10 top AIM stocks for ISA season

22nd February 2017 14:02

by Ben Hobson from Stockopedia

Share on

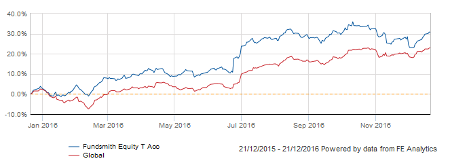

The Alternative Investment Market (AIM) has risen by 33% over the past year. Even by the bullish standards we've seen right across the market, the gains among the very smallest stocks are mightily impressive.

Yet, while surging prices on the stockmarket are generally welcomed by investors, they do pose challenges too. For would-be buyers, there's a sense that small company shares have quickly got a lot more expensive. And, with ISA season around the corner, that's disconcerting.

One way of tackling the problem of pricey shares is to consider a strategy that embraces 'expensive' - so long as it buys the very best quality and momentum available.

In search of quality

High-quality companies with strong share price momentum can be thought of as the market's High Flyers. They're often some of the biggest and best-known names that have long track records for compounding returns. The trouble is that they almost always seem expensive - and that puts many investors off.

Just look at the price charts of the market's most popular and best quality stocks. Some of those names include , , , and . These companies have solid performance histories, but they're the sort of shares that value investors wouldn't touch. In many cases, they've rarely had appealing valuations over many years - but it hasn't stopped them delivering super returns.

Investing in high-flying shares is an approach to the market that echoes the kind of strategies used to devastating effect by the likes of Richard Driehaus, William O'Neil and Mark Minervini. These guys rarely worry about price. Instead, they focus on riding momentum in high-quality stocks.

How to find a quality and momentum

To find companies with strong quality and momentum, there are some straightforward places to start. Generally, a quality company is one that's highly profitable with high industry leading margins, stable, growing and ideally accelerating sales and earnings. It will have a strong and improving financial track record and no signs of accountancy or bankruptcy risk.

In turn, strong momentum will show up in stocks trading at, or above, their 52-week highest prices and performing strongly against the rest of the market. They'll often be beating broker estimates and seeing estimate upgrades and recommendation changes.

At Stockopedia, we simplify all this by scoring and ranking every company in the market with a Quality Rank and a Momentum Rank - taking the above measures into account. To be a true High Flyer, these stocks would also have to rank fairly low against our third ranking factor, the Value Rank.

Over nearly four years, performance tracking of high-quality and momentum small-caps (valued between £50 million and £350 million) has seen some impressive performances. Over that time, small-caps in the top 20% of the market for their combined quality and momentum (QM) have delivered a stunning theoretical 110% return (before costs). The lowest QM stocks have fared much worse.

Here's a snapshot of some of the highest rated quality & momentum stocks on AIM right now:

The common feature of the companies on this list is that they appear to be expensive, but they score very well for their combined quality and momentum. Among the names with this kind of investment profile are , the veterinary medicines group, , a telecoms specialist, and , the data and analytics company.

Many of the names here are well-known among hardened small-cap investors, and have proved to be excellent investments (although there's always a risk that may not carry on). Companies like , and have shown themselves to be good quality, promising growth companies.

Importantly, these companies are perhaps not yet the sort of multi-year compounders that you see with much larger high flyers. But AIM does have a track record of producing them. Companies like , and were all once small AIM stocks that grew into big successes.

A risk with High Flyers is that their momentum begins to break down. And that's arguably more of a risk with smaller shares, so this strategy does need care. Even so, after a prolonged spell of rising prices, it does offer a different way of thinking about expensive looking shares. They might seem pricey, but small-cap high flyers are often marked-up for good reasons - and have much further to go.

About Stockopedia

Interactive Investor's Stock Screening series is written by Ben Hobson ofStockopedia.com, the rules-based stockmarket investing website. You canclick here to read Richard Beddard's review of Stockopedia.com and learn more about the site.

● Interactive Investor readers can enjoy a completely FREE 5-day trial of Stockopedia by clicking here.

It's worth remembering that these and other investment articles on Interactive Investor are simply for generating ideas and if you are thinking of investing they should only ever be a starting point for your own in-depth research before making a decision.

*No fee for publication is involved between Interactive Investor and Stockopedia for this column.

Ben Hobson is Investment Strategies Editor at Stockopedia.com. His background is in business analysis and journalism. Ben researches and writes regularly on investment strategy performance and screening ideas for Stockopedia.com. He is the author of several ebooks including "How to Make Money in Value Stocks" and "The Smart Money Playbook"

interactive investor readers can get a free 14-day trial of Stockopedia here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.