A massive quarter for equities

11th October 2016 10:38

by Lee Wild from interactive investor

Share on

Alcoa, one of the world's largest producers of aluminium, kicks off the third-quarter reporting season after London closes Tuesday. Confidence has improved and the shares have rallied in the run-up to the numbers.

There's renewed optimism this side of the pond, too, and news that Russia and OPEC could agree either a cut or freeze in oil production has the back near a record high.

First thing Tuesday, the FTSE 100 had a second stab at breaking above 7,122.74, its previous best reached in April 2015. Having made it to 7,121.93 a week ago, the index touched 7,121.98 today.

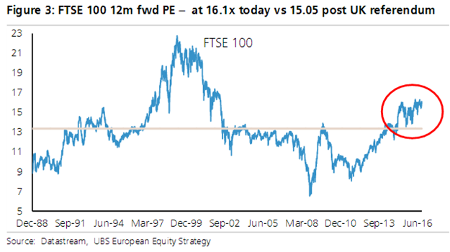

There are few places outside equities for investors to stick their cash, and despite the UK's leading index trading on near-record multiples excluding the tech boom (see chart below), there is definitely momentum and further gains cannot be ruled out. This is the historically strong fourth quarter after all.

UBS said recently the sickly pound would have to fall by another 10% in 2017 and the oil price by 10% to get its own forecasts up to consensus for earnings per share (EPS) growth of 17%. There is a great chance that both targets will be hit.

And the latest survey of finance directors by Deloitte reveals that sentiment rebounded in the third quarter. Admittedly, the number of CFOs pessimistic about the financial prospects for their firms is still a gloomy 31%, but it is much better than the 70% reported immediately after the EU referendum.

With some improvement in uncertainty levels, too, risk appetite has also picked up marginally and companies say they're more likely to hire and invest over the next 6-12 months.

Much of that has to do with events in the aftermath of the Brexit vote, including the swift appointment of Theresa May as PM, easing of monetary policy by the Bank of England, and growing expectations of fiscal easing at the 2016 Autumn Statement on 23 November.

Third-quarter winners

With that in mind, it's interesting to see which companies did best in terms of share price performance in the third quarter, which very neatly began seven days after the EU referendum and ended just a few days before the FTSE 100 came with fractions of a new record high.

The blue-chip index rose 6% during the period to 6,899. topped the pile, up 39%, joined in the top 10 by and . Even bombed-out housebuilders and , and banks and are among the winners.

Just 20 companies failed to manage gains during the quarter. A grim profits warning savaged outsourcer , down 30%, and unloved education giant still can't teach investors to love it. The shares fell a fifth.

The more domestically exposed FTSE 250 had an even better quarter than its heavyweight counterpartsSurprisingly, lost 3% during the period despite the lure of a 7% dividend yield and savings to come from the BG Group acquisition. An unreliable oil price and doubts about the dividend in some circles were an obvious turnoff.

A 10% surge in the week after Brexit took the wind out of . The highly-rated Dettol, Nurofen and strepsils firm spent the next three months ticking lower.

Elsewhere, the more domestically exposed FTSE 250 had an even better quarter than its heavyweight counterparts. The mid-caps added almost 10% over the period, again headed by billion pound miners and , up 67% and 61% respectively.

Nice to see smashed up challengers , and up there, too, between 40% and 53% higher, admittedly from record lows.

AIM stars

But top prize goes to the . After sinking to multi-year lows in February, and again in June, the junior index rocketed nearly 16% to levels not seen since spring 2014.

And, if any investor needed evidence that this is where fortunes can be made (and lost), check out AIM's best performers between June and September. There were 27 companies which doubled in value during the third quarter, and it wasn't just the minnows trading at fractions of a penny either.

Altitude shares soared 340% in the quarter, but the company doesn't know the reason for the surge, the £41 million miner formerly known as Mwana Africa, was pick of the bunch, bagging shareholders an incredible 500% return in just a few months.

rose 420% and is now capitalised at almost half-a-billion pounds, making it one of AIM's largest companies.

swelled fourfold and is now worth £244 million, while Harvest Minerals netted shareholders a 380% gain over the three months.

Away from the resource sector, is certainly worth a mention. Just days after publishing half-year results, chairman Peter Hallett bought 55,000 shares in the company at 42.85p. The shares soared 340% during the quarter to 54.25p, despite Octopus Investments selling 550,000 shares earlier this month.

And Altitude's fine form continued into fourth-quarter. The company says it knows of no reason for the sudden surge in buying interest, but the shares still change hands now for 89p. They were worth just 7.5p in April!

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.