UK Oil & Gas worth twice as much

6th March 2017 13:51

by Lee Wild from interactive investor

Share on

It's been eventful for UK Oil & Gas since the business was set up to invest in the domestic oil and gas sector three years ago. Under Australian entrepreneur David Lenigas, the firm made headlines after striking oil close to Gatwick airport, and some bold claims were made.

Lenigas is long gone, and a switch in analyst coverage meant house broker WH Ireland put its 'buy' rating and 8.7p price target under review, pending a comprehensive assessment of UKOG's assets.

Having added the finishing touches, WHI has just published a 43-page research note, claiming shares in the controversial explorer could be worth significantly more than the current price.

UKOG's Horse Hill-1 well, in which it has a 31.2% stake, was tested at 1,688 barrels per day (b/d), the highest initial production rate of any UK onshore discovery well, note WHI.

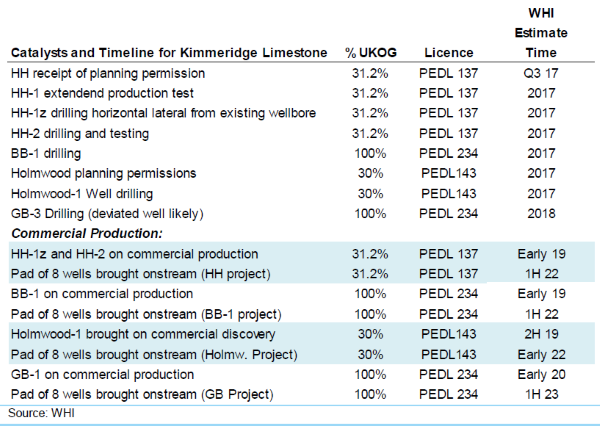

"An extended production test anticipated in 2017 will provide a key value catalyst by providing confidence in the ability of wells drilled into the company's naturally fractured Kimmeridge Limestone resource play to produce at commercial rates over the long-term," explains analyst Brendan Long.

"In our opinion, the company's conventional asset portfolio provides diversification and a strong alternative growth trajectory. We re-initiate with a 'buy' and a target price of 2.79p per share."

This target price – double the current price of 1.37p - is equivalent to the value of successfully commercialising only 2% of the 428 km2 net licence area in the Kimmeridge Limestone resource play.

While it's likely much of the land cannot be developed, Long "anticipate[s] potential for accelerated exponential growth beyond our target price".

In fact, the target only reflects the partial value of a first phase of the commercialisation of Kimmeridge. Include all the value of this initial phase and there could be additional value of 7.24p per share.

"We believe that UKOG's assets are at the early stage of appraisal and that further appraisal and testing have the potential to unlock what we believe to be the most exciting potential new resource the onshore UK oil & gas sector has seen in decades," writes Long.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.