Scary charts raise sell-off fear

30th August 2016 17:41

by Lance Roberts from ii contributor

Share on

Despite a "belief" that "This Time Is Different (TTID)" due to Central Bank interventions, the reality is that it probably isn't. The only difference is that the interventions have elongated the current cycle and created a greater deviation than what would have normally existed.

What is not "different this time" is that the eventual reversion of that extreme will likely be just as damaging as every other bear market in history.

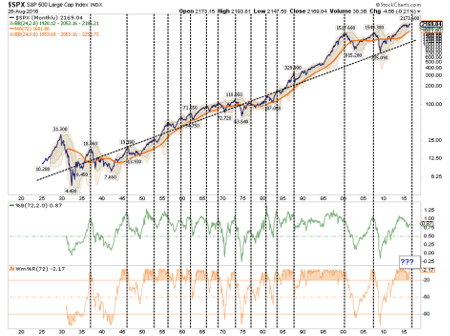

The chart below shows the S&P 500 back to 1925 with the long-term trend line overlaid with a 72-month (six-year) moving average and Bollinger bands. The bottom two graphs are the percentage of the band width of 2-standard deviations of the 72-month moving average and the 72-month Wm%R [a momentum indicator].

The vertical dashed lines correspond with corrections when both the %B and Wm%R both turn down from highs. While that has not occurred as of yet, it is unlikely at this point that it won't. It's just a matter of timing.

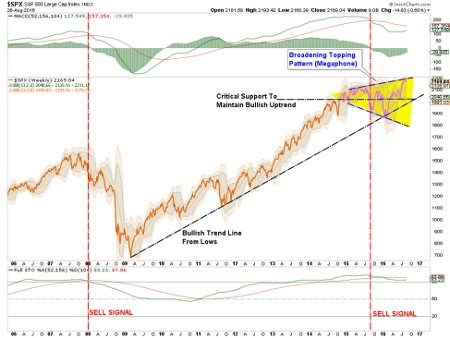

Furthermore, on a longer-term basis, the market continues within a "broadening topping process" or a "megaphone" pattern. While these patterns do not always come to fruition, the fact this one is combined with a dual sell-signals only registered prior to the financial crisis does provide some cause for concern.

Lance has identified a number of other charts flashing warning signals. To read more, click here.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of "The Lance Roberts Show" and Chief Editor of the "Real Investment Advice" website and author of The "Real Investment Daily" blog and the "Real Investment Report". Follow Lance on Facebook, Twitter and Linked-In