Regular Income portfolio: Investment trust tips for steady dividends

2nd May 2017 09:00

by Holly Black from interactive investor

Share on

Purposeful Portfolios: Regular Income - investment trust tips for steady dividen

James Brumwell began his career in the 1980s as a gilts and fixed-income broker. Today he is more likely to be found investing his own money in derivatives and shares. However, when he manages portfolios for other people - mainly friends and family - he favours investment trusts.

He says: "There are a lot of benefits to using investment trusts. They offer more freedom because they don't have to worry about redemptions, and they tend to outperform funds over the long term."

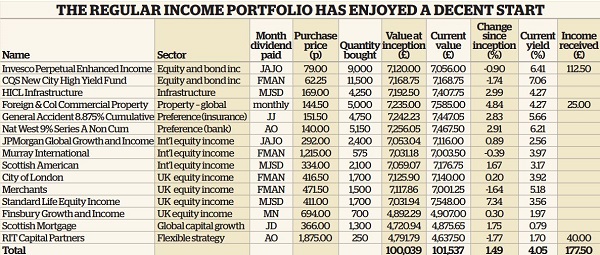

We have charged Brumwell with constructing and running our Regular Income portfolio, which aims to provide a regular payout for investors while delivering an element of capital growth. It's an increasingly popular strategy among retirees unwilling to buy annuities with their pension savings as rates are at such low levels. Instead, many are keeping their cash invested and drawing down on it for steady income.

Brumwell's portfolio, like all our Purposeful Portfolios, launched on 1 April, so we are in a position to judge his first month of performance. He says: "It has actually done a bit better than I had hoped. In the first month we produced capital growth of almost 1.4% and received dividend payouts of £177. If we can do that every month, I will be happy."

The construction of an income portfolio looks very different today from a typical portfolio when Brumwell started investing more than 30 years ago. He says: "If we had created this portfolio even 10 years ago, it would have been mostly gilts and a few equity investments, and it would have been easy to get a yield of 5%. Today we have to think about how to get income without taking ridiculous risks." One gilt he had invested in back in 2007, when it was yielding 4.65%, pays just 1.08% today - not even enough to beat inflation.

The Regular Income portfolio aims to produce a reasonable yield that is secure and can potentially grow each year to help offset inflation. To achieve that, it includes bonds, preference shares and equity income investment trusts, with a focus on those that have raised their dividends year after year.

Any capital gain from investments is a bonus but not the main focus. Brumwell says: "This is a portfolio that hopefully we will tinker with just once or twice a year - the perfect outcome would be not having to do anything."

Seven of the 15 holdings are equity income trusts - four UK-focused and three international. has been the top performer in the first month, having gained an impressive 7.34%. Manager Thomas Moore has a bias towards mid- and small-cap income stocks.

Bond benefits

Among the more unusual holdings in the portfolio are two preference bonds from insurer and . The preference bond market is something of an investment backwater these days; hundreds of these bonds exist but rarely trade. But both bonds yield around 6% and have the attractive feature that investors are paid dividends as a priority before shareholders.

Brumwell says: "With any type of bond investment, the fact that interest rates could increase is always a concern. But we've been expecting interest rates to rise for years and they haven't so far. I don't think you should give up an attractive yield because of something that may or may not happen."

is the only constituent that pays its dividend every month. It's a 'Steady Eddie' yielding 4.3%, and has paid £25 since 1 April. The trust has also produced some of the best growth over the first month, up 4.84%.

Also among the top performers in the first month is , which is up 3%. It owns roads, schools and hospitals across Europe, the US and Australia.

Infrastructure is an increasingly popular income investment, so many of these trusts are trading at hefty premiums to net asset value - HICL is on a premium of around 15%.

Brumwell feels he can justify this overpayment, however. He says: "The trust yields 4.8% and has grown its dividend every year, and that is what you pay for. In addition, many of the assets it owns are used by government or local authorities, which provides some extra protection."

and have earned their places in the portfolio after raising their dividends for 50 and 33 years in a row respectively. Today they yield 3.92% and 5.18% respectively. and also have good dividend growth records and add global exposure.

Brumwell says: "Scottish Mortgage is probably my favourite investment trust over the long term. It yields almost nothing, but it has gone up and up. I think anyone with a growth portfolio should own this trust."

It hasn't disappointed in its first month in the Regular Income portfolio, having gained 1.75% - although it has the lowest yield of all the holdings, at 0.8%. The Baillie Gifford run trust has almost half its assets in US firms.

has an interesting strategy. The trust announced last summer that each year it will set its dividend at 4% of its NAV. Since that announcement in June, its share price has surged from around 200p to 298p, which means it looks to be yielding only around 2.5% at the moment. The dividend will be reset in June for the current NAV.

Four holdings are down after the first month, among them . The trust has announced a dividend to be paid next month, so its value dipped as it went ex-dividend.

Three trusts - , F&C Commercial Property and - paid dividends in the first month.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.