts are likely to increase.

"The picture is mixed for UK housebuilders. Berkeley Group has committed to delivering a dividend for the next three years and should be able to withstand a tough trading period in the short term, although earnings will be more volatile."

This article was originally published by our sister magazine Money Observer here

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.