How to inflation-proof your portfolio

26th October 2016 10:10

by Kyle Caldwell from interactive investor

Share on

One of the biggest risks facing long-term savers and investors is the stealth tax that is inflation, which slowly but surely erodes the real value of your money over time. For the last couple of years inflation has been pretty much at the bottom of investors' "worry list".

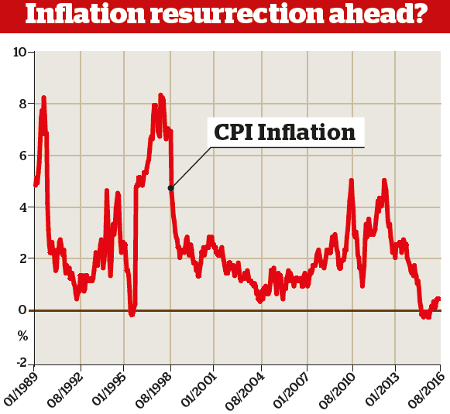

Both the consumer prices index (CPI) and the more comprehensive retail prices index (RPI), which includes mortgage interest payments, have remained stubbornly low, in part driven by the dramatic oil price rout that began in summer 2014.

Inflation set to rise steadily

Since November 2015, CPI inflation has been below 1%, but the consensus views of various economists and analysts is that over the next year or so inflation will begin to rear its head once again. Indeed, last week it crept up to 1%.

Most predications have inflation rising to around the 3% mark over that period, so the rise will be muted and gradual rather than returning to the double digits of the mid-to-late 1970s.

Future inflation fears stem from concerns that the result of the EU referendum could result in a slowdown in the UK economy.

But a more common view is that the weakness of sterling since Brexit (down 10% against the dollar) will make imports, especially energy and food, more expensive, and this will lead to a rise in inflation.

Financial planners, including Patrick Connolly of Chase de Vere, are concerned. Connolly suggests that now is the time for investors to consider using inflation insurance policies.

"It does seem likely that inflation will rise, especially as it is starting from such a low level and the energy price falls have already worked their way through the calculation, although it is hard to make a confident prediction in terms of how much it might rise and for how long," he says.

"Sensible investors should take a long-term approach and assume that there will be inflation over time."

Bond inflation insurance

Inflation is a bond's worst enemy, as it erodes the purchasing power of the income investors are paid. When inflation returns, holders of long-dated bonds suffer the most, but it would be a mistake to write off fixed income in its entirety. Some bonds will benefit when inflation is higher, as they are inflation-linked.

Inflation-proofing is difficult and a bit of a forgotten skill as it's been irrelevant for a decade or soAndrew Merricks, head of investments at financial adviser Skerritt Consultants, has been preparing for a higher inflationary environment by significantly upping exposure to index-linked gilts and European and global inflation-linked bonds.

He has purchased three bond exchange traded funds: , and .

"The benefits of linkers are without question in a rising-inflationary scenario, so to tuck some away now, before everyone is focusing upon them, makes sense if you think that inflation will raise its head again," says Merricks.

"But inflation-proofing is difficult and a bit of a forgotten skill as it's been irrelevant for a decade or so. We've also had a few false dawns in inflation predictions - not least when many economists predicted rampant stagflation as a result of the first bout of quantitative easing."

Tom Becket, chief investment officer at wealth manager Psigma, has also recently bought inflation insurance through the .

Another way to mitigate risk is to use funds that hold bonds a couple of years away from maturityHe adds: "The market's inflation expectations are far too low and I think there is a real risk that investors wait until after the event (inflation returning) before putting strategies in place to protect their portfolios."

Another way to mitigate risk is to consider bond funds that hold bonds with short lifespans - in other words are a couple of years away from maturity.

Darius McDermott of FundCalibre favours the . He is not the only fan - over the past year the fund's size has swelled from £269 million to £484 million.

Equity inflation insurance

Inflation is bad news for certain parts of the equity market - most notably companies that are price-takers rather than price-makers. Cyclical businesses that compete on price, such as supermarkets and retailers, will struggle.

Therefore, to ensure that dividends keep up with inflation levels, it makes sense to target shares that possess pricing power.

Stocks that fit the bill have huge barriers to entry and are well-placed to grow their earnings come what mayDavid Coombs, a multi-asset fund manager at Rathbones, endorses this strategy and has been tilting his portfolios to have a greater amount of exposure to businesses he thinks will continue to thrive in a higher-inflation environment.

