Why these UK stocks are 'underloved and undervalued'

22nd May 2017 13:55

UK stockmarkets have proven hard to stop this year and the rally in both the FTSE 100 and FTSE 250 indices continue unabated. Both are currently near record highs, and we heard this week from chartist Alistair Strang that a massive 7,720 is not beyond the realms of possibility for the blue-chip index, maybe more.

Against this backdrop, it would be easy to assume that equity valuations are getting ahead of themselves and, particularly with the spectre of Brexit looming and a general election two and a half weeks away, become wary of potential for trouble ahead.

But analysts at Barclays remain upbeat on prospects for the UK, both in terms of financial markets and economically. "With valuations near financial crisis lows, investors appear to be pricing in recession," they said in a note to clients Monday, suggesting domestic UK stocks remain one of the least favoured investments for many.

In fact, only this morning, peer-to-peer lender Kufflink claims that almost 40% of UK investors now favour safe haven assets.

This pessimism is unfounded, however, Barclays analyst Dennis Jose argues. Economic data in the UK has been robust with Barclaycard data remaining strong and, Jose says, the assumed collapse of the consumer is unlikely.

UK unemployment continues at multi-decade lows, wage acceleration seems likely and inflation pressures peaked in the third quarter of 2016. Therefore, "consumer confidence should remain well-supported hereon".

"International companies…are now responding to the value in the UK, with inbound M&A at record highs," according to Jose who believes domestic UK remains "underloved and undervalued".

Indeed, the more domestically focused FTSE 250 remains cheaply priced relative to the more internationally tilted FTSE 100. This despite surprisingly significant earnings per share (EPS) upgrades post-EU referendum.

With this in mind, Barclays says investors should "buy British" and has put together a "domestics" basket of stocks it favours. It has also made three changes to its European "Top Picks" portfolio, bringing in a trio of domestics – , and – and removing , Madrid-listed pharma Almirall and Paris-quoted Société Générale.

We round up the broker's top sectors and stock ideas below.

Banks

Banks are certainly back in favour now, with the likes of star fund manager Neil Woodford buying back into the sector recently. Woodford has not owned bank shares since selling out of HSBC in 2014, but gave both his and funds exposure to Lloyds this month.

"Despite the rally in banks late last year, valuations relative to the market remain quite low," Jose says. "Moreover, relative to US banks, valuations are near the cheapest they have ever been."

Again, Lloyds is favoured, with the popular high-street lender brought into the top picks portfolio. Woodford, meanwhile, reckons it's "a well-managed bank with a conservative approach to its balance sheet". Its valuation is attractive and it has the ability to pay a very healthy and growing dividend.

RBS is the second bank in Barclays' list of favoured domestically exposed UK stocks, although Ian Gordon, an analyst at Investec, said recently he prefers Barclays over any UK-listed big five lender.

General retailers

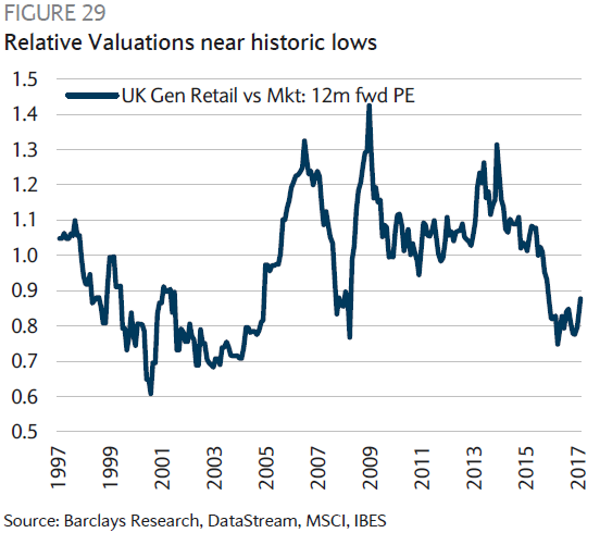

According to Jose, retail stocks are pricing in a further 20-point drop in consumer confidence. "Our work suggests that a collapse of the consumer is unlikely," he says.

"Barclaycard data suggests that consumer spending growth in the UK remains robust… we also find that the volume of sale reported by the retailers, according to surveys by the CBI, suggest still-robust spending growth," Jose explains.

On valuations, he adds, the general retail sector is now near the cheapest levels seen in two decades.

Retailers are a preferred sector, with both WH Smith and Marks & Spencer joining Barclays' European Top Picks portfolio, with the former seemingly going against the grain. The food to clothes high-street chain is disliked by Investec, while UBS has recently downgraded from 'buy' to 'neutral'.

The firm, up 12% year-to-date, will report full-year results Wednesday, with some pencilling in a 12% decline in pre-tax profit.

Barclays keeps its views on Smiths the same, with an 'overweight' rating and price target of 1,990p, implying 11% potential upsid.

Smiths' travel division now accounts for 68% of the business in Barclays' sum of the parts valuation, and this is expected to grow over time.

As operating profit margins on international sites moves from 6% closer to levels generated in UK Travel, analyst Richard Taylor thinks "the valuation discount to stocks such as SSP Group will look increasingly anomalous given WH Smith's [forecast 2017] price/earnings ratio (PE) of 17 times".

The counter view to this comes on a longer-term view. David Jane, multi-asset fund manager at Miton, reckons retailers in both the UK and US are under threat from internet disruption. "Retailing is an industry which is losing share of wallet not just to online retail but to other activities such as gaming and social networking," he explains.

Like Barclays, Jane has a positive view on the UK and US consumer, but "this can readily be expressed through exposure to leisure or homebuilding, without the need to look at retail". Matalan and in the UK are "feeling the strain".

Travel & leisure

Barclays also likes the travel and leisure sector.

As with retailers, stocks in this sector "also appear deeply discounted in multiples only now recovering from decade lows". But pub spending appears robust, while the likes of have reported impressive third-quarter updates in recent weeks.

While none of these stocks make Barclays' list of domestically focused firms, theme park operator is a longstanding constituent of its European top picks portfolio and has secured a return of 14% since being added back in June 2016.

Housebuilders

Housebuilders are another set of stocks returning to favour, and they've continued to outperform since the Brexit vote. But Jose says relative performance remains below the highs seen in 2015.

"Moreover, homebuilders in aggregate provide a dividend yield that is nearly 2% higher than the rest of the market," adds Jose. "In terms of the outlook for house prices, the RICS survey has started to recover from post-Brexit lows. By extension, a collapse in UK house prices over the coming months appears unlikely."

The broker places , and in its favoured UK domestics portfolio. Woodford has also just bought into the former two.

Iain Wells and Douglas Scott, managers of the fund, are also bullish on the outlook for the UK housing market, which has enabled them to buy into Taylor Wimpey recently.

"The housing companies have been very disciplined and have refused to focus on volume growth, thus limiting the chance of a supply problem," they say.

Interestingly, Mark Martin, manager of the Neptune UK Mid-Cap fund, does not like domestic cyclical firms due to a potential slowdown in the UK economy. He says many of these companies are expensive relative to history and is actively avoiding housebuilders due to this.

Real estate

Real estate stocks are also undervalued, Jose continues, trading on 0.8 times price/book value. This suggests a near 20% decline in book value per share over the coming year is currently being priced in.

However, "with the IPD Capital Values index picking up recently, we do not think that a dramatic collapse in book value per share is forthcoming", he adds.

, another new entrant into Woodford's armoury, and are all liked by Barclays.

Other real estate firms to have made the cut with Woodford include , and , with student property developer also incoming.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks