18 funds for a £100,000 long-term growth portfolio

28th June 2017 09:12

by Holly Black from interactive investor

Share on

Mike Deverell is feeling cautious. This is one of the more risk-averse adventurous portfolios he has put together. The discretionary wealth manager for Equilibrium Asset Management thinks UK and US equities look expensive and fears there could be a dip in the stockmarket on the horizon.

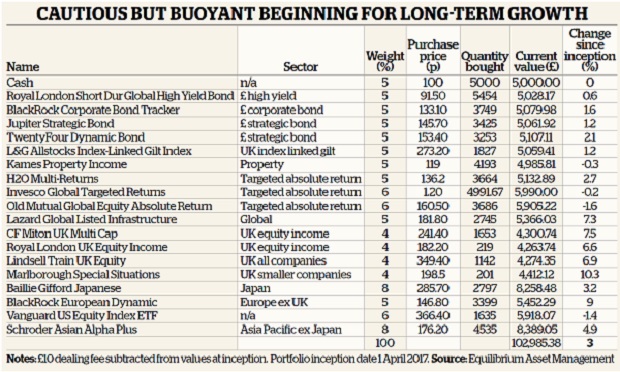

Charged with constructing our Long-Term Growth portfolio, Deverell currently has just 65% of the £100,000 portfolio in so-called risk assets, but he is ready to pounce when the opportunity arises.

"Markets look expensive at the moment, so I'm exercising more caution than usual with this portfolio; but one of the most important things with this mix is that we have money invested where it should do well if the market dips, and we are then in a position to take advantage of new opportunities," he says.

Not that exercising caution seems to have done any harm to the portfolio so far; overall it is up 2.8% in its first two months despite its risk-off approach. The top performer is the , which has returned a meaty 10.3% since inception.

The fund invests in out-of-favour UK businesses such as sports retailer and support services company , which are more domestically focused than many of those in the .

Deverell says: "Domestic companies did very badly after last year's referendum and they have been left behind somewhat while the FTSE 100 has soared since, so I think they still have some catching up to do."

This is the reason he has also chosen to invest in , which has so far returned 7.5%, and , up 6.9%.

"Another of the strongest performers in the first two months is the , which has returned 9% since 1 April. With 18.5% of its assets in French equities, the fund got a major boost from the recent French elections.

Deverell observes: "The fund got its positioning just right around the elections: it backed cyclical stocks such as banks at the right time and it outperformed."The only US exposure in the portfolio currently is through the , accounting for just 6% of the total amount invested. The stockmarket across the pond is notoriously difficult for active fund managers to outperform, so trackers and ETFs are a popular way to access US equities.

The fund is a cheap way to follow the progress of the S&P 500 stockmarket, which includes companies such as , and .

But Deverell is concerned that the US stockmarket, too, could be due for a fall if president Trump fails to deliver on his manifesto promises. Perhaps his hunch is right: the tracker fund is down 1.4% over the past two months, and is the portfolio's second weakest portfolio constituent.

Instead, Deverell is keener on Asia and Japan, with some 16% of the portfolio allocated across the two. He says: "Japan has been a bit unloved, but it has done better over the past year or so - we may end up taking profits from these funds in the coming months."

has returned 3.1% in the first two months in this portfolio, while is down 0.8%. In Asia, he is targeting those funds which are focused on domestic consumer businesses rather than those reliant on exports overseas, which he thinks have too much risk associated with the US.

invests in online retail company and China Pacific Insurance Group, while backs state-owned telecoms company and hypermarket operator Sun Art Retail. The two funds have returned 5.5% and 4.7% respectively since the portfolio's inception.

While Deverell has picked this portfolio with a 20-year timeframe in mind, he is not averse to making changes. Currently his reticence over the UK economy is reflected in the fact that the portfolio has just one property fund - , which is so far down 0.3%.

The property market tends to be closely tied to the economy, and there is uncertainty on the horizon with negotiations to leave the European Union yet to begin; if they start positively and the economy holds up well, he could increase his exposure to the sector.

"I am focused just as much on risk as returns. Any changes will depend on what looks good value and on what markets do; right now we have a bit of a problem, because not much looks to be good value," he says.

With rising inflation in mind, 5% of the portfolio has been invested in the ; this and the have been chosen also for the protecction they offer against any fluctuations in the value of sterling.

That's also why absolute return funds feature in the group. Deverell says: "I don't like the term absolute return fund, because it implies they always provide a return when, clearly, they don't ( is the weakest performer of the Long-Term Growth line-up so far, down 1.6%), but they provide diversification, and if markets dip I expect this fund will hold up quite well."

Asset allocation and diversification are two of his main drivers when choosing investments, as well as not overpaying for assets. While Deverell is pleased with the portfolio's performance over the first couple of months, his short-term caution suggests he hopes to ramp up returns in the future.

With just 65% of his portfolio currently in risk assets, he is hoping to have the chance to increase that to 80% when the opportunity arises, making for a racy portfolio with the potential to deliver some strong returns for those who have the risk appetite and the necessary long-term perspective.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.