"Those that fit the bill have huge barriers to entry and are well-placed to grow their earnings come what may. Examples include US firms and ," says Coombs.

A number of Money Observer Rated Funds, including , and , all invest in this fashion - seeking out high-quality businesses with competitive advantages.

Alan Steel, who has been a financial adviser for over 30 years, says that on the whole equities will beat inflation substantially over the long term, driven by the compounded growth of reinvested dividends, which over time provides the biggest chunk of an investor's total returns.

Those who stick to cash or who have too much of their portfolio exposed to bonds will lose out, he adds.

He adds that rather than obsessing about the individual stock winners and losers, DIY investors should outsource the investment decisions to the professionals and simply buy and hold a range of equity income funds, both UK and global.

An uptick in inflation would be no bad thing for businesses seeking to increase prices, and thus profits"While, as an asset class, equity income funds have been successful over the last 20 years in falling inflationary if volatile times, they were also successful value plays back in the 1970s and 1980s when inflation was at its peak," says Steel.

'Neil Woodford () has the experience back to the mid-1980s, plus there are plenty of other experienced heads at the helm of , , and the .

"They invest mainly in businesses with long records of growing dividends, and an uptick in inflation would be no bad thing for businesses seeking to increase prices, and thus profits."

Other ways to inflation-proof

Gold has previous form in offering some protection against inflation. Becket recommends every investor should have a small weighting, of around 5%, to the yellow metal.

"Gold pays no income and is difficult to value, but one thing is for sure: it offers a hedge on financial market chaos and is also an inflation insurance policy," says Becket. Assets that are scarce also tend to do well in inflationary environments, including classic cars, rare stamps and rare coins.

The challenge is to hold enough equities to provide growth and beat inflation, but not so many as to incur too much riskInfrastructure is also a good bet due to its monopolistic pricing power, according to McDermott. He adds: "Toll roads, for example, have prices linked to inflation. One fund to consider is ." Property, another real asset, has also historically acted as an impressive long-term hedge against inflation.

Connolly, however, stresses that investors should keep it simple and stick to equities. 'The best way to beat inflation is to hold growth assets such as equities, which can be expected to outperform over the longer term.

"But the challenge for many investors is to hold enough equities to provide growth potential and beat inflation, while not holding so many that they are taking too much risk.

"While it might sound a little boring, the right approach for most investors to beat inflation is a balanced portfolio which includes equities to provide growth potential, and more secure assets such as fixed interest to provide diversification and so help manage risks."

Steel adds that a sensible approach is to back a multi-asset fund manager that has a proven track record for avoiding big mistakes.

"Examples include Sebastian Lyon at , which has a 15-year track record, or David Jane, who is now at Miton. Another option is Alastair Mundie at Investec, just giving a few examples," says Steel.

"Over 15 years Lyon has returned 7.9% a year after charges, beating the FTSE All-Share's 5% yearly average return. Lyon's only negative 12-month period in these last 15 volatile years was a fall of 1.8% in 2013, a time when he was overcautious and built gold holdings too soon.

"In multi asset funds a manager can select value alternatives to lower risks, such as possible increases of inflation, so he will be attracted to the likes of index-linked bonds, gold and quality equities."

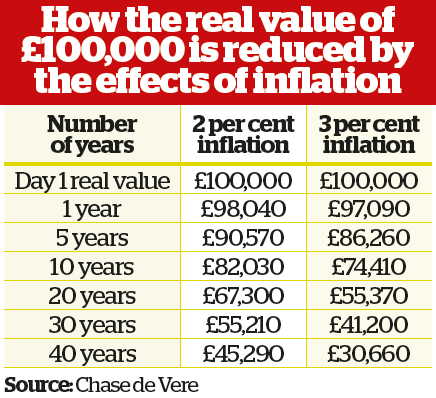

How inflation erodes the value of savings

While cash may seem safe in uncertain times, over the long term most cash accounts fail to protect your money from losing its real value as inflation picks up.

With CPI inflation at time of writing at 0.6% (now 1%), 459 of the 661 savings accounts currently on the market can beat or match inflation, according to Moneyfacts.

But this is likely to be a temporary phenomenon. The spectre of inflation making a comeback, coupled with pitifully low savings rates, should in theory encourage risk-adverse savers to consider investing in the stockmarket, which offers the potential for higher returns.

This article was originally published by our sister magazine Money Observer here

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.