10 shares for a £10,000 income in 2017

27th January 2017 15:00

by Lee Wild from interactive investor

Share on

Investors spent much of 2016 arguing about valuations, worrying that equities were just too expensive. But despite huge market shocks including the China-inspired crash, Brexit vote and Donald Trump's election win, share prices recovered each time with renewed vigour.

We shouldn't really be surprised. Where else is the public expected to invest its money? At a time of record-low interest rates, dividend-paying equities are catnip to income-seeking investors - even more so following the Bank of England's decision in August to halve rates to 0.25% and beef up its programme of quantitative easing (QE).

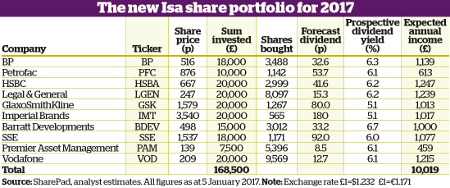

Acknowledging the persistent difficulty of achieving decent returns on your money, we decided to build another portfolio of 10 companies able to generate annual dividend income of £10,000. Our inaugural income portfolio in 2015 achieved its objective, give or take £80, and although it suffered some capital depreciation, it outperformed the over the 12-month period.

In 2016, having received a few tweaks, our portfolio did far better, and required less upfront capital too.

How did we do in 2016?

Our £176,270 portfolio generated £10,326 income in 2016 - a 5.8% yield. That's more than expected, far outstripping the paltry rates paid on bank savings accounts and significantly above inflation. Capital appreciation of £14,000, or 8%, was very generous icing on the cake.

Our portfolio yielded 5.8% in 2016, outstripping paltry saving account rates and significantly above inflation

Behind a significant slug of this outperformance were and , who both announce their dividends in dollars. Over the year the greenback surged by 16% versus sterling, most of that in the aftermath of the EU referendum vote, which sent the pound to a 31-year low.

Converting those valuable dollars back into cheap pounds generated a windfall which, when added to the special dividend paid by , easily offset mildly over-optimistic dividend forecasts elsewhere in the portfolio.

A 58% share price gain in addition made Shell our star stock of 2016. In most cases, the difference between what was predicted and what our companies paid was modest. However, support services and construction firm came in short, and the shares slumped in May after it took a big charge on a problem energy-to-waste contract in Glasgow.

Bicycles-to-car parts retailer had a cracking five months before a drop in annual profits and the Brexit vote put a spanner in the works. It still did well for us, however, generating a 15% profit and 5.4% yield.

Getting harder

With the FTSE 100 up 15% and the FTSE All-Share index up 13% in the past year, both to a record high, share price gains have outpaced dividend growth, eroding yields. That might typically make it more expensive to generate £10,000 of annual income. However, by taking on a bit more risk, we've managed to build a portfolio to do it, and for even less than in previous years.

There are certainly plenty more challenges in 2017, most seriously Trump's approach to the US presidency, Theresa May's determination to trigger Article 50 and the UK's withdrawal from the EU, and elections in France and Germany.

The FTSE 100's current crop of top-yielders is littered with strugglers, too, among them , and .

With oil prices on the up, a weak pound increasing costs for UK firms, and both rail fares and energy costs increasing sharply, inflation will rear its head in 2017. Any pressure on consumer spending could easily feed through to vulnerable sectors such as retailers, airlines and pub companies.

Unless conditions are severe, dividends should survive - but risk has increased nonetheless. So, after weeding out the wrong 'uns, 6% looks like a cracking yield this time round. By widening the net and placing con-fidence in resurgent sectors, we need upfront capital of just £168,500 this year.

Portfolio reshuffle

Half the portfolio gets the boot, some shares being the victim of their own success and others punished for underperformance or greater perceived risk of disappointment in future.

Shell falls into the first camp, following a sharp recovery in the oil price and pricing in the potentially lucrative acquisition of BG Group, which completed early in 2016.

Its dividend does remain generous, however, and Ben van Beurden will not want to be Shell's first chief executive to cut the payout since World War II. If this were a multi-year portfolio we might have considered running the position, but as it begins afresh each year and Shell has made us a 58% profit, is better value and the dividend is equally impressive.

Another company generating money from the black stuff makes the portfolio in 2017. , a £3 billion oil services firm, equalled the market's performance in 2016, and big contract wins are tipped to recommence over the next few months. Make no mistake, this is a spicy pick, but a forward price/earnings ratio of 9 and prospective dividend yield of over 6% are worth it.

Ben van Beurden will not want to be Shell's first chief executive to cut the payout since World War II

Defence giant earned its keep in 2016, and military fan Donald Trump could be good for business. That said, the shares are no longer cheap, and we can get a better yield elsewhere.

A major beneficiary of the post-referendum rally, lost its way in November, and both a modest yield and flat share price performance over the 12 months have caused our eye to wander, but only as far as fellow utility .

High energy prices could give a major boost to earnings at the Scottish power company, and we're assured that it's on track to keep its promise of annual dividend increases at least in line with retail prices index inflation, currently at 2.2% but tipped to rise much further in 2017.

While Interserve's dividend looks safe,the shares are volatile and the yield insufficient to keep its place in the portfolio. Despite some wobbles, we still like Halfords, but a likely squeeze on consumer spending could cause sleepless nights. Far better to call in mobile phone heavyweight , which is on track to hit results forecasts and offer a dividend yield of well over 6%. An increase in profits and declining spectrum costs should drive big improvements in return on capital and underpin the payout.

Last of the new constituents, and the riskiest of them all, is Alternative Investment Market-listed . It only returned to AIM in October, nine years after a private equity-backed management buyout, and hasn't paid a dividend yet.

But it will, beginning with returns for the three months to December. And it can afford to be generous. Premier has over £5 billion of assets under management, has reported 14 consecutive quarters of net positive fund flows, is debt-free and profits are growing fast. A small investment here could be lucrative.

The keepers

Of the 10 companies in the 2016 portfolio, five keep their place in the new basket of dividend kings. Big-hitters HSBC, GlaxoSmithKline and make it three years out of three. Significant dollar earnings are an obvious boon for all three while the pound remains under pressure.

For HSBC shareholders, the payment of dividends in dollars is also beneficial currently. Like last year, Glaxo promises an ordinary dividend of 80p in 2017 and Imperial has an impressive dividend track record.

And we still back to fill up the coffers in 2017. A recession seems less likely now, and concerns that EU regulation will hurt the bulk annuities market look overdone. The insurer and fund provider will also benefit from the increasing popularity of passive and exchange traded funds.

Finally, there's room for again. Last year was awful, but it gives new investors a great chance to lock in a knockout dividend on the cheap. A rebound from the post-referendum crash has also found fresh momentum, so, barring a catastrophe, there could be decent capital appreciation too.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.