High-yielding Persimmon is flying

5th January 2017 12:46

by Harriet Mann from interactive investor

Share on

In another two fingers to Brexit doomsdayers, has added further fuel to the fire that's warming sentiment to the housebuilders. With decent sales momentum and a big increase in cash, the company starts 2017 in a powerful position and that 6% dividend yield looks safe as houses.

While both the property and stockmarkets have looked immune to Brexit uncertainties so far, the backdrop could deteriorate once prime minister Theresa May triggers Article 50 in March.

Beginning the formal process of Britain's exit from the EU could threaten sentiment during the key spring selling season - around a third of annual reservations are made between February and April, explains Liberum analyst Charlie Campbell.

But Persimmon, the country's largest housebuilder by market capitalisation, starts the year in good shape. Shrugging off Brexit, revenue jumped 8% to £3.14 billion in 2016 and the order book is currently worth £1.2 billion - 12% higher than last year.

Cash in the bank rocketed from £570 million to £913 million, nearly three times higher than the £339 million dividend pay-out expected this year (110p per share). At least the dividend looks protected against any potential turbulence as EU negotiations play out.

As usual, there'll be no mention of profit until final results on 27 February. However, management thinks gross margin will have improved in the second half of the year as land cost recoveries associated with opening new sites reduced and the group kept a tight grip on development costs.

The basic market fundamentals remain firmly in the housebuilders' favour: more people are able to get on the housing ladder thanks to government stimulus, but there's still a severe shortage of homes after decades of chronic underdevelopment. The government is expected to force already stretched local councils to increase the number of homes they are going to build in the new Housing White Paper due to this month.

Broker fans

Deutsche Bank is a fan of the sector. The broker said yesterday that tasty dividend yields, strong cash generation and 25% return on capital could mean 30% upside for share prices.

Persimmon built 15,171 homes in 2016, 599 more than the year before, and increased its average selling price by 4% to £206,700. Demand stayed strong in the aftermath of the Brexit vote, and Persimmon's second half private sales rate was 15% ahead of the year before.

There are still opportunities to be had within the land market and the company opened 255 new sites across the UK. Work has started on all of those with planning consent.

"We like Persimmon for its high dividend at low risk, and are confident that the company will achieve the payments pledged because of the management's incentive scheme," Liberum's Campbell says. "Additionally, its long landbank means it could cut land spending entirely to boost cash flows, and the strategic landbank may continue to boost margins too."

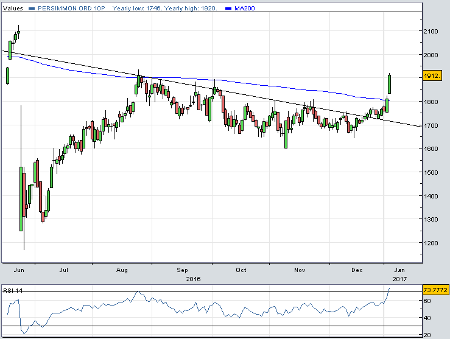

Leading the FTSE 100 Thursday, Persimmon jumped 6% to 1,920p, extending a break above the 200-day moving average to its highest since August. The shares are already trading 63% higher than their post-Brexit low at 1,170p, yet still change hands for just 10.5 times the 182.8p earnings per share (EPS) the City expects in 2017.

This traditional valuation metric looks undemanding, especially with further support from yield close to 6%.

On Wednesday, Deutsche Bank analyst Glynis Johnson rated Persimmon a 'hold' with 2,069p price target. "Few alternative stocks in the index offer dividend yields >6.5%, which are covered by [free cash flow] with scope for more should the companies look to return their full net cash," she said of Persimmon and the other two FTSE players Taylor Wimpey and Barratt Developments.

Persimmon is Liberum's top pick, along with , and , all rated 'buy'.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.