Share of the week: A 'must own' company

21st October 2016 16:17

by Harriet Mann from interactive investor

Share on

After the commodity market collapse in 2014, smaller utility companies were able to take advantage of paralysis among the "big six". A transformative deal with npower lumps in with the big guns, which has been detrimental over the last two years.

But after a surge in UK wholesale power and gas prices, TEP shares are a "must own", according to broker Macquarie which has just upgraded forecasts.

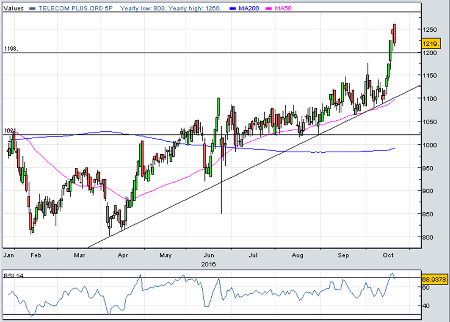

Among the FTSE 350's top performers this week, TEP surged 10% to 1,226p - a 50% rally since April. Interestingly, they've just smashed through the 38% retracement of the slump from the late-2013 high. Now trading on 18 times 2018 earnings estimates, TEP is valued at a double-digit premium to the European utilities and telecoms sector.

But Macquarie analyst Dilip Kejriwal thinks this is justified. In fact, he has just upgraded his price target from 1,170p to 1,300p. "We believe the slight premium is justified given TEP's strong medium-term growth potential, asset light business model and high operational leverage," he explains.

Smaller players have benefitted from the CMA's four-tariff rule, which was removed this yearWith power and gas prices up 34-40% in the year to date, the market has begun a new cycle.

While many smaller utility companies are exposed to rising commodity prices due to their limited hedging, TEP has a 20-year supply agreement with npower that gives it access to power and gas at a price set by the average of the "big six", less an agreed discount.

Benefitting from low and unhedged power prices since 2014, new entrants flooded the market, making life tough for Telecom Plus. Smaller players have also benefitted from the Competition and Markets Authority's (CMA) four-tariff rule, which was removed this year, and limited environmental and social obligations.

With over 20 new suppliers joining the UK market, TEP's membership growth rate sank from the "high teens" to -5%, data from broker Macquarie shows. That's why its share price nearly halved.

But the recent commodity price reversal has narrowed the tariff differential and TEP can now play its competitive hand. The 18-month hedged position of the "big six" is currently below the spot price of new entrants, most of which are now operating at negative of low single digit margins.

This swing in competitive power should continue to improve and TEP's churn rate should shrink as the tariff differential continues to squeeze. The broker has increased customer growth rates from a 5.3% average to 6.5% for 2016-2020, although this is still just a third of the growth rate witnessed between 2011 and 2014.

There's room for expansion into insurance, too. TEP could easily add £1 million to its valuation and boost margins with just a 20% uptake of motor insurance, the analyst reckons. Without a big marketing budget, a wider range of services would improve earnings visibility and improve customer stickiness.

Investors will find out how the group got on during the opening six months in the November interims. For the 2017 financial year, Kejriwal expects revenue to grow 8% to £801 million, driving a 14% increase in pre-tax profit to £36.4 million and EPS to 63p.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.