The 10 best trusts for compounding returns

15th November 2016 11:52

by Heather Connon from interactive investor

Share on

Whether Albert Einstein actually said "the most powerful force in the universe is compound interest" has never been confirmed, but it is certainly an ingenious concept. Buy an investment with a good and growing income, and you can simply sit back and watch the pounds accumulate.

Even relatively low rates of income growth can build up quickly: a dividend growing at just 3% a year would double in less than a quarter of a century, and many investment trusts have averaged far better growth rates than that.

Income is always popular with investors - a growing income even more so - and, with cash and bonds currently offering such paltry returns, investments that offer a good and growing income are particularly in demand.

Helpful reserves

Investment trusts are a particularly attractive vehicle for anyone seeking a reliable and rising income. Unlike open-ended funds such as unit trusts, which have to pay out all their income each year, investments trusts can choose to add some of their income to reserves in bumper years, using those reserves to keep dividends growing when times are harder.

They can also borrow money - or "use gearing" in the technical jargon - to invest, which can mean they outperform in rising markets, albeit with the risk that too much gearing can detract from performance if markets are falling.

Annabel Brodie-Smith, communications director at the Association of Investment Companies, elaborates: "[Trusts have] a compelling case for being included as part of a balanced pension portfolio.

"They also have special income advantages which can be of benefit for long-term investors who may want to draw an income from an investment company in retirement and leave the capital invested, perhaps to pass on to their family when they die.

"These advantages include the ability to smooth dividends, which allows investment companies to hold back up to 15% of income in good times and pay it out in bad times.

"This means investment companies can maintain or increase their dividends, even at times when the companies they invest in are reducing theirs.

"They also have access to a wider range of investments such as commercial property and infrastructure, which can offer a higher level of income and, being illiquid, are better suited to being held in an investment company's closed-ended structure."

Brodie-Smith adds: "Investment companies are also able to pay dividends out of the profits they make when they buy and sell investments, unlike many open-ended funds.

"As this flexibility will reduce the capital profits, it tends to be used quite sparingly; however, it can be a useful tool to maintain or increase dividends in difficult times."

Accumulation and decumulation

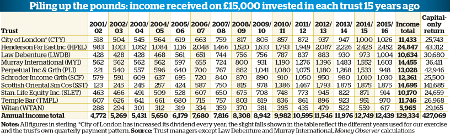

To show the benefits of compounding, and the attractions of investments with a good and growing income, we selected 10 investment trusts on the basis of their yield in 2001 and their dividend growth.

We then assessed their performance over the 15 years since then, under two different investment objectives.

The first, the accumulation portfolio, looks at the benefits of using such trusts to build up a pension. We invested £1,000 on 1 August each year in each of the 10 trusts from 2001 to 2015 and reinvested the dividends to build a pension pot.

The second, decumulation, portfolio of the same 10 trusts is for an investor who wants to take the income rather than reinvest it. This assumes that £15,000 was invested in each trust on 1 August 2001 and that dividends were withdrawn each year.

We then calculated the income earned from this portfolio each year, and what the shareholding, minus income reinvested, would be worth 15 years later.

The selection criteria were not entirely scientific. We used only equity-oriented trusts, ignoring property, private equity and bonds. We looked only at those trusts which had at least maintained their dividends for the whole 15 years - something which, of course, we can only know with hindsight.

We allowed only one trust per fund manager, so excluded the high-performing and , as managers Mark Barnett and James Henderson were already represented by and respectively.

The top performer is Scottish Oriental Smaller Companies, where £15,000 grew to £66,000And we decided to breach the requirement that the initial yield was at least equal to that of the FTSE All-Share in 2001 so that we could include a generalist trust, choosing from the global sector on the basis of its performance over the period, and some Asian flavour via .

The results are extraordinary. The £150,000 invested in the accumulation portfolio over the last 15 years has grown to £386,467 - a return of more than 150%.

The standout performer is Scottish Oriental Smaller Companies, where the £15,000 investment has grown to almost £66,000, reflecting the dramatic growth in emerging markets as well as the skills of Angus Tulloch and his team at First State Investments.

Tulloch is no longer manager of this trust following a First State reorganisation, so this record may now be at risk - although others on the team continue in place. But all of the trusts in the portfolio have more than doubled the initial investment over 15 years - and handsomely beaten the FTSE All-Share index.

