10 of the best mining stocks right now

19th October 2016 14:01

by Ben Hobson from Stockopedia

Share on

There have been some stunning changes of fortune in the stock market since the European Union (EU) referendum. Not only was the initial shock of volatility quickly replaced with a surging run in index prices, but previously unpopular sectors suddenly found themselves in fashion. Nowhere was that swing in sentiment quite so stark than in the mining sector.

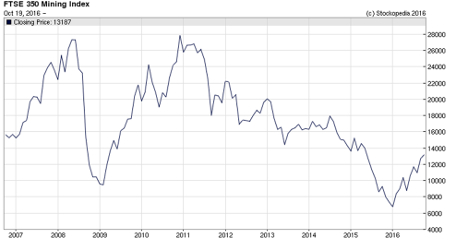

Mining stocks enjoyed a fabulous run during the first 10 years of this century. Booming global demand pushed a wide range of commodity prices to racy levels. Investors simply couldn't get enough of miners, ranging from the mega-caps of the to the small-cap exploration firms that proliferated on the .

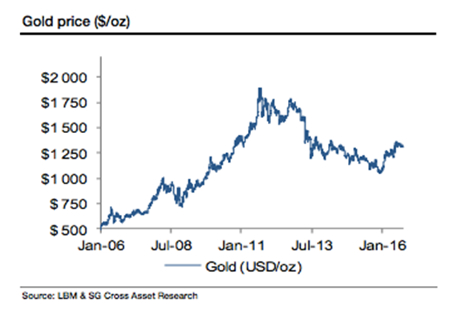

By mid-2011, the price of gold had stretched to just over $1,800 per ounce, but it turned out to be a high water mark.

Since 2011, mining stocks have been on their knees, as slowing demand and falling prices forced them into swingeing write-downs, cutbacks and profit warnings. Many of the exploration minnows on AIM have long since gone.

And, despite regular calls by some market-watchers that commodities are due to bounce off the bottom, nobody has wanted to own them...until now.

Commodities stage a comeback

The price of gold was already showing signs of a sustained mini-recovery when the EU referendum was held in June. So it was no surprise on the day of the result that it was mining stocks that enjoyed some of the biggest gains, and they've continued to surge ever since.

Part of the appeal of mining shares, particularly among the large caps, is that they offer investors comfort in times of domestic economic uncertainty. For a start, commodities are global in nature and almost always priced in dollars. Plus, of course, these firms earn large proportions of their revenues from foreign markets.

We screened for stocks with the best blend of high quality, appealing value and positive momentumIn terms of the falling value of sterling, UK quoted mining stocks whose shares are priced in pounds are theoretically now more attractively priced for foreign investors.

For the companies themselves, though, a slump in sterling may not necessarily make a difference.

Many of them hedge their commodity exposure to take account of price fluctuations. So, a rising gold price may not have an immediate effect on the earnings for some of them.

With all this in mind, we had a look for some of the most potentially interesting mining stocks around right now. We used the StockRank to look for those with the strongest blend of high quality, appealing value and positive momentum.

We also looked for stocks where earnings are forecast to grow next year and where brokers have upgraded their earnings forecasts in the past three months.

Name | Mkt Cap £m | Stock Rank | PE Rolling | Yield % | 3m EPS Upgrades % | Forecast EPS Growth % |

Centamin | 1,694 | 96 | 10.2 | 2.3 | 30.2 | 134.8 |

Pan African Resources | 403.2 | 96 | 11.0 | 4.3 | 12.5 | 110.3 |

Rio Tinto | 47,050 | 89 | 15.7 | 4.2 | 22.7 | 44.0 |

Ferrexpo | 618.1 | 87 | 5.8 | 4.0 | 45.0 | 1,144 |

Anglo American | 14,436 | 81 | 13.1 | - | 111.7 | 43.1 |

Fresnillo | 12,048 | 75 | 50.4 | 1.0 | 22.2 | 337 |

Antofagasta | 5,151 | 67 | 39.9 | 0.9 | 43.2 | 1,242 |

BHP Billiton | 64,508 | 66 | 15.8 | 2.3 | 41.1 | -31.8 |

Hochschild Mining | 975.1 | 60 | 38.4 | - | 120.2 | - |

Kaz Minerals | 1,197 | 55 | 33.6 | - | 585.1 | 1,674 |

Those with the highest combined quality, value and momentum are Egypt-focused gold miner and South Africa based gold firm . But what's striking about the list is the forecast data, which includes some very substantial percentage earnings increases for next year.

It's worth remembering that in some cases, these increases are flattered as a result of starting from a low level. But even so, there is a consistent trend towards a much brighter financial performance from these firms next year. There are also notable yields of more than 4.0% on offer at the like of Pan African, and .

It would be foolhardy to try and predict a cyclical upturn in the mining sector, but there's no doubt that in the circumstances these firms have suddenly become much more appealing among investors.

Volatility in this sector can be severe and unpredictable, so careful investigation is needed. But in the search for ideas after several years of poor performance for natural resources companies, mining stocks could be an interesting place to start.

About Stockopedia

Interactive Investor's Stock Screening series is written by Ben Hobson ofStockopedia.com, the rules-based stockmarket investing website. You canclick here to read Richard Beddard's review of Stockopedia.com and learn more about the site.

● Interactive Investor readers can enjoy a completely FREE 5-day trial of Stockopedia by clicking here.

It's worth remembering that these and other investment articles on Interactive Investor are simply for generating ideas and if you are thinking of investing they should only ever be a starting point for your own in-depth research before making a decision.

*No fee for publication is involved between Interactive Investor and Stockopedia for this column.

Ben Hobson is Investment Strategies Editor at Stockopedia.com. His background is in business analysis and journalism. Ben researches and writes regularly on investment strategy performance and screening ideas for Stockopedia.com. He is the author of several ebooks including "How to Make Money in Value Stocks" and "The Smart Money Playbook"

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.