Four portfolios to generate a £1,000 monthly income

4th October 2016 11:24

by Kyle Caldwell from interactive investor

Share on

In the new world of flexible pensions, growing numbers are deciding against handing over their life savings to an insurance company, and are instead taking matters into their own hands and choosing to live off their investments in retirement.

People in this position typically have other income to draw on, such as a defined benefit pension. Others may choose to buy an annuity with part of their pot to secure their basic living expenses, and then leave the rest invested.

For most, the aim will be to secure a reliable and regular income from their investments, while at the same time not inflicting too much harm on the capital. With average life expectancies now running into the mid-80s, these pension pots need to be designed and built to last.

Check out our sister magazine Money Observer's 12 Model Portfolios for more ideas on how to invest your pension cash.

Example portfolios

The challenge, of course, is how best to produce such an income. Money Observer has come up with various ways a portfolio can be constructed to deliver a monthly income of £1,000 a month at retirement.

But first, before we get to the nitty gritty, a big caveat needs to be spelt out. To achieve the £1,000 a month goal, your pot size needs to be at least £250,000 - and that is if you are prepared to consider the highest-risk strategy outlined.

Otherwise, a pot size of £300,000 or £350,000, with the underlying investments collectively yielding 4% or 3.5%, is more realistic. Advisers say smaller pot sizes will be taking too much risk if they aim to produce this size of income.

Also bear in mind that with all of these strategies, there will be periods when the underlying assets fall sharply in price. This is, of course, part and parcel of stockmarket investing.

It is therefore prudent to hold a separate cash pot that you can draw on when your assets have lost value. Advisers typically recommend two years of income should be held in cash.

The all-out income approach

First up is the "all-out attack option" for those prepared to prioritise income now over income growth in the future. This is something some retirees looking for a monthly salary will be prepared to accept, perhaps because they are not in good health or are relatively elderly.

But a word of warning - focusing exclusively on income comes at a cost: your capital will likely not grow much.

In this scenario, due to its high-risk nature involving more or less 100% in equities, retirees need to be particularly mindful of eating into capital, and only take the "natural income" (dividends and bond interest payments) generated by the investments.

According to Sam Lees of Fundexpert.co.uk, an initial investment of £250,000 can generate £1,000 a month with minimum hassle, split equally across the following five funds:

(yield of 7.2%), (7%), (6.8%), (4.4%) and (4.1%).

All-in-all the average yield comes to 5.9%. Each fund pays quarterly, as opposed to monthly, but number-crunching by Lees reveals that dividend payments are in excess of £3,000 per quarter (paid in January, April, July and October), meaning that an effective monthly income of £1,000 can be achieved.

"The fund managers tend to smooth payouts throughout the year, but investors should be aware that they may not be completely equal for each quarter. However, in this hypothetical portfolio there is a reasonable amount of leeway built in to cope with any fluctuations," says Lees.

The three highest-yielding funds differ from your run-of-the-mill UK equity income fund, in that they use a special technique that involves selling derivatives to other investors in order to boost the income.

Capital growth is therefore sacrificed, so when stockmarkets are riding high don't expect these funds to keep up. Equally, in extreme periods when stockmarket volatility reigns, these funds are never going to top the capital preservation league tables.

Lees says this is why it is important to balance the portfolio with other funds. He adds that the specialist income funds should not be viewed in isolation as a silver bullet solution for investors desperate for yield.

Active balanced approach

A less risky approach with a wider spread of different assets can also achieve £1,000 a month.

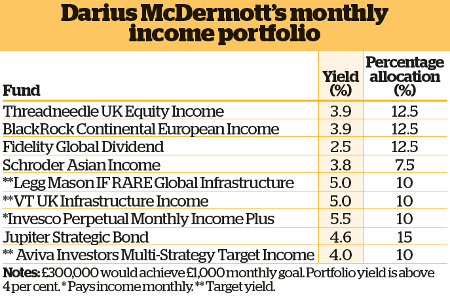

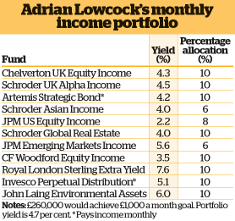

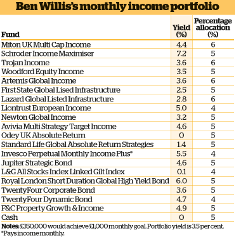

The three fund analysts Money Observer spoke to - Darius McDermott of FundCalibre, Ben Willis of Whitechurch Securities and Architas's Adrian Lowcock - have come up with hypothetical portfolios of a similar asset mix, recommending 45 to 55% in equities.

The bulk of the balance consists of fixed interest, while a small pocket is reserved for funds that specialise in property and infrastructure. The minimum investments for each example differ, however.

Lowcock's portfolio provides a yield of 4.7% for a pot size of £260,000, McDermott has aimed for a yield of 4% plus for £300,000 of capital, while Willis has been the most conservative in putting together a portfolio that will generate a yield of 3.5%. Willis says a pot size of around £350,000 is required.

While it is not unusual for an income fund to pay dividends quarterly, the majority tend to pay twice a year.

Each analyst made the point that investors building a pension portfolio that pays a monthly income should not get too hung up about this and should instead divide the income produced into monthly payments themselves.

In some dry months, however, capital may have to be drawn down in order to meet any shortfall.

"The biggest challenge in getting a regular reliable income from your investments is ensuring it is spread evenly across 12 months.

"Many funds tend to pay out quarterly or half yearly, and they tend to do so at similar times of the year. So whilst it is easy to get funds which pay an income in February, April is less common," says Lowcock.

"I wouldn't overthink this, though. Building a portfolio of investments that includes a fund which pays its income in April isn't the right approach - the fund is being selected not because it's the best performer but just because it pays out in a particular month.

"With the use of platforms investors can spread the income produced out into more regular payments, so effectively they create the monthly income they need, even though the underlying portfolio income is volatile. You can also do this using your bank account; it is cash-flow management."

Dividend calendar trick

It is possible to build a portfolio that is guaranteed to pay £1,000 every month, all year round, through the use of investment trusts.

According to the Association of Investment Companies (AIC), around one in three trusts now pays dividends quarterly, up from 17% five years ago. The growing trend to return cash to shareholders more frequently makes it easier to design and run your own monthly income portfolio.

One strategy, which admittedly is time-consuming and fiddly, is to build a portfolio of "dividend heroes" - trusts that have long track records for growing their dividends year in, year out. In order to achieve a monthly income, the trusts selected will need to pay dividends at different times of the year.

Trusts have the advantage of being able to put away 15% of yearly income for a rainy dayVictoria Hasler, head of research at Square Mile Investing Consulting and Research, says: "There are no guarantees, of course, but trusts that have a long track record of growing dividends look well-placed to continue growing their income streams.

"The advantage trusts have in being able to put away 15% of income generated each year for a rainy day helps them maintain their long dividend track records during tougher times."

One simple example of a possible combination is (which last year paid dividends in January, April, July and October), (February, May, August and November) and (March, June, September, December).

In reality, however, a greater number of trusts would be preferable to achieve higher diversification, which will help reduce risk.

To ensure enough income is being generated each month, it may also be worth supplementing the trusts chosen with a trust that pays dividends monthly. Examples include and .

Bear in mind that the date an investment trust pays the dividend can be subject to change.

Monthly income fund option

There are a couple of dozen or so funds that pay income on a monthly basis. The fund manager invests in shares, bonds or a mixture of the two. The amount of income generated is based on the dividends the underlying holdings have paid each month.

Therefore, as with any fund, the income can vary, but to counteract this most of the funds smooth the dividend payments into 12 equal amounts, holding back some income in good months, which is then used to top up leaner periods.

Any excess cash leftover at the end of the year is then handed back to investors.

Hasler likes (yielding 3.5%) and (5.7%), while McDermott picks out (4.7%) and (5.5%) as his favourites.

Willis, however, cautions against investors restricting themselves to using an array of monthly income-paying funds. "There is not a plethora of these funds, so investors run the risk of buying a substandard fund just because of its income frequency," he says.

This article was originally published by our sister magazine Money Observer here

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.