10 trusts with biggest discount and premium moves since Brexit

19th October 2016 12:38

by Andrew Pitts from interactive investor

Share on

Some of the most extreme movements in discounts and premiums (the difference between a trust's share price and its net asset value) occur in the more specialised sectors of the closed-ended investment company universe.

That was certainly the case in the immediate aftermath of the Brexit vote. UK smaller company and property trusts were among the worst hit. Investor sentiment towards trusts such as swung violently in the space of a week.

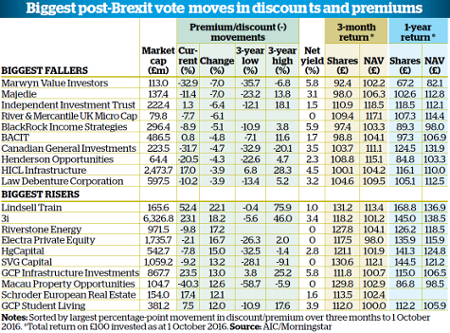

Much of the post-referendum action had subsided by early July, and in the table below we have measured the 10 biggest percentage-point risers and fallers in the three months to 1 October (after filtering out trusts with a current market capitalisation of less than £50 million).

Interesting situations

It shows some interesting situations. , the global trust run by feted fund manager Nick Train, is quoted on a premium to its net asset value (NAV) of 52%.

Demand for its shares added 22.1 percentage points to the premium over the past three months. It has been as high as 76% over three years.

Investors should consider crystallising gains from Lindsell Train and swapping into the fundTrain also runs a similar open-ended fund, , whose quoted investments are similar to the trust's. The main difference between the two is that the trust's portfolio is dominated by a holding in the management company, which accounts for 35% of assets.

However, the NAV return from the trust over one year, 37%, is not that far ahead of the open-ended fund at 31%.

So investors should consider whether it is worth crystallising the gain the current premium offers - especially given that the premium has been as low as nil in the past three years - and switch into the open-ended fund instead.

and share the largest widening of their discounts, a 7% move, over the past quarter.

Majedie looks the more interesting situation, as Marwyn's portfolio is highly specialised and the share register is dominated by institutions led by Invesco, which holds a 38% stake.

Majedie, a Money Observer Rated Fund, also has a large stake in its management company, at 27% of the portfolio. At 11%, the trust's current discount compares with a low of 23% and a premium of 14% over three years.

This article was originally published by our sister magazine Money Observer here

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.