The best and worst investment funds of 2016

21st November 2016 17:30

Political instability is starting to impact asset prices and it's Money Observer Rated Funds in the global and emerging markets sectors that are faring best.

The past year has been a tumultuous one for investors, dominated in the UK by the result of the European Union referendum and its increasingly uncertain outcome. Hard or soft Brexit? Somewhere in the middle? Or perhaps no Brexit at all? It has, and will continue to have, an influence on the performance of Money Observer's Rated Funds.

The vote to leave the EU was driven by a rise in populist, nationalist and often racist political idealism. This phenomenon has not been confined within the UK's borders and has culminated in the election of Donald Trump as president of the US.

His narrow but not wholly unexpected victory is further proof that for too many people, capitalism is not working and they feel increasingly marginalised and less well-off.

Crisis and scapegoats

Populist standard-bearers such as Trump, Nigel Farage and Boris Johnson - not to mention several other far-right European leaders with fascist leanings such as Marine Le Pen, the leader of France's National Front - offer up immigrants and refugees as prime scapegoats for the woes of working people on low incomes.

But post-financial crisis policies such as quantitative easing and austerity, a lack of affordable housing and plummeting pension incomes have very little - if anything - to do with immigration and refugees.

Bad for business

These issues need to be highlighted because they are among the factors that are contributing to the performance of financial assets today, and they provide an inkling of what to expect of those assets in the future.

In 2016, the effect of populist politics on asset prices has been more pronounced than what we saw in Europe in 2014/15 with the rise of Syriza in Greece and Podemos in Spain.

If Trump delivers his protectionist agenda, emerging market asset values will likely slumpThe Brexit vote trashed the pound and created a climate of uncertainty in business boardrooms and a commensurate slump in capital expenditure plans.

In the week before the Trump election victory, the US stockmarket recorded its longest losing streak since 1980 and a doubling in volatility measures such as Wall Street's "fear gauge", the Vix index.

The fear factor prior to the election indicated that a Trump win would not be good for business; markets have since risen on the back of his policies thought to be good for mining, energy and pharmaceuticals.

I haven't seen any convincing reasons why Brexit would be good for business. And with far-right parties challenging the centrist status quo in core northern European countries, the corporate status quo is under threat on that front as well.

His promise to repeal Obamacare would benefit big pharma firms and healthcare providersSo how will the shifting political tides contribute to returns from various asset classes and the funds investing in them?

In the US, we know that if Trump follows through on his protectionist electoral agenda, emerging market asset values will likely slump in response to the introduction of trade tariffs.

His promise to repeal the Affordable Care Act, also known as Obamacare, would benefit big pharmaceutical companies and healthcare providers.

Who cares?

Of course, if you are Terry Smith, you don't much care. As the feted manager of wrote in the Daily Telegraph recently, it is far better to focus on the "known knowns" than the "known (or unknown) unknowns".

All you need to do is buy good companies and hold them for as long as possible, he says. But even Smith acknowledges that his fund's performance benefited from the known unknown of sterling's dive against the dollar following the Brexit vote.

The only global peers to have beaten Fundsmith are those with a global equity income mandateAs he put it when I spoke to him shortly after the vote, it amounted to "a half-billion pound boost for doing nothing".

Given Fundsmith Equity's heavy focus on shares with earnings in dollars, this plunge certainly boosted its performance beyond that of peers in the Investment Association's global sector, as well as the other funds and investment trusts in Money Observer's Rated Funds global growth asset group.

With a return of 28% in the year to date, the only global peers to have beaten Fundsmith are those with a global equity income mandate - specifically and , which have risen 35% and 29% respectively.

, the investment trust with an income focus, has returned to favour this year, with a sharp narrowing in its discount to net asset value (NAV) contributing to a 45% rise in its share price, making it the fifth best Rated Fund performer in 2016.

Global outperformers

Asset classes with a global focus have outperformed UK-focused Rated Funds, but it is emerging markets and Asia-focused Rated Funds that have served investors particularly well, in spite of a rising US dollar.

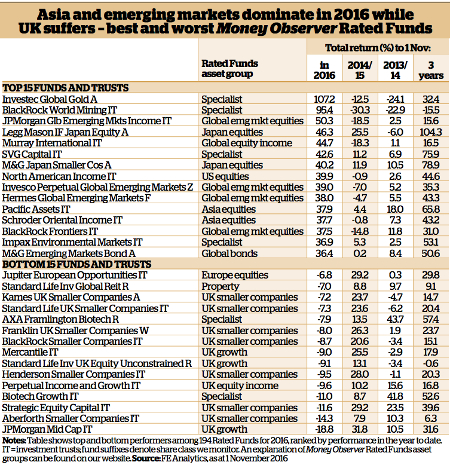

Led by , up 50% in the year to 1 November, all eight Rated Funds in the global emerging markets asset group rank among the top 38 best Rated Funds for 2016, with three in the top 10.

Two of our global bond choices with a focus on emerging markets - and - are also sporting gains of above 35% that rank nearly as highly as the equity-focused selections.

Some higher-risk specialist choices such as , private equity trust (the subject of a takeover bid) and two Japan-focused selections also show up well.

In UK growth, the worst performers were mid-cap-focused fundsTo find the best UK-focused performer so far in 2016, we have to look much further down the list to number 70 among our 194 Rated Funds.

is a member of our UK equity income asset group, although it is actually a constituent of the Investment Association's growth-focused UK all companies sector.

It has continued its strong long-term run with an 18% gain, and its multi-asset stablemate is just a whisker behind it.

Worst performers

At the other end of the performance table, and barring a few specialist funds in the biotechnology space, UK Rated Fund asset classes dominate the list of worst performers. In the UK growth asset class, the worst performers are those focused on medium-sized companies.

loss of 19% has been exacerbated by a widening of its discount to NAV from around par to 11%, which implies a loss at the NAV level of less than 10% over the course of the year.

However, as the table above shows, that follows gains of 32% and 10% in the previous two annual periods to 1 November respectively, leaving longer-term investors still sitting comfortably.

The derating of smaller companies investment trusts gives investors a buying opportunityOur Rated Funds in the UK smaller companies asset group have fared worst of all as a group.

Half of the worst-performing 14 funds and trusts are in this group, with investment trusts suffering most in 2016. But here again longer-term investors should not be overly concerned.

The derating of investment trusts that focus on smaller companies arguably presents far-sighted investors with a buying opportunity.

The three that appeal most as undervalued are , and .

As we have been warning for some time now, UK dividends are under pressure, and this is now manifesting itself in poor total return performance among funds and trusts in the UK equity income category.

This is notable because despite sterling's fall, which has boosted the prospects of overseas earners (and therefore the where many equity income funds and trusts focus), eight of them are in negative territory for the year after stripping out average annual income of 3%.

But in times of stress, investment trusts generally have an advantage over open-ended funds as far as income is concerned, because trusts can hold back some of the dividends they receive in good years to maintain payments in leaner times.

That should stand income investors in good stead next year, should dividends remain under pressure.

Stand-out performer

The last observation is reserved for the stand-out performer in 2016. Investors who backed at the start of the year have more than doubled their money, healthily reversing more than two years of depressing losses for investors in funds with a focus on the precious metal and gold-mining companies.

This is one asset class that has further to run, in tandem with the rising appeal of populists.

This article was originally published by our sister magazine Money Observer here

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks