How to bag a bargain share in the January sales

10th January 2017 13:24

by Kyle Caldwell from interactive investor

Share on

There are various ways to weight the odds of investment success in your favour: investing for the long term, rebalancing regularly and diversifying are three strategies that spring to mind.

Another is to keep a close eye on valuations and seek out undervalued areas of the market. This approach entails many risks, but potentially offers great rewards.

Contrarians who back an unpopular sector or an investment trust on an unusually wide discount can find themselves holding a potential gem, the true worth of which is not reflected in its current share price.

Famous investors, including the late Sir John Templeton, advocate bargain-hunting. Templeton once said: "If you want to have a better performance than the crowd, you must do things differently from the crowd."

Going cheap

Cheap stockmarkets are often inexpensive for a reason, and can end up being value traps. Low valuations may be due to political or economic instability in a country, for example, but they may be a sign of unrecognised potential.

Usually, a catalyst such as political reform is required to realise this potential. When this materialises, bold investors who bought towards the bottom of the market are richly rewarded.

According to Star Capital, a firm that keeps tabs on stockmarket valuations, the five countries with the cheapest markets at the time of writing (at the end of November) are Russia, China, South Korea, Brazil and Austria.

This ranking is based on various measures of value, including the price/earnings (PE) ratio, price to book and cyclically adjusted price/earnings ratio (CAPE).

Research Affiliates, a US company specialising in long-term return predictions across various stock and asset markets, agrees that on valuation grounds Russia has the greatest return potential.

The US is red hot on valuation grounds, scoring 27 versus a long-term average CAPE of 16The firm rates the likelihood of investors achieving an annual return north of 10% there over the next decade at 50%.

The company lists Poland, Italy, Turkey and Spain as four countries that long-term, patient investors may find appealing. It claims investors in these countries have a 75% chance of achieving annual returns in the region of 7% between now and 2027.

On the CAPE measure, which compares a firm's market value with its profits over 10 years, the UK is neither cheap nor expensive on a score of 14, slightly below its long-term average.

The US, however, is considered red hot on valuation grounds, scoring 27 versus a long-term average of 16. Research Affiliates has pencilled in a 50% chance of a return of just 1.1% a year on US large-cap stocks over the next decade.

The simplest way to gain exposure to "cheap" stockmarkets is via an ETF, as many ETFs focus on the market in a single country.

Although active funds may also focus on one country, it tends to be a larger nation such as China. ETFs are offered by iShares, and , among other firms.

Testing the market

The UK stockmarket hit record heights a couple of months ago, but it is not considered expensive.

Matt Hudson, manager of the and funds, puts this down to the wide disparity between cheap and expensive stocks.

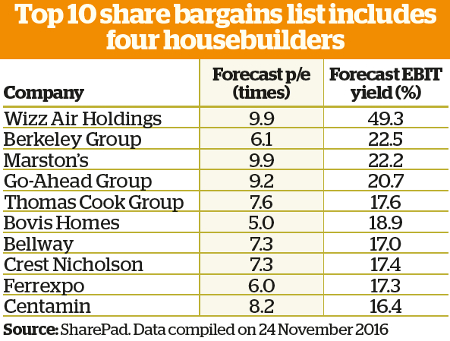

With this in mind, we asked SharePad, a data service for DIY investors, to screen the FTSE All-Share index for cheap shares that should be on a value investor's radar.

Some "safety tests" were applied to eliminate shares that stand out as obvious value traps. To pass the test, each cheap share had to have an earnings before interest and taxes (EBIT) yield of 10% or higher.

To further sort the wheat from the chaff, Phil Oakley, an analyst at SharePad, ensured each share had forecast earnings per share growth of at least 5%.

"Growing profits are a sign of health. [In this context] they could tell you that a share may have been overlooked and that too much pessimism is baked into the current share price," he says.

The table above shows the top 10 cheap shares based on all the filters Oakley applied, ranked in order of EBIT yield.

Four housebuilders came to the fore: , , and . Since 2010 housebuilders have been in something of a sweet spot, helped by favourable government policies and pent-up demand outweighing supply.

