How to earn a £10,000 annual income from investment trusts

10th February 2017 16:38

by Helen Pridham from interactive investor

Share on

The Bank of England's decision last August to reduce the base rate to 0.25% was further bad news for investors needing to take an income from their capital.

At the same time, the likelihood of rising inflation after sterling's fall in value against major currencies following the Brexit vote means existing incomes may be squeezed.

One of the answers is to consider putting at least part of your capital into shares paying regular dividends that have the potential to increase over time. And one of the easiest ways of doing this is through investment trusts, which have a reputation for generating rising incomes.

Investing in shares has historically proved to be one of the best defences against inflation, as many businesses are able to increase their prices to take account of rising costs, enabling them to maintain their profitability.

Investment trust managers will focus on these successful businesses and pay out the dividends they receive regularly. An increasing number of investment trusts now pay quarterly dividends.

Income growth

For many trust managers, income growth is one of their key objectives, and the ability of investment trusts to hold income reserves has enabled a growing number of trusts to maintain and increase their income for many years.

For higher-rate taxpayers, another attraction of investing in investment trusts for income nowadays is that the first £5,000 of dividends they receive will be free of any additional tax. This is, of course, also true of income from trusts that are held in ISAs.

Capital growth generated by investment trusts can also be used to supplement income and these capital gains can also be taken tax-free if they fall within your annual capital gains tax allowance, which is £11,100 for 2016/17.

Although capital returns are less reliable than dividend payments, over the medium to long term investment trusts have a good record of producing gains.

In order to demonstrate how useful investment trusts can be to income seekers, our sister website Money Observer has put together a portfolio of trusts to generate £10,000 of annual income.

This was first done two years ago. It was reviewed and amended last year, and we have updated it again this year to make it relevant for new investors looking for ways of generating income.

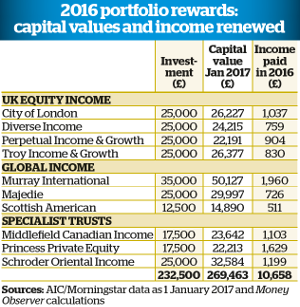

Last year we calculated that an investor would need to put in a lump sum of £232,500 in order to receive an estimated £10,000 of income. In the event, the portfolio not only generated more income than we had estimated but also delivered a 16% capital gain.

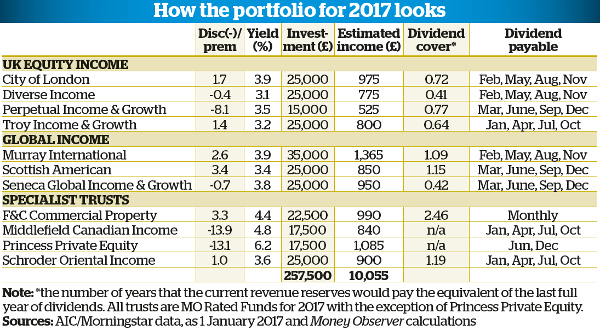

This year, unfortunately, the initial investment needed to deliver the required income has risen by £25,000 to over £257,500, due to the rising demand for trusts and rising share prices, which have pushed trust yields down.

But this will not affect existing investors, who are still holding the same number of shares.

Any investor who does decide to put money into investment trusts will naturally need to be prepared for fluctuations in the value of their capital. In 2015, there was a capital loss from our portfolio, but this was recouped in 2016.

By spreading your investments across a number of different trusts, run by different managers and investing in different areas, you are spreading your risk; there is a good chance that if some trusts lose value this will be offset by gains in others, or that losses one year will be followed by a recovery the next.

Falling UK exposure

The foundation of the portfolio consists of its four UK-focused equity income trusts. It is conventional wisdom that investors should have good exposure to their home economy, as this helps to reduce currency risks. During 2016, our UK trusts delivered on the income front.

Indeed, they all paid out slightly more income than estimated, with the strongest increase of 12% coming from , which had been added to the portfolio at the beginning of the year. However, two of the trusts lost some ground on the capital front.

For the second consecutive year the best overall performance among the UK trusts was delivered by which delivered on both the capital and income front.

The unsettled market conditions seen in 2016 have favoured the defensive approach adopted by the trust's managers Francis Brooke and Hugo Ure.

Areas of the market they focus on include utilities and consumer staples.

The worst performer in capital terms among the UK holdings and across the whole portfolio during 2016 was .

Much of this loss was due its share price moving to a discount to net asset value from a small premium at the beginning of the year.

Although we believe this is only a temporary setback, we are suggesting a lower allocation to this trust for new investors, in order to increase the portfolio's allocation to global equities, which we believe will produce better returns than UK equities in 2017.

As a result the portfolio's UK equity exposure this year will fall to 35%.

A change to our global perspective

Our three global equity income holdings all delivered the expected amount of income in 2016. The star performer in capital terms was , which is also the portfolio's largest holding.

