Our 2016 investment trust tips reviewed

10th January 2017 10:51

by Fiona Hamilton from interactive investor

Share on

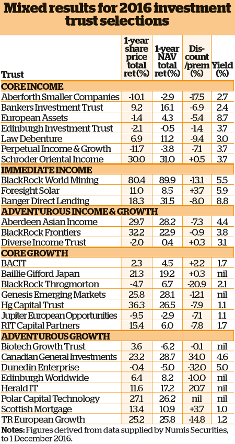

Our experts' tips produced exceptionally varied results last year. This was partly because most overseas-oriented trusts received a big boost from sterling devaluation, whereas UK-oriented trusts were hit by worries about the medium-term impact of the Brexit vote.

It was also partly because some highly regarded managers suffered an uncharacteristically poor year in 2016. They included Alex Darwall at , Sam Cosh at , and Mark Barnett at and .

This poses a big question for investors. Has it thrown up an opportunity to back these former stars on unusually wide discounts, or have they have lost their touch?

Successful selections

Of the four trusts mentioned above, just one has been retained by the same expert for the coming year, whereas eight of the 2016 tips that performed spectacularly or relatively well have been chosen again this year.

They are , , , , , , and , which disappointed in share price terms but did well in its sector.

BlackRock World Mining cannot be expected to repeat its fantastic recovery over 2016, during which its holdings benefited from rising commodity prices and contracting competition, but it should make progress if infrastructure spending picks up in the US and elsewhere.

Ranger Direct Lending has been much the most successful company in the direct lending sector. Aberdeen Asian Income is one of several Asian trusts managed by Aberdeen to have returned to form.

John Newlands at Brewin Dolphin has been one of our most successful trust pickers over the years. He picked the second-, third- and fourth-best performers in 2016: , and BlackRock Frontiers.

HgCapital enjoyed a well-deserved re-rating, but it now looks fully valued compared with most other private equity trusts, so Newlands has looked elsewhere in its sector for 2017.

Emerging market enthusiasm

The other two capitalised on the revival in enthusiasm for emerging markets. Donald Trump's election success has raised questions over whether that will be maintained, but Newlands is keeping faith with BlackRock Frontiers, whose managers have a knack of finding pearls in unpropitious corners of the world.

Newlands' other selections included , which performed reasonably, and BlackRock Throgmorton, which is now on a well-above-average discount for its sector, despite a NAV record that's much better than average.

Newlands has stuck with it, at least partly because its portfolio of contracts for difference should allow it to capitalise on falling as well as rising share prices.

Jean Matterson at Rossie House Investment Management is a long-term admirer of Baillie Gifford Japan's manager, Sarah Whitley. Matterson did well to make it one of her regional choices last year. Almost all the other experts steered clear of Japan.

Matterson's other regional choice performed even better, despite being in a less favourable stockmarket. The has notched up a formidable record since Ollie Beckett was appointed manager in 2011.

Matterson's UK selection, , was more resilient than most other UK choices, although its manager, Gervais Williams, struggled to keep NAV total returns above water in a taxing year for UK equities.

Happily, RIT Capital Partners performed reasonably in the multi-asset class. Matterson has retained it for 2017, despite its big premium.

Peter Hewitt at F&C Investments also backed Baillie Gifford Japan, but was less successful than usual last year with his other tips.

Andrew McHattie at The McHattie Group and Tim Cockerill at Rowan Dartington did well to make one of their specialist selections, as it made the most of a good year for technology shares.

Cockerill's selection of Foresight Solar fulfilled its task of paying out an attractive quarterly yield while holding its NAV relatively steady. His choice of proved a very rewarding play in the Far East ex Japan sector.

However, the only tip Cockerill is retaining for 2017 is Bankers Investment Trust, which did well in its sector last year in terms of net asset value total returns but has fallen to an above-average discount.

This enhances its upside share price potential and its yield, which is 2.4%, paid quarterly.

This article was originally published in our sister magazine Money Observer. Click here to subscribe.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.