FTSE 100 extends rally past 500 points

9th January 2017 13:43

by Lee Wild from interactive investor

Share on

The relentless drive into uncharted territory continued Monday as Prime Minister Theresa May's hint at a "hard" Brexit sent the pound crashing. That's great news for the army of blue-chips who make most of their money in strong dollars, but not so good for the domestic-focused mid-caps.

In an interview over the weekend, May appeared to confirm the UK could not hang onto "bits of EU membership", implying we'd lose access to the single market. That had sterling down from $1.2270 to $1.2125, its lowest in over two months.

Check out the FTSE leaders Monday - , , , , . All make oodles of cash in the US and elsewhere, generating riches when money made in foreign currency is converted back into cheap pounds.

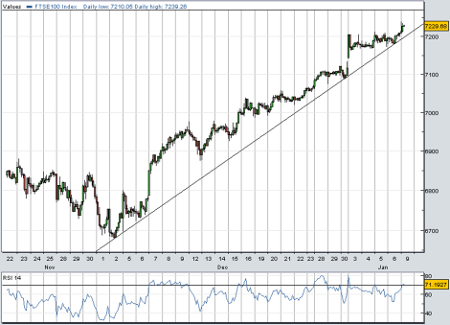

After the S&P 500 hit a record high Friday, and the Dow Jones came within 0.37 points of 20,000, the FTSE 100 traded as high as 7,239 Monday, extending its incredible streak since 5 December to 19 winning sessions out of 23. It's up 500 points, or 7%, since.

is top of the pile currently, leading a pack of miners including , and , all of which have underperformed the market so far in 2017.

A bullish note on the sector from Barclays certainly helped. It remains upbeat on metal prices, at least for the first six months of the year, and tweaks to commodity price assumptions have triggered a wave of price target upgrades.

Anglo American goes up to 1,240p, BHP to 1,385p, to 4,490p and to 800p. Coverage of Glencore is reinstated as Barclays Top Pick among European miners with 390p price target.

Among the banks, is off the boil following last week's heroics. Upgraded by Barclays to 'overweight' with price target up 36% to 75p, we now hear that the government sold another 700 million shares Friday to take its stake below 6%.

Rival high street lender also struggled Monday despite Deutsche Bank upgrading the shares from 'hold' to 'buy'. The broker tips the fast-rising shares to 270p from 198p as it starts the year "well placed for earnings growth".

In fact, financials are taking a breather across the board, with insurers , and easing up. There's no love for retailer following last week's profit warning, or for ahead of its third-quarter update on Thursday.

Data last week revealing the UK economy was performing better than had been feared following June's Brexit vote, had been a significant boost to the FTSE 250, with its focus more on domestic earners.

And the mid-cap index has made 1,000 points since early December, or nearly 6%. However, a weak pound makes imports more expensive, causing price hikes here and a possible squeeze on consumers upon whom UK firms depend.

As well as weak financials like and , domestic plays including pub owner are down heavily Monday. Property and construction companies are tumbling, too, which explains why , , and are out of favour.

Still, there's plenty of fun on AIM today as the small-cap index makes new multi-year lows as it approaches post-financial crisis levels.

Standout performer on the junior market today is , whose shares just doubled. Last we heard was on 30 December, when the firm said it had continued to reduce outstanding liabilities and it was "reviewing acquisition prospects" in the live event and entertainment sector. Progress there, perhaps?

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.