Smaller companies tipped to bounce back in 2017

13th January 2017 10:18

by Marina Gerner from interactive investor

Share on

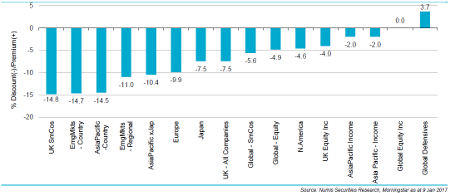

The investment broker Numis has released a new report on equity investment trusts which details the sectors with the biggest discounts, as well as providing some recommendations for 2017.

For 2017, the broker aims to identify funds where the share price will outperform the benchmark on a risk-adjusted total return basis, either through a narrowing of the discount or outperformance.

In its view, there is currently value among UK mid and smaller-company funds, where discounts have widened significantly over the past year.

Despite uncertainty for the UK economy over the Brexit process, Neil Hermon, manager of , points out that smaller companies' balance sheets "are stronger than during the financial crisis, dividends are well supported, and there continue to be opportunities to invest in businesses with exciting growth plans".

Over the past 60 years smaller companies have outperformed large-cap shares. Research in 2015 by the London Business School found that investing £1 in 1955 in the Numis 1000 index, composed of the smallest UK-listed companies, would have produced £12,144 by the end of 2015.

The same £1 invested in the FTSE All-Share would have grown to just £829.

Over 10-year periods since 1955, smaller firms outperformed larger companies five times out of six.

Trust picks

One of Numis's favoured trusts is , which has a well-defined value approach. "Although Aberforth's track record looks dull even over a 10-year period, we regard the team highly and believe that there is a role for a value-oriented fund."

Further, the Numis team views Henderson Smaller Companies as an attractive core holding.

"Neil Hermon's approach is focused on companies with good growth prospects, sound financial characteristics and strong management, trading at a valuation level that does not reflect these strengths."

In common with many of its peers, the fund faced a difficult period for performance around the time of the Brexit vote. However, the net asset value (NAV) recovered strongly in the second half of 2016 (+21.1%), which resulted in a gain of 8.3% for the year as a whole.

And Numis notes that Harry Nimmo of has a good long-term record since he started managing the fund in 2003, through a focus on high-quality growth businesses.

Keep a diversified portfolio, whilst retaining firepower to exploit opportunities"The growth style differentiates the fund from most of its peers that tend to focus on growth at a reasonable price. Towards the end of 2016, the NAV lagged behind many of the peers due to less exposure to a recovery in resources and other cyclical stocks.

"The discount has widened to 7% and we believe that this is attractive, particularly given that the board has a commitment to keep the discount to 8% through buybacks (and tenders if necessary).

"During 2016, Harry Nimmo confirmed his intention to remain as manager of the fund for the next six years."

Numis is not the only expert to favour small and mid caps for the year ahead, but the team warns that in general it's hard to find good value at present.

"Valuations are not cheap, in our view, with a historic [price/earnings ratio] for the FTSE All Share of 24.8 times," says Numis.

"As a result, we recommend maintaining a diversified portfolio, whilst retaining some firepower to exploit opportunities as a result of market volatility during the year."

This article was originally published in our sister magazine Money Observer. Click here to subscribe.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.