Why this share is impossible to sell

21st July 2017 16:04

by Richard Beddard from interactive investor

Share on

, how don't I love thee? Let me count the ways…

1. There are those times I wrote to you and you were diffident, and evasive. It seemed like you didn't want me to understand you.

2. You hide yourself away, inviting me just once a year to meet in neutral territory, a motel off the A1(M). Why can't we go to your place?

3. You lead these different lives. You're a manufacturer of naval cannon, you make forgings, and you construct petrol stations. You're complicated.

4. The way things are going, I'm wondering if there is a future in us. I mean, you're not exactly stable.

5. Sometimes I think you love your executives so much more than minority shareholders like me.