Its performance had lagged in 2015 due to its high exposure to Asia and the emerging markets, but this was one of the reasons we felt it had potential to recover, especially in the hands of its highly experienced manager, Bruce Stout.

A multi-asset approach in order can reduce volatility

We expect this recovery to continue now that investor sentiment towards the emerging markets has improved; further, even though its yield has fallen due to the rise in its share price, it is still paying a very attractive income.

also delivered a solid capital return, and in order to increase the portfolio's allocation to global equities we have decided to increase our holding in this trust.

We believe the manager's strong emphasis on companies with growing and dependable cash flows and dividend streams will help to ensure that the trust continues to generate a good income stream for investors alongside attractive capital growth.

Its holdings in bonds and property, which account for around 15% of its portfolio, also provide useful diversification.

gained ground, but although the trust is classified as global, the majority of its investments are in the UK.

For this reason, as we are keen on having a good global spread this year, we have therefore decided to replace it with , which has a higher exposure to overseas equities, mainly through other open- and closed-ended funds.

We also like the fact that it pursues a multi-asset approach in order to reduce volatility.

Specialist exposure increased

The three specialist trusts, which formed 25% of our portfolio at the start of the year, have jointly been our best performers during 2016, assisted by the weakness in the value of the pound following the EU referendum.

All three have delivered strong total returns (capital and income combined) over the 12 months.

One of the holdings, , paid out slightly less income than expected, but this was more than offset by the significantly higher income payout from .

Princess Private Equity generated good growth in both income and capital last year

Moreover, Middlefield Canadian Income more than made up for its income shortfall with the strong rise in its capital value. The trust has a broadly diversified portfolio of higher-yielding Canadian and US shares.

It can invest up to 40% of its portfolio outside Canada in order to take advantage of investment opportunities not available there.

However, with the Canadian economy continuing to recover and the uncertainty being experienced in the UK and Europe, its managers are expecting sentiment towards Canadian equities to go on improving in 2017.

The Canadian dollar is expected to outperform the pound, which will also favour UK investors, and the country will benefit from increases in energy prices. Energy is one of the sectors in which Middlefield Canadian Income is currently overweight.

Princess Private Equity managed to produce good growth in both income and capital over the year. Returns to UK investors were also helped by currency movements, because this trust's shares are denominated in euros.

The trust invests in private equity and private debt, with a principal focus on small- and mid-cap buyout transactions.

Most of its investment portfolio now consists of direct investments but it also includes some funds. The bulk of the portfolio is invested in Europe and North America.

The trust's dividend is supported primarily out of capital realised from sales of mature holdings in its portfolio, but it also has cash resources to cover around two years' annual dividend payments.

Additional holding

As a result of lower yields on most of our existing holdings, due to the impact of increasing share price rises, a larger capital investment will be needed to achieve an initial £10,000 of income from the portfolio this year.

In order to keep the additional capital required to a minimum, we have decided to include a higher-yielding property trust, , in the portfolio to provide an income booster. The trust currently yields over 4% and pays monthly dividends.

Like other property investments, F&C Commercial Property was hit by the dip in confidence in the sector following the Brexit vote. At one time last summer, its share price discount to NAV widened to over 20%.

However, unlike their open-ended fund rivals, investment trusts were not forced sellers of property in order to pay off exiting investors.

Since the initial panic selling, sentiment has stabilised and the trust's price has returned to a small premium.

After several years of strong capital growth in the property sector, a slowdown was evident even before the referendum. However, property is still an attractive asset class for income investors.

F&C Commercial Property's manager aims to spread risk by investing in a range of geographical areas and property sectors throughout the UK, and he believes the trust is positioned strongly to withstand the ongoing uncertainty due to Brexit.

What should existing investors do?

Investors who have used our £10,000 income portfolio suggestions from previous years to create their own portfolio may be wondering what action they need to take in the light of our suggestions for new investors.

Fortunately, there is no need for you to increase your investment as you will still hold the same number of shares, which should ensure your income is maintained, or increased. At the same time the value of your original capital investment has grown.

With regards to the trusts themselves, we would suggest that you retain your original holding in Perpetual Growth & Income as it has a strong long-term track record under the management of Mark Barnett.

Although it underperformed in 2016, it increased its dividends; we believe that Barnett is well aware of the challenges he faces and will be able to continue identifying companies that will maintain their dividends in the future.

However, we would recommend that you consider switching from Majedie to Seneca Global Income & Growth in order to increase the overseas content of your portfolio.

Majedie's performance lagged other global trusts during 2016 mainly because of its high UK content, which recently stood at 76%, with another 20% invested in Ireland.

From an income point of view, there is no need for you to include F&C Commercial Property in your portfolio, unless you like the idea of greater asset diversification.

This article was originally published in our sister magazine Money Observer. Click here to subscribe.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.