Saltydog Portfolio: The enema within

25th May 2017 08:53

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Normally one confronts an enema with a certain amount of fear and trepidation. Almost certainly you will be undertaking this treatment because of a deeper underlying medical problem. But this is a 'clear-out' with a purpose, and you have confidence that at the end of this effrontery the medical profession is competent to improve your health and well-being.

This is one way of describing what's happened in India.

Narendra Modi was elected prime minister of India in 2014 with the promise to cut the costs of doing business, reduce the amount of fraud and tax avoidance, and improve the standard of living for millions. He is addressing the fragmented interstate tax system by introducing a single national tax on goods and services.

But the enema that he inflicted on the population at the end of last year was to remove 80% of the country's currency virtually overnight. The black-market economy was brought to a standstill as the old notes had to be replaced with new from a bank, forcing the people into the banking system and digital payments. In other words, the government now knows who you are!

Modi still enjoys remarkable success and electoral popularity, however. This means that businesses and investors can make long-term plans around his reform programme in a way that people in America and Europe can only dream of.

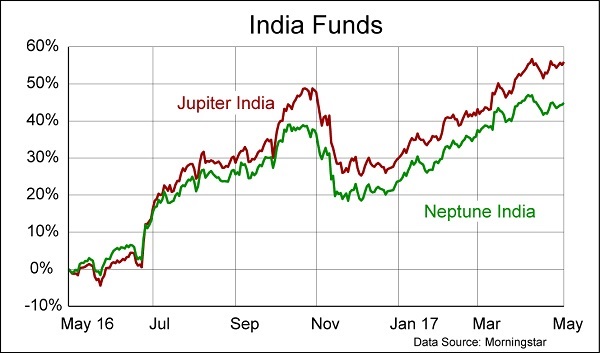

At Saltydog we have been aware of this success, which the one-year graph of the Jupiter India and the Neptune India funds clearly demonstrates. This is a momentum trend which we can all join in. It is also very clear as to the time-line on the graph when the enema was administered, and the recovery that has taken place since. Making gains in this Saltydog momentum way is just common sense, provided of course that you have the information.

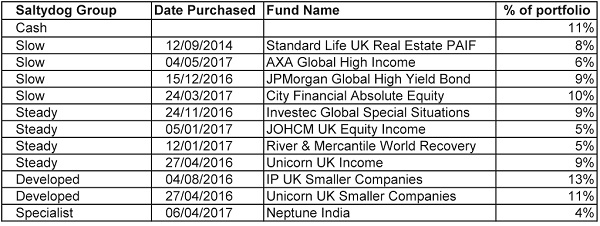

Here's a list showing all the funds in this portfolio:

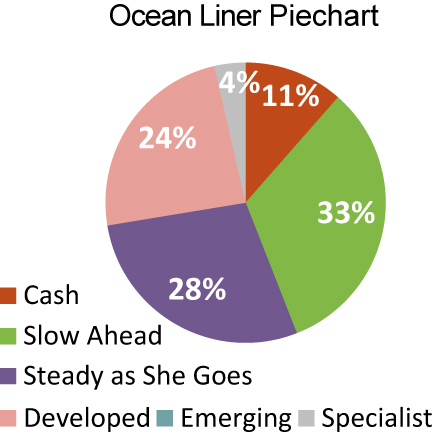

Over the last couple of months, the pound has started to strengthen and this has made the 'global' funds less appealing. This portfolio has responded by increasing the amount invested in the UK Equity Income and UK Smaller Companies sectors.

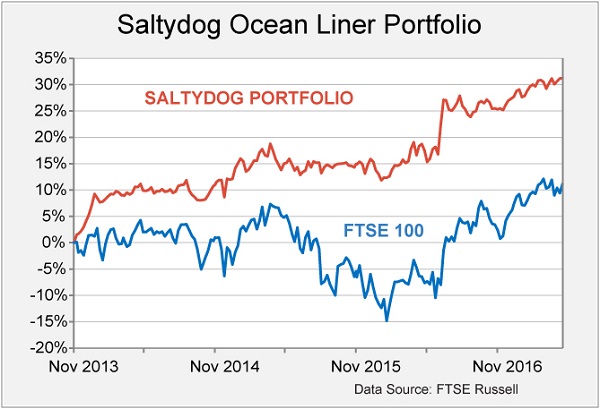

Here's a graph showing its performance since launching in November 2013.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks