12 value shares with earnings momentum

20th March 2017 12:59

by Lee Wild from interactive investor

Share on

A big switch out of safe-haven low volatility, or quality stocks into value plays was a key theme of the latter half of 2016. This trend appears to have stalled in 2017, but we're told that another leg to the rotation is coming which could cause so-called low-vol stocks to underperform by another 15%.

Low-vol stocks have already benefited hugely from fears around the European political calendar, so there could be serious ramifications if political risk declines - the result of last week's Dutch election suggests it might.

According to Dennis Jose, an analyst at Barclays, reflation - where governments pump money into the system to stimulate the economy - is also not priced into markets.

Valuations for low-vol stocks remain too high, argues Jose, and way above levels seen in 2010 and 2014 when investors were pricing in reflation hopes. De-rating to longer-term averages would imply further downside.

Core inflation, even in Europe, could accelerate, says Barclays, and the European Central Bank (ECB) is tipped to turn up the hawkish rhetoric in the coming months. And that has implications for company profits.

"The ensuing recovery in developed market inflation should lead to better pricing power for European companies and by extension, higher profit margins," writes Jose.

"We think European companies in aggregate are price-takers, as opposed to us companies who are price setters. Therefore global inflation matters greatly to European margins. A pickup in global inflation to 2% supports margin expansion by 2%, and therefore very strong earnings growth."

Given investors had bought low-vol stocks because of their stable earnings at a time when profit forecasts were being downgraded elsewhere, expect a rotation into value to pick up as earnings estimates for European stockmarkets are revised upwards.

As Jose points out, "earnings in Europe have finally started to show signs of life" and an upswing in profit growth is underway in excess of low-vol rivals. In fact, more companies in Europe are seeing upgrades relative to downgrades for the first time since 2011.

Currently, Barclays forecasts double-digit earnings growth both in the UK and Europe in 2017 following a weak 2016.

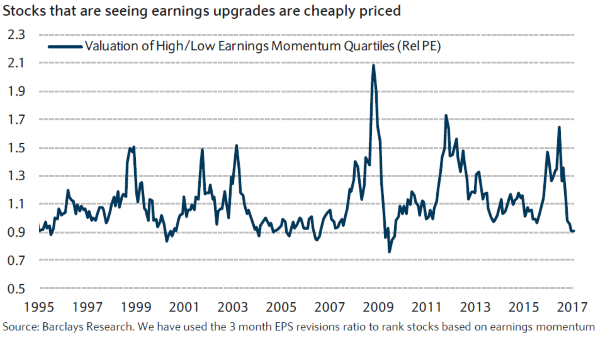

"Stocks with positive earnings per share revisions are the cheapest they have ever been," claims Jose, which is why Barclays now recommends buying value stocks with earnings momentum better than the market.

"History would suggest buying stocks that are seeing earnings upgrades when valuations are this cheap."

A dozen London-listed stocks are among the 42 that appear on Barclays' radar – housebuilders , and , insurers , and , , lenders and , British Airways-owner , and .

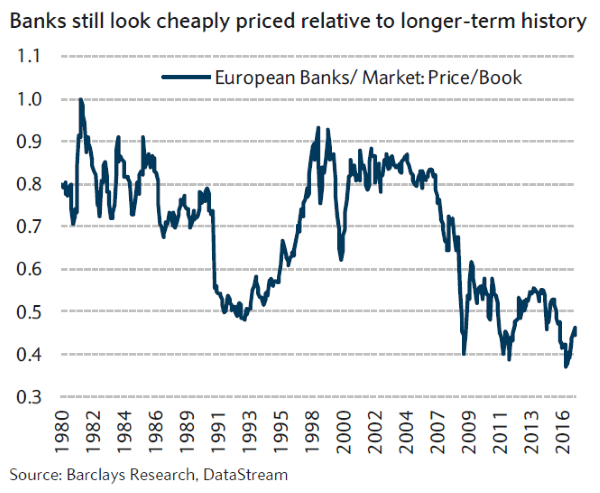

"From a sector perspective, we reiterate our 'overweight' in financials, particularly in the banks," says Jose. "Sector valuations still appear depressed versus longer-term averages.

"We also maintain overweights in consumer discretionary, industrials, technology and telecoms. We close our 'underweight' on energy following the sector's underperformance year-to-date."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.