Impressive returns

The decumulation statistics are equally impressive. The annual income generated from the £150,000 portfolio has grown from £4,772 to £12,439, an increase of 160% over the 15-year period.

The income in the final year of our analysis equates to a yield of 8.3% on the initial investment, about double the average for the index and a very attractive return when base rates are 0.25%.

The decumulation portfolio generated £130,000 of income and almost tripled in valueThe standout performer is , which has earned almost £25,000 in income - or 166% of the original investment - over the period.

In total, the portfolio generated almost £130,000 of income over the period, but that has not been at the expense of capital growth

The value of £427,069 on 31 July 2016 is well on its way to being three times the initial investment, and every single trust in the portfolio is at least 65% above its starting value, despite the fact that all the income was withdrawn.

Of course, investors do not have 20/20 hindsight and cannot go back in time to pick the best performers. Back in 2001, an investor could easily have opted for a trust that subsequently cut its dividend, performed badly - or even disappeared completely.

And, as the risk warnings say, past performance is not a guide to the future. While the past 15 years have not been brilliant for equities - the FTSE All-Share index, for example, has risen 47% over the period - the next 15 may not be any better.

A diversified portfolio and a focus on income can deliver good results even in sluggish marketsGlobal growth is sluggish at best, despite eight years of quantitative easing and other measures global policymakers have used to try to kick-start growth in developed markets.

There is a growing concern about what will happen to financial markets when these extraordinary measures are finally unwound. Meanwhile, China and other emerging markets have been inflating their own debt bubbles, and are showing distinct signs of slowdown.

But what our exercise does show is that a diversified portfolio and a focus on income can produce very satisfactory results even in sluggish markets.

While some of our trusts have done better than others, in terms of both income and capital growth the overall result has been good, whether building an investment portfolio or using it to provide an income in retirement.

What the experts say

Would this be a sensible portfolio to consider for future pension savings or withdrawal? We would certainly recommend broadening the range of funds to include other assets, including fixed interest and property in addition to equities.

But the experts agree that the portfolio we assembled gives a reasonable spread of equity exposure as well as good income prospects.

David Liddell, founder of the online investment advisory service Ipso Facto, thinks it a "reasonable portfolio", although he would prefer a bit more US and European exposure: at the time of selection, Europe did not have the same dividend discipline as the UK, while many US companies prefer share buybacks to paying dividends.

Dividend champions

Darius McDermott, managing director of Chelsea Financial Services (which is in the process of adding investment trusts to its FundCalibre ratings service), adds: "There are a number of 'dividend champions' - trusts that pride themselves on increasing their dividends every year - which can be particularly good in the decumulation phase."

He added that their ability to build up reserves was particularly useful when banks and oil companies were cutting their dividends over the last five to 10 years.

Tim Cockerill, investment director at Rowan Dartington, believes that the attraction of income is not properly appreciated by investors. "The longer the time period you have, the more effective compounding is."

Interest and inflation are low: locking in a long-term, inflation-beating income is a good strategyHe adds that growing income can be a useful hedge against the effect of inflation - even if inflation is just 2% a year, it can quickly erode the purchasing power of anyone on a fixed income.

Liddell adds that investment trusts generally have low charges, "something which is particularly important for long-term savings". When investment returns are relatively low, as they are currently, charges can have a disproportionately large drag on portfolio values.

Of course, we cannot guarantee that income growth in the future will be as healthy as it was in the past: many companies are struggling to make headway as economic growth remains sluggish, competition is intense and the emerging markets which were supposed to be the engine of the future are not proving quite as turbocharged as had been hoped.

But interest and inflation rates remain very low: locking in an income which will grow faster than inflation over the long term is a good investment strategy.

The 10 trusts profiled

City of London*

Yield 3.9%

Managed by Job Curtis for more than 25 years, is already firmly established as a dividend hero, having recently achieved the landmark of being the first investment trust to increase its dividend every year for half a century.

The payment in the year to June 2016, of 15.9p per share, was more than double the 7.5p paid in the year to June 2001, just before our analysis started.

The trust invests mainly in blue-chip shares, focusing on growth as well as income, and aims to beat its peer group every year.

Henderson Far East Income*

Yield 5.81%

One of the best-performing trusts in the portfolio, and the highest yielding. Manager Mike Kersley manages to combine excellent capital performance with generous income payments, with his investments spread across 12 countries and a range of industries.

The yield currently stands at around 5.8%, slightly above where it was at the start of our 15-year analysis period. Growth over the past 10 years has been an average of 7.8%, compared with 3.8% for the FTSE 100 index.

Analyst Winterflood points out that its dividends have historically been fully covered by the income generated, so it has not had to use the facility to pay dividends out of reserves.

Law Debenture*

Yield 3.24%

James Henderson, who runs Law Debenture, could have been in the portfolio twice - his Lowland trust also has an excellent income and growth record but, in the interests of diversifying risk and portfolio ideas, we allowed just one trust per manager. Law Debenture just pips Lowland in terms of total return over the 15 years so we have decided to include it.

One of the oldest investment companies, dating back to 1889, it has few constraints geographically or by sector, although currently its investments are predominantly in the UK. Dividends have grown from 6.9p in 2001 to 16.2p in 2015, an increase of more than 130%.

Murray International*

Yield 4.05%

A diversified global trust, aims for an above-average yield through a diversified portfolio of international equities and fixed income securities, although in the past few years that has meant paying some of the dividend from reserves, to the detriment of its net asset value.

Its recent performance has been a bit disappointing, with the trust lagging its benchmark over the last three years, but 2016 has been markedly better. Manager Bruce Stout still takes a pessimistic view of global growth and so is diversifying investments.

Perpetual Income and Growth*

Yield 3.31%

Manager Mark Barnett, like James Henderson, could have featured in the portfolio twice as he also manages the Keystone investment trust. Again, however, we chose the better-performing of these two trusts.

Indeed, Barnett's performance on Perpetual Income and Growth was one of the key reasons he was chosen to succeed Neil Woodford, his mentor, on Invesco's and open-ended fund twins when Woodford departed to set up his own firm.

Barnett's approach is long term and contrarian - he is happy to hold out-of-favour stocks for some time and he favours companies which pursue a sustainable dividend policy and where the source and progress of sales and profits is clear.

Schroder Income Growth

Yield 3.89%

One of the best performers in the portfolio, has a 20-year record of dividend increases with annualised growth of 4.7% over that time. That record should be sustainable following top-ups of reserves in the past few years.

Manager Sue Noffke, who took over five years ago, seeks out companies which have fallen out of favour but have strong recovery potential. She currently has a high weighting to financials and consumer goods, with and among the top 10 holdings.

Scottish Oriental Smaller Companies*

Yield 1.25%

While this trust did not meet the yield criteria for selection back in 2001, the desire for a diversified portfolio and its consistent dividend performance since means we decided to include it in our analysis.

It has been managed by First State Investment's Angus Tulloch, but a reorganisation of the company means he will be stepping back, although co-manager Wee Li Hee will remain in post.

Dividend growth has been impressive, with the payout rising from 1.5p to 11.5p over the period under review. We will monitor the effect of this change on the trust to determine whether it should remain in the portfolio.

Standard Life Equity Income

Yield 3.6%

Dividend growth on has averaged 5.5% a year over the past 10 years and it also has a comfortable level of cover which should protect the payment for the next few years.

Thomas Moore, who has managed the trust for the past five years, has increased the exposure to smaller and medium sized companies with , and among the larger holdings - setting it apart from many of the traditional UK equity income funds.

Temple Bar

Yield 3.6%

Last year marked the 32nd consecutive year of dividend increases for , and the prospect of continued growth makes the 3.6% yield attractive.

Manager Alastair Mundy, who has run the trust for most of our 15-year span, looks for cheap, out-of-favour companies predominantly from within the FTSE 350 index. Larger holdings include HSBC, and the .

Witan*

Yield 1.62%

Back in December 1974, you would have paid the equivalent of 7p for a share in Witan; by 2015, you would have been earning almost two-and-a-half times that, 17p, in dividends for each share, a yield of 189%.

That statistic, from chief executive Andrew Bell, underlines the benefits of compound growth and taking a long-term view. Witan was established in 1909 and has a global mandate.

Unusually for trusts, it is a multi-manager fund with different specialists in charge of particular mandates. They include Artemis, Lindsell Train and Heronbridge in the UK, Veritas and Tweedy, Browne for the global element; and Marathon among the European managers.

*Denotes a Money Observer 2016 Rated Fund.

This article was originally published by our sister magazine Money Observer here

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.