BAT and Reynolds to create £130bn colossus

21st October 2016 12:06

by Lee Wild from interactive investor

Share on

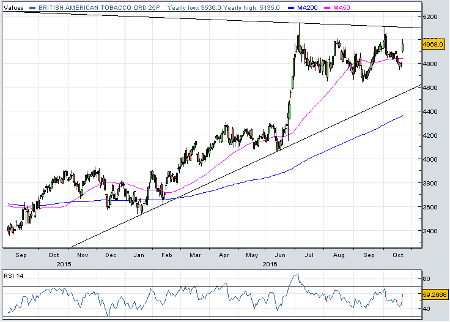

A 30% surge in the share price this year has shrivelled impressive yields somewhat, but investors just can't get enough of right now. The tobacco industry heavyweight has left rivals for dead, and it's about to get even bigger after flagging plans to buy the rest of for $47 billion (£38.4 billion).

BAT, which made a £5 billion profit last year from brands like Dunhill and Lucky Strike, has owned a 42.2% stake in Reynolds since 2004 when Brown & Williamson merged with RJ Reynolds. Now, it's offering Reynolds shareholders $24.13 per share in cash ($20 billion), plus $32.37 of BAT shares for the other 57.8%.

That's a 20% premium to last night's closing price, and values the entire business at $93 billion, or an enterprise value/cash profit ratio of 16.3 times. Get this deal past the regulators - and they should - and it will create the world's largest listed tobacco company by net turnover and operating profit. Only China National Tobacco would be bigger.

The Americans have a foothold in the US tobacco market, the largest global profit pool outside ChinaWhile the timing is perhaps a surprise, the rationale is not. With fewer smokers in the west, tobacco companies have chased growth in the Far East and elsewhere. There's been a huge upsurge in e-cigarettes, too, and both BAT and Reynolds do big business here.

Clearly, the Americans also have a huge foothold in the valuable US tobacco market, the largest global profit pool outside China. They also make significant sales in South America, Africa, the Middle East and Asia.

Crucially, there are fewer litigation issues these days, too. And, a year after making the deal, Reynolds finally completed the purchase of Lorillard Tobacco for $27.4 billion in June. BAT would not have made its move until then. Remember also that there was a 10-year moratorium on BAT buying additional Reynolds stock.

And, despite "relatively modest" cost savings of around $400 million, the deal would be earnings accretive in the first full year and improve the dividend.

Reynolds shares have underperformed recently, and this announcement comes just days after it missed third-quarter profit forecasts, blaming lower pricing and volumes. It also warned that industry volumes would likely fall 2-2.5% this year.

BAT, on the other hand, has prospered, and chief executive Nicandro Durante said Friday that revenue is up 8.1% in the first nine months of 2016, or 6.2% on an organic basis. Factor in the weak pound, and 497 billion cigarettes sold generated growth of over 10%.

Higher volumes in Ukraine, Bangladesh, Russia, Vietnam and Turkey have been behind a 40-basis point increase in market share so far this year.

A hugely lucrative business

Investing in tobacco stocks is not for everyone, certainly not ethical investors. But it has been a massively profitable investment for the rest of us. Last year, research by the London Business School and Credit Suisse revealed $1 invested in US tobacco companies in 1900 - with dividends reinvested - would now be worth $6.3 million.

BAT itself changed hands for around 300p a share as the turn of this century. It's now worth over 16 times that. It does mean, however, that the shares are not cheap, trading on around 19 times forward earnings. And the dividend yield is now under 4%.

Bargain hunters in what remains a hugely defensive sector might look instead to , or Imperial Tobacco as it was until February. Talk used to be that BAT would buy its London-listed rival, the firm behind Davidoff and Lambert & Butler cigarettes. It now trades on around 15 times earnings, or less, and yields over 4%.

Imperial embarked on a wild acquisition spree after it was spun out of the Hanson conglomerate in 1996. It paid almost £10 billion for Gauloises cigarette firm Altadis in 2007, and last year completed the £4.6 billion purchase of big brands, including Winston and 'blu' e-cigarettes, when Reynolds agreed to buy Lorillard Tobacco for $27.4 billion.

Might ailing Japan Tobacco be in its sights this time?

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.