21 years' worth of investors' fund picks revealed

21st October 2016 15:30

by Rebecca O'Keeffe from interactive investor

Share on

Interactive Investor is 21 years old. To celebrate, our top journalists and the great and the good of the City have written a series of articles discussing what the future might hold for investors.

A look back at our investors' favourite funds over the past 21 years offers a potted history of the markets that takes in star fund managers, the extraordinary expansion of emerging markets, financial crises and a flight to yield-based assets and lower-cost funds.

Our investors have always been on the higher-risk side of the fence, helped by an average age in the 40s - unlike some of our competitors, whose clients' average age is significantly higher.

They tend also to be quick to adapt to the changing investment landscape, which has served them very well.

While the most popular funds now are predominantly active global equity/equity income funds, peppered with some passive alternatives, this has changed significantly over the past 21 years - reflecting the breadth of choice investors now have, an ever-intensifying focus on reducing costs and the consequent rise of index tracker funds.

In the late 1990s, when execution-only investing was in its infancy, Fidelity and Artemis dominated the top picks list - in particular , managed by Anthony Bolton.

Such was his popularity that his fund outsold the next most popular fund, , by a 3:1 margin. Investors' faith was well-founded: the fund was one of the best long-term choices for investors throughout Bolton's 28-year tenure, achieving annualised returns of over 9% a year (see table one, below top).

Technology meltdown

The early 2000s brought the dramatic bust of all things technology related. The plummeted from its over-inflated closing level of 6,930 on 30 December 1999 to a low of 3,287 in March 2003.

The technology bubble had seemingly sensible investors replacing their stable, boring, old-style stocks with a new wave of internet and other high-tech companies in expectation of future fortunes.

In the mid-2000s, investors' focus turned to commodities and emerging markets Those investors who had been quick to move into technology and fortunate enough to get out early fared well. But latecomers who suffered the fallout spent years recovering.

Two fund managers sought to avoid what they correctly perceived to be an imminent car crash. Bolton was one; the other was Invesco Perpetual's Neil Woodford.

Their foresight was attractive for investors who still possessed the courage and money to invest in the aftermath of the bubble, and both managers saw a wave of additional capital push their fund sizes to levels that seemed impossible to manage.

Nevertheless, the funds continued to perform. In the mid-2000s, investors' focus turned to commodities and emerging markets as China woke from its slumber to become an international growth phenomenon.

At that time Ian Henderson, manager of , joined the list of star fund managers. Investors also bought into the China story directly, with Gartmore China Opportunities a very popular fund (see table two below).

Many investors will wonder why the equity market continued north throughout much of 2007, despite the US property bubble bursting and initial signs of financial peril for banks.

In mid-October 2007, the FTSE 100 hit a seven- year high, coming within 200 points of its all-time peak. However, things were looking precarious for the banks, with Northern Rock, the most volatile of the UK banking stocks, trading a daily range of 20%.

Throughout the post-financial crisis years our investors kept their love of developing countriesMeanwhile, commodity prices were enjoying one of their best-ever periods. Yet again, those investors who were able to ride the wave on the way up were handsomely rewarded for their foresight, but the key (as always) was to know when enough is enough.

The fall, when it came, was swift and severe. The FTSE 100 dropped by almost 50% in 18 months . However, aided by aggressive central bank support, including near-zero interest rates and quantitative easing, the market managed to claw back its losses to reach a new high of 7,089 in April 2015.

Throughout this period, our investors maintained their love of developing countries and higher-risk assets, proving that investing over the longer term (especially with global central banks on your side) is worthwhile.

And so to the current market. Low interest rates imply lower future returns for investors. This low-return environment has encouraged investors to weigh up the pros and cons of active management and percentage-based fees versus the attractions of lower-cost passive funds and a fixed-fee schedule.

Our investors' preferences show the huge opportunities provided by market cyclesWhile passive tracker funds are now increasingly popular, many active managers have succeeded in retaining a loyal investor base, helped by the backdrop of large currency moves so far this year, which have delivered significant opportunities for managers with an unconstrained international mandate.

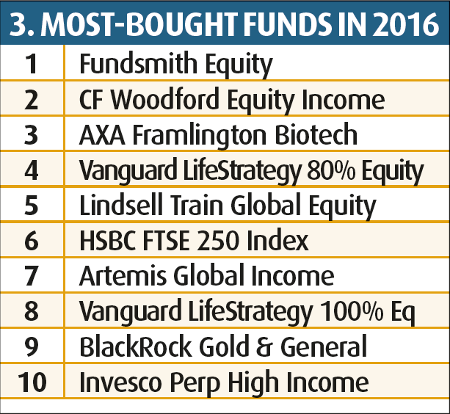

Topping our investors' list is Terry Smith's , which has been a stellar performer, reaping the benefits of large holdings in the US on both a valuation and a currency basis.

Behind him, in second place, Neil Woodford continues to appeal to investors who trust his ability to generate solid returns over the longer term (see table three below).

What the past two decades of changing fund preferences among our investors clearly show is that the market operates in major cycles, providing huge opportunities for investors, alongside equally large risks.

Peril of too little risk

While our investors' top 10 fund choices have typically delivered excellent returns in each of the periods reviewed above, it is sobering to think that some of them have also crashed horribly since.

Active investors able to ride the bull market up and savvy enough to get out before a fall becomes a crash will make fortunes. However, it is important to remember that regular investors can also benefit over the long term from buying dips as well as peaks.

Hopefully our investors will continue to ride the waves, embrace risk and remain engagedMy view of investing is that your future financial security is likely to be in greater peril from taking too little risk rather than too much risk, particularly during periods when markets appear subdued or pessimistic.

Market rallies are great, but as the last 21 years have shown, it is crucial not to get sucked into the last frothy spikes of an ageing bull market, since crashes can be severe.

Who knows what the next 21 years will bring, but hopefully our investors will continue to ride the waves, embrace risk and remain engaged in investing.

Rebecca O'Keeffe is head of investment at Interactive Investor.

This article was first published in our special publication 21: Twenty-one years of Interactive Investor. Download your digital copy for free here.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.