Seven fund alternatives to equities and bonds

20th July 2017 13:43

by Dzmitry Lipski from interactive investor

Share on

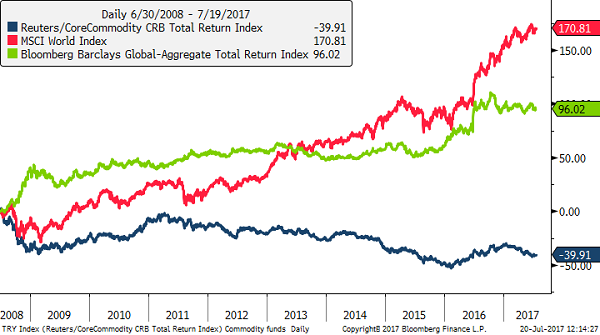

After a decade of loose monetary policy and low interest rates, equity and bond markets rallied and are now trading on stretched valuations. In contrast, commodities have been in a bear market since 2008, but last year started to show growing signs of strength with both Citigroup and Goldman Sachs turning bullish on asset class.

While many investors remain sceptical on whether commodities are currently positioned for sustainable recovery, most agree that commodities, or shares of production companies are worth owning for broader diversification and reduction of risk.

Traditionally, broad exposure to commodities has been considered a good source of portfolio diversification, as it shows low correlations with equities and bonds. Commodities may also be used as a portfolio hedge against rises in inflation and political uncertainty.

In the past decade, demand from China and other emerging markets has been a major driver for commodity and natural resources. With Chinese growth slowing, commodities have been in decline since 2011.

However, some investors argue that even with slowing demand from China, the investment case for the asset class remains strong. As emerging economies' populations continue to grow, urbanise and become wealthier, demand for commodities can be expected to grow in response. And investing in global resources companies can provide investors with the opportunity to access this growth potential.

While commodities are still probably the most unloved and challenged asset class today, this does not mean that the sector lacks opportunities for investors. The global resources equity sector is diverse, with some funds covering all the main sub-sectors of the commodity complex, specifically energy, agriculture, industrial and precious metals.

Investors looking for a diversified portfolio of commodity and natural resources-related equities can consider . For more specialist exposure to mining and infrastructure sectors that are benefiting from higher prices of industrial metals such as copper, iron and steel, (Money Observer Rated Fund) and are good choices for investors to explore.

Alternatively, investors might consider an allocation in emerging markets which are the world's largest producers of natural resources such as Brazil and Russia.

is for investors looking for growth opportunities in energy equities. Fund managers believe that the oversupply in the global oil market continued to weigh on oil prices, but the current situation is unsustainable with a large proportion of production occurring at a loss.

Supply cuts by OPEC countries and slowly rising global demand could lead to more stable, higher prices over the longer term, creating a favourable environment for energy companies.

Preferred funds with indirect exposure to gold are and (Money Observer Rated Fund). Gold is considered an important hedge not only against inflation, but also during an uncertain economic environment. With global monetary policy still loose, an exposure to gold should protect investor's portfolio against any uptick in inflation.

(Money Observer Rated Fund) is a good choice for those looking to gain exposure to agricultural commodities such as sugar, corn and wheat. Agriculture is becoming a more mainstream investment, driven by demand from a growing population. Forecasts suggest the world population will balloon from 7.4 billion today to 9.6 billion by 2050.

No doubt commodities remain a valuable portfolio allocation. However, given the specialist nature of commodity-related investments, they can be subject to specific sector risk and tend to be more volatile as a result. They should, therefore, only play a small role as part of a broader well diversified portfolio.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise.The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.