How 'gearing' boosts investment trust returns in rising markets

17th July 2017 17:28

by Fiona Hamilton from interactive investor

Share on

Low charges used to be one of the chief attractions of investment trusts relative to open-ended funds. Now that the latter have trimmed their fees, many trusts look less competitive on the cost front, and even frugally managed trusts such as , or look pricey compared to low-cost passive funds.

However, trusts retain some important advantages over open-ended investment companies (Oeics). Their closed-ended status protects them from unpredictable fund flows, making them much more suitable for investing in illiquid asset classes such as very small companies, frontier markets, private equity, infrastructure and property, with the post-Brexit travails of most open-ended property funds reminding investors of why that format is so ill-suited to investing in real estate.

Independent boards of directors are another invaluable differentiating feature. As the shareholders' representatives, their responsibilities include controlling their trust's costs, ensuring its remit remains relevant and its manager is up to the mark, and changing either or both if they are not. Equally importantly, they are responsible for deciding their trust's gearing policy, and reviewing it regularly with the manager.

Sensibly priced and well deployed gearing can play an important role in enabling trusts to outperform their peers and their benchmarks, as demonstrated by the fact that so many of this year's Money Observer investment trust awards went to trusts which are among the most highly geared in their sectors. It is therefore one of the key factors that investors should consider when making their investment choices.

Gearing in its classic form involves borrowing extra funds to invest in the stockmarket. It works best in rising markets, such as many stock markets have experienced since 2009.

It is likely to prove a liability when there is a downturn; however, investors should not be investing in an equity-based trust unless they believe the long-term trajectory for its portfolio returns is positive.

Low interest rates

This is the argument put forward by the 15 or so equity-oriented trusts which have used the low interest rate environment prevailing over the past two years to raise new long-term debt. They include raising £75 million for 30 years at 3.77%, Scottish Mortgage raising a total of £105 million for periods of between 25 and 30 years at rates of 3.05 to 3.12%, and , which recently borrowed £25 million for 20 years at just 2.74%.

The dangers of gearing were illustrated when a number of well-regarded but significantly geared trusts were hard hit by the financial crisis. Scottish Mortgage, Schroder UK Growth Trust, and suffered net asset value (NAV) total returns of -39 to -48% in calendar year 2008 - among the worst in their sectors.

However, with the support of their boards and their bankers, those four trusts avoided being forced to cut their borrowings and dump investments at knockdown prices, and were rewarded with NAV gains of between 45 and 59% in 2009, outperforming most of their peers.

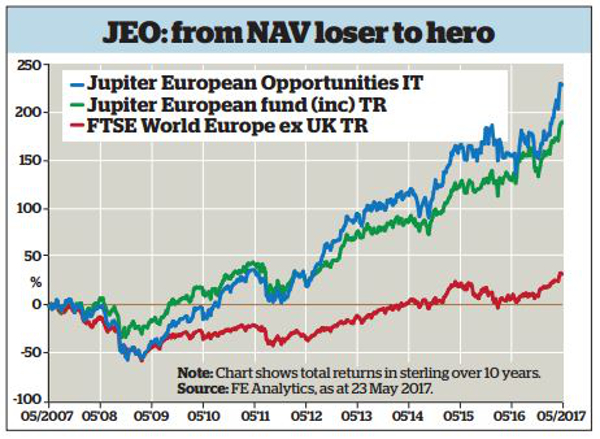

JEO is a good example of the long-term power of gearing. It has an open-ended counterpart, managed by the same manager and with a very similar portfolio and lower charges. The main differentiation is therefore JEO's regular gearing of between 7 and 17%. The inference is that it is largely responsible for the trust's NAV per share rising by around 220% over the past 10 years, compared with the open-ended version's 170% return.

Other similarly managed geared trusts range from and to and .

Gearing comes in a variety of forms, and trusts may combine them to maximise their opportunities. The best-known are the long-term loans described earlier. One of their key attractions is that they allow trusts to lock into interest rates that are expected to prove competitive for the long haul - though a lot of boards got it badly wrong when they took out long-term loans on double-digit interest rates in the 80s and 90s.

Long-term loans

Long-term loans also encourage trusts to put that gearing to work and not to try and time the market, which is notoriously difficult to get right. Alan Brierley of is among those who argue that trusts need to capitalise on their long-term gearing potential if they are to retain a following.

Long-term loans may be supplemented or in some cases replaced by short-term bank borrowings, which can be repaid when the manager feels cautious. Short-term borrowings arguably reduce the risks of being badly caught out in a downturn, but the rate of interest on them is liable to rise as interest rates rise, and managers who have been clever enough to reduce their gearing/exposure near the top of the market often fail to restore it near the bottom.

Managers such as Fidelity International prefer to use contracts for difference (CFDs) for most of their gearing, claiming they are cheaper and more flexible than long-term loans. They use CFDs to increase exposure to companies they think are undervalued, or to take short positions in companies whose prices they expect to fall - which allows them to make gains in a falling market if they short the right stocks.

In this context it is interesting to note that the gearing of the large and successful has oscillated between 28 and 10% over the past three years, according to its manager's view of the stockmarket outlook. It is achieved through a combination of a three-year fixed rate $150 million multi-currency loan facility and CFDs.

It is similarly interesting that and , which have the same manager and broadly similar portfolios, have achieved similarly competitive NAV total returns over one, three and five years, although the former uses CFDs to gear whereas the latter relies on borrowings. Throgmorton's board expects its approach to show at its best in falling markets, and is proud it has not held the trust back in better times.

The other main way to gear is through a split capital structure, with the proceeds of investment divided between different share classes, such as zero dividend preference shares (ZDPs) and highly geared ordinary shares (HGOs). Split caps fell from favour when a number of dangerously geared trusts were wiped out in the 2000 to 2003 bear market. This is a pity, as the structure can work well when sensibly deployed-as has been demonstrated over the past few years by the accelerated returns on the ordinary shares of several UK smaller company trusts which use ZDPs to gear.

In the case of , for example, at end April 2017 the five year NAV total return on its shares was 193%, compared to a NAV gain of 118% on the shares of the sparsely geared but similarly invested .

Gearing up has worked for these award winners

Money Observer's Investment Trust Awards recognise trusts that have achieved consistently above-average NAV total returns in their sector over three years; many of the winners are among the most highly geared trusts in their sectors.

This applies to Scottish Mortgage and in the global sector, and to in the global income sector; but it is not the case for , which has gained an edge by excluding the UK from its remit.

Likewise, , which won the UK income award, has generated its impressive returns from an exceptionally concentrated high-conviction portfolio rather than from gearing. But , which was runner-up to FGT, is consistently one of the more highly geared trusts in its sector, as is , highly commended in the UK smaller companies sector.

, the runaway winner of our Best European Trust award, has deployed relatively high gearing to enhance the gains from manager Ollie Beckett's good stock-picking, while and trusts, which shared our Japan sector awards, are almost always among the most highly geared trusts in their sector. BGFD was also the highest-ranking equity-oriented contender in our best large trust category.

won this year's global emerging markets trust award thanks to a much improved performance since Carlos Hardenberg took charge in October 2015, adjusted the portfolio and introduced some gearing.

But neither of our Asia ex Japan award winners currently has much gearing. The most highly geared trusts in that sector are managed by Aberdeen's Asian team, which has been through a dull patch on the stock-picking front over the past three years; gearing exacerbated their problems during the 2015 downturn. However, over 10 years Aberdeen's Asian trusts have outperformed.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise.The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.