10 high-yielding shares with long records of raising dividends

26th August 2016 16:49

by Kyle Caldwell from interactive investor

Share on

Since the start of 2015 dividend cuts have come thick and fast - more than a dozen FTSE 100 companies have taken the axe to their dividends over the past 18 months.

Some of these had in the past been consistent payers. , one of the dividend casualties, was a decade ago considered an income staple.

This is not the only headwind. Income seekers are also facing the greater challenge of sourcing income at a sensible price. Consistent payers, those companies that boast long dividend histories, have proved immensely popular, and as a consequence their dividend yields have been driven to low levels.

In tougher times one sensible strategy is to seek out companies that have a solid record for growing payments year in, year out.

Dividend heroes

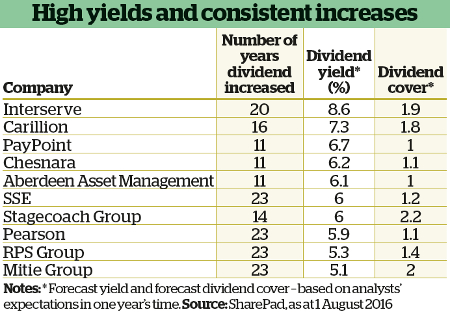

Research for our sister magazine Money Observer by SharePad, a portfolio analysis tool, screened the UK stockmarket for companies that have grown their dividends for at least a decade.

Out of the 700-odd shares in the FTSE All Share, a total of 92 shares had achieved the feat. Investment trusts, however, were excluded.

A low dividend cover score, around one or lower, suggests dividends are vulnerableOur table lists the top 10 high yielders, with outsourcing group top of the pile, yielding 8.6%, followed by construction services firm and payment specialist , yielding 7.3% and 6.7% respectively.

But Phil Oakley, analyst at SharePad, says: "Investors need to question whether the dividends can keep growing. High yields tend to go hand in hand with low dividend growth going forward as the stockmarket rarely hands out a free lunch."

As a rule of thumb, a low dividend cover score, around one or lower, suggests dividends are vulnerable, as the company is using most, if not all, of its profits to fund the dividend. A figure of two or more is viewed as comfortable.

This article was originally published by our sister magazine Money Observer here

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.