Final service for Restaurant Group sites

26th August 2016 14:17

by Harriet Mann from interactive investor

Share on

Admitting you are part of the problem, let alone the main reason, is hard to do. But it's exactly what has done after a difficult year collapsed its share price by two-thirds. Alongside interim results, it's earmarked nearly £60 million to shut 33 outlets just weeks before ex-Paddy Power boss Andy McCue takes the helm.

Running more sites than last year, revenue for the six months to 3 July grew 3.4% to £358.7 million. However, on a like-for-like basis this slipped to 3.9% due to issues in its Leisure division. Operating profit fell 4.4% to £37.5 million, with adjusted pre-tax profit down 3.7% to £36.6 million, giving earnings per share of 14.26p.

That beat many City forecasts, although estimates had already been slashed. A strategic review has so far focused largely on its underperforming Frankie & Benny's chain. Bosses are convinced it remains "relevant", but admit recent challenges are self-made.

It's getting rid of the worst sites, including 14 Frankie & Benny's restaurants and 11 Chiquito sitesA poor focus on value, weak menu changes and bad operational execution has weighed on the business just as competition intensifies. So the group is bringing back past popular dishes, testing new value offers and focusing on families.

And it's getting rid of the worst sites, among them 14 Frankie & Benny's restaurants and 11 from the Chiquito chain. Include a £59.1 million one-off charge to cover the closures and impairments on site asset value, the group plunged to a £22.5 million loss, although the closures are tipped to boost 2017 operating profit by £6-£8 million.

"Whilst the performance in the first half of 2016 was disappointing, the company is profitable, highly cash generative and retains a strong balance sheet," said the firm. "The board has confidence that it has identified the issues impacting performance and is taking the correct actions to improve performance and create value for shareholders."

Most had expected a dividend cut Friday, but management is confident it will meet current trading forecasts and have maintained the 6.8p interim payout. Expecting the full-year dividend to stay at 17.4p, the shares yield 4%.

Look for full-year sales of £695 million and adjusted pre-tax profit of £77.1 million, says Numis Securities analyst Tim Barrett. Forecast earnings per share of 30.2p gives the shares a price/earnings multiple of 14 times.

Frankie & Benny's under the microscope

With only itself to blame for issues at Frankie & Benny's, relief flooded the market when old Paddy Power boss Andy McCue was announced as the chief executive in mid-August. This is part of a wider shake-up of the group, which has seen Barry Nightingale join as the new chief financial officer and Debbie Hewitt join the board as chairman.

"We expect him to prioritise stabilisation of the F&B brand, but we also see scope for more effective capital allocation," says Barrett, "but we also see scope for more effective capital allocation. The decision to close 33 underperforming sites seems a sensible start."

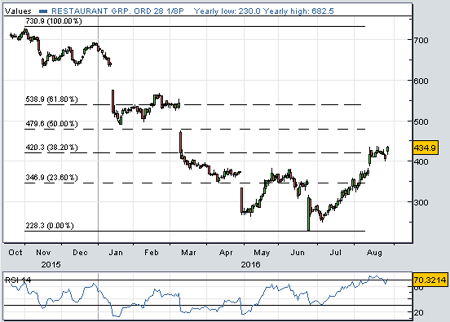

Collapsing by two-thirds since last November, Restaurant Group's share price cashed to a six-year low of 228p after Britain voted to leave the EU in June. The shares have clawed back some of these losses, boosted by news of McCue's appointment. Up 7% to 435p Friday, the 38% Fibonacci retracement level from last year's high becomes technical support.

"We view it as an attractive, cash generative, turnaround situation that under the credible new management team should return to earnings growth relatively quickly," adds Barrett.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.