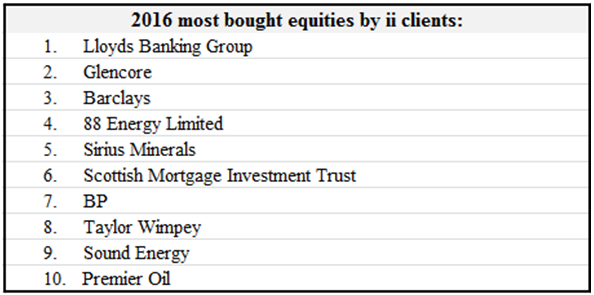

10 most-bought shares of 2016

21st December 2016 13:08

by Lee Wild from interactive investor

Share on

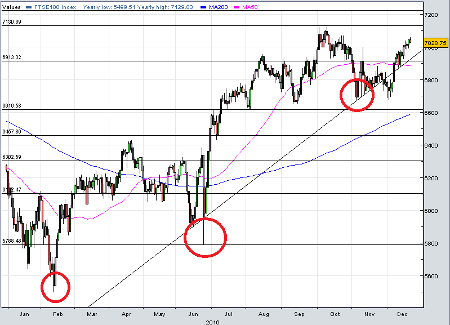

After a catastrophic start to the year, and with the Brexit vote and Donald Trump's election still fresh in the memory, there's a tendency to reflect on 2016 as a year of disaster. However, there have been many great trading opportunities over the past 12 months, and buying the dips has proved immensely profitable for many investors.

Every one of those three potential disasters wrong-footed many investors. Who would have though after the Brexit vote that the FTSE 100 would rally over 1,300 points to a record high at 7,129?

Our annual look at the most-bought stocks among Interactive Investor clients tells the story of the markets this year, and many of these shares have done great things in 2016.

"Equity investors have spent the year trading in and out of financial and commodity stocks, as both sectors delivered plenty of opportunities for engaged investors," explains Rebecca O'Keeffe, head of investments at Interactive Investor.

" is the most owned retail stock, so inevitably is the most bought share, with investors seeing the share price trade in a wide range. However, the biggest winners of the year were miners and oil producers, which soared alongside their underlying raw material prices. These stocks dominated much of the trading tables throughout the year."

Indeed, there was never a wrong time to buy this year. Kicking things off at just 90p, and only months after some analysts had written it off, the miner and commodities trader rode a wave of optimism around debt reduction, capacity cuts and rising metal prices.

Glencore shares had hit 200p by the summer, eventually peaking at almost 308p in December. Dollar strength following Trump's election and a first rise in US interest rates for 12 months has removed some of the froth, but some think there's more to come here.

It was a similar story at . It finally put the Gulf of Mexico disaster behind it and proved a major beneficiary of the oil price recovery from late January. At near-500p, BP shares haven't been this high since mid-2014 when oil prices stood above $100 a barrel.

Brexit was a serious hammer blow to . Fears that repercussions could ruin the UK housing market had investors fleeing the sector. Wimpey lost 43% of its value within hours of the 'leave' vote, but bargain hunters have done well and there has been a partial recovery.

However, performance has been unconvincing since, and a prospective dividend yield of around 8% implies traders anticipate a tricky 2017. Fear is that a weak pound stirs inflation and UK consumers feel the pinch.

Defy the doubters

defied the doubters and looks certain to end 2016 as the best-performing domestic bank share. Despite a valiant effort from and Lloyds, both of which have proved profitable trades for bottom fishers, Barclays shares have actually risen in 2016, currently up 3.6%.

Elsewhere, Saudi Arabia's recent deal with non-OPEC producers to cut oil output has underpinned gains at , while Alaskan shale driller has been an excellent performer following progress at its Icewine project.

It was an incredible year for , surging to a record high of 52.5p in August after finally getting all approvals needed for its potash project in North Yorkshire. The shares were worth just 10p in February.

However, to secure the required funding, Sirius could only get a share placing away at 20p, which has since proved a magnetic attraction for the shares. At least investors will not be tapped for any further cash, so further dilution is unlikely. Now, the hard work begins, with activity at the site ramping up early next year.

rewarded investors with a 16% gain in 2016, but we've saved the best performer till last.

Starting the year at 18p, shares peaked at 102p in September, the culmination of a three-month rally following great news from its Tendrara well onshore Morocco, then its Badile well in Italy.

Sound shares have slipped to around 70p since, but analysts at broker finnCap believe they're worth at least 87p.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.