But the Brexit vote hurt the sector: some shares plunged 30% or more within hours of the result being known. As a consequence, shares are on much lower PE multiples today.

Essentially, investors need to weigh up whether or not the market is incorrect in its assumption that the sector's high-returning days are numbered.

Cheap sectors

Other sectors also look cheap. Alex Wright, manager of the and funds, says miners as well as oil and gas producers are as cheap as chips, but potentially dangerous.

Wright favours , which is offering a juicy yield of 7.5%. The firm has not cut its dividend since 1945.

Banks should also be on value investors' radars. However, Wright has been decreasing exposure to the sector since the Brexit vote, because he now expects interest rates to be "lower for longer", which is negative for banks.

Banks' dominant market position remains, thanks largely to inertia"Banks are, however, in a strong position compared with previous occasions when economic growth has slowed," he says.

"There has not been exuberant lending, balance sheets are much stronger and there is less competition today."

Dan Brocklebank, a fund manager at Orbis Investments, says banks are the standout value trade. At the end of September Orbis publicly disclosed positions in four banks: , , and .

Brocklebank says: "Regulators have come down on banks like a ton of bricks since the financial crisis, which is one reason why there's still negative sentiment towards the banking sector.

"The return on equity in future will be lower than it was a decade ago, but the valuations are much cheaper. Banks' dominant market position remains, thanks largely to inertia. Challenger banks are attempting to steal market share, but I cannot see them threatening."

Trust bargains

As we enter 2017, only two mainstream investment trust sectors offer juicy discounts: UK smaller companies and Europe. Both sectors are out of favour.

Smaller companies are avoided because sterling weakness and uncertainty over how the UK's divorce negotiations with the EU will pan out have reduced investment appetite.

The Brexit blues have also had an impact in Europe, but a bigger concern is the rise of the far right. In 2017 a handful of major elections take place, the biggest of which will be in Germany, France and the Netherlands.

Strategic Equity Capital looks a steal, trading at a 10% discountAll have eurosceptic political parties that have been gathering momentum. Given the macroeconomic uncertainty, it is no surprise that investors are not rushing to get their chequebooks out.

However, poor sentiment can allow long-term investors to gain exposure to a trust that has earned its stripes over the years. looks like a UK smaller companies trust bargain on a discount of 22%, which is wider than its one-year discount figure of 16%.

also looks a steal. It is trading on a 10% discount, much bigger than its one-year average of 4%.

In Europe, the discounts offered by and , of 6% and 4% respectively, are also wider than usual.

Fund favourites

Because of the way funds are structured, bargain hunting is more of an art than an exact science. But various experts, including Ben Willis at wealth manager Whitechurch Securities, view out-of-favour funds where there is a catalyst for a change in fortunes as value opportunities.

Willis tips , managed by Rob Burnett. He says the manager's value investment style has been out of favour for nearly a decade, but with inflation expectations rising, value has begun to come back into favour.

He adds: "Burnett has had a good year, largely due to his big 'overweight' to banks. Could this be the inflection point for value? Interest rates have hit a floor and are expected to go up in the US. A large headwind for value is removed."

We only need signs inflation is coming back, ahead of expectations, for financials to recoverBen Yearsley, co-founder of Wealth Club, agrees value could come back into fashion in 2017.

He says: "As a strategy, value has largely outperformed growth over the long term, with periods of underperformance coming typically when we are in a rate-cutting environment."

Yearsley says he has been adding to his value holdings, with the likes of and .

Willis tips as a potential bargain, because its performance was flat in 2016. The sector sold off heavily in expectation of a Hillary Clinton presidential victory.

Yet another fund with plenty of scope for recovery in 2017 is . Willis says: "It has been just under a decade since Lehman Brothers' collapse and the onset of the global financial crisis.

"Since then banks have gone through regulatory change, recapitalised and largely got their houses in order.

"We don't need high inflation and systematic rate hikes; we only need to see signs that inflation is coming back, ahead of expectations, for these sectors to recover."

This article was originally published in our sister magazine Money Observer. Click here to subscribe.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.