UK still on course for a Brexit recession?

26th August 2016 15:30

by Holly Mackay from ii contributor

Share on

The dispute about whether Brexit is a good or bad idea will continue, but what is undeniable is that the 'leave' vote has ushered in a period of unprecedented uncertainty.

The stockmarket response has been relatively orderly so far, but sterling has taken a significant hit, and there are fears that economic growth will decline. Against a backdrop of strong opinions and scaremongering, many people are wondering whether we are heading for recession.

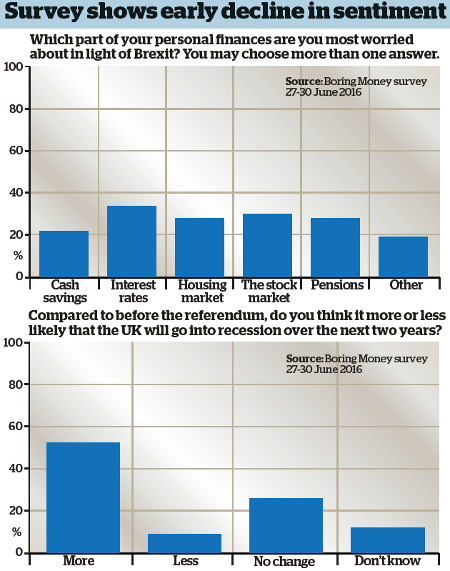

Our Boring Money poll of 1,000 UK adults the week after the Brexit vote found that 52% of people thought a recession was more likely post-Brexit. Women were more nervous than men: 61% of women thought the likelihood of a recession had increased.

Recession: A price worth paying?

These worrywarts, logically, must include some people who voted to leave. Perhaps they thought a recession was a price worth paying to be released from the shackles of Brussels.

Perhaps they hadn't anticipated the immediate impact on capital markets around the world on the day the UK voted to leave.

Either way, recessions can be kick-started as easily by negative sentiment as by economic reality, and there have been early signs that we are, to use a technical term, bottling it, creating a gloomier view than the fundamentals dictate.

JP Morgan and other asset managers plan to move operations out of the UK after BrexitWeakening sentiment and unease can also extend to companies. At a time of uncertainty, firms are less likely to commit to capital spending and hiring people. Equally, with access to the European single market under threat, some companies will no longer want to do business in the UK.

The Bertelsmann Foundation surveyed 700 businesses in February. Some 29% of the UK and German companies polled said that in the event of a Brexit, they would either reduce capacity in the UK or relocate elsewhere.

Morgan Stanley was one of the first global companies to feature in rumours circulating about potential mass relocations. JPMorgan has announced plans to move 4,000 jobs out of the UK.

Other asset managers have said they will set up bases in Dublin or Luxembourg to ensure ongoing access to the common market.

It would be easy to dismiss these losses as just bankers and financial wonks. Hedge fund groups have also announced plans to leave, and we definitely wouldn't miss them or their shouty ways, would we?

It seems likely the cost of living will rise, as the falling pound makes imports more expensiveWell, the trouble is, financial services are a key part of the UK economy: they contribute up to 12% of total tax receipts, depending on which figure you believe. So actually, we would miss them.

It seems likely that the cost of living will rise, despite the supermarket sector's ongoing fisticuffs and price wars. The UK imports a vast amount of the goods it needs, and the falling pound makes those goods more expensive.

If people still want to buy German cars, French cheese or US technology (how we love a stereotype), it will cost them more, leaving them with less money to spend on other stuff. So Brexit will fairly quickly put pressure on family budgets.

This isn't just rarified economist chat. I have received at least three emails from retailers this week, telling me that prices are increasing by about 10% as their supplier costs have gone up. It may be opportunism, but it could also be genuine financial pressure.

Race for remedies

So far, so miserable. However, policymakers are trying to find ways to mitigate the problems. The Bank of England has loosened the capital requirements for banks, potentially freeing up £150 billion for lending. This is designed to provide more lending to households and businesses.

The theory goes that if people have greater access to cheap credit, they will keep spending. The long-term consequences of this may be a little iffy - rising debt - but for the time being, it could keep the ball rolling.

With interest rates already at record lows, monetary stimulus is in a 'last chance saloon'In our survey, a rise in interest rates was the biggest worry in the wake of Brexit. It was cited by 35% of respondents as a key concern, ahead of the affect of Brexit on stockmarkets, pensions and the housing market. However, despite the inflation fear, interest rates are expected to fall, not rise.

The Bank of England's remedy is Mark Carney's commercial equivalent of Viagra: it encourages us all to go out and have financial Friday night on the tiles - borrowing and spending - to boost the economy.

The trouble is that interest rates are already at historic lows, so we are (to mix a heady cocktail of metaphors) in the last chance saloon and running out of ammunition.

Moreover, monetary policy is an imperfect tool. Seven years of ultra-loose monetary policy have done little to generate lasting recovery, and it is not guaranteed to work now either. People don't always want to borrow, even when banks are willing to lend, particularly if they feel insecure in their jobs.

A weak pound reduces the price of the UK's exports, making them more attractiveSterling has been battered. But what does this mean for the economy? In some cases, a weaker pound may help business. It may encourage people to buy relatively cheap domestic products.

It reduces the price of the UK's exports abroad and therefore makes them more attractive, which should improve the outlook for exporters.

But again, this is not a perfect mechanism - the UK tends to export high-valued-added goods that are not particularly price sensitive - although it should help at the margin.

Some winners

Of course, some companies will benefit from a weaker currency. , for example, expects to double its profits this year from currency translation alone, because more than 90% of its revenues come from outside the UK. Its share price has leapt by more than 10% since the vote.

is another classic example of why the FTSE 100 has remained relatively calm. Such big beasts tend to be more reliant on Beijing than Birmingham.

We can find silver linings, but the bottom line is probably inflation and higher living costsBurberry makes more in Asia than it does in Europe, Africa and the Middle East put together. If cash-strapped Brits decide not to buy posh macs, it won't hurt the company much.

The chairman of recruitment agency , Leslie Van de Walle, has been relatively upbeat. He says in a recent results statement: "Wherever there's change, there's opportunity. Look at the number of lawyers that will be needed. Cyber security is a growth area.

"And jobs in media and communications have come on as a result of Brexit." I guess that's optimism, though it feels like a rather unholy version.

We can find a silver lining to the sterling cloud, but the bottom line is that we will probably import inflation, the cost of living will rise and we will be flagging up the waning appeal of the UK on the global stage, at least over the short term.

Bricks and mortar

The focus for many people is on the property market. Property funds have hit the headlines as the big fund managers have stopped withdrawals from their funds.

The thinking is that if you have a fund with two big shopping centres, an office block and a supermarket, you can't sell these overnight to satisfy your redeeming investors.

Even if you could sell one of them, you'd be in a rush, you wouldn't get a great deal and it would unfair to all the remaining investors sitting tight.

A lack of confidence, not fundamentals, may be the property market's undoingMeanwhile, lots of people are wondering what Brexit means for house buying or selling. The experts disagree on the outlook.

Technically, there are no obvious reasons why the housing market should slow down: interest rates are super-low and supply remains tight relative to demand. However, people are rattled.

A Bank of England report has warned that we could see falls of 15-20% in house prices. On the average home price of about £200,000, this would amount to a £40,000 hit.

The bank wants to warn people - in order to manage expectations - by sketching out a worst-case scenario. But a warning can look like a prediction in a five second headline sound bite on BBC News at Ten.

Some fear an exodus and brain drain from the City, which will dampen property prices in the capital. We might also see foreign investors selling buy-to-lets as the UK loses its appeal.

It may not be Armageddon, but it's hard to see how the UK can escape a recessionEstate agent has issued a profit warning, and its share price fell by 20% two days after the Brexit vote. In the end, a lack of confidence rather than fundamentals may prove the undoing of the property market.

Overall, we may not be on the brink of Armageddon as some fear, but it is difficult to see how the UK can escape without a recession.

We can only hope it is relatively shallow and short-lived, and that the agreement we ultimately forge with the EU allows business to carry on, if not quite as normal, in much the same way as it did before.

Theresa May might be promising to be a "bloody difficult woman" with the EU, but as a new prime minister she will probably find that a wounded UK economy brings the "bloody difficult" conversations much closer to home.

This article was originally published by our sister magazine Money Observer here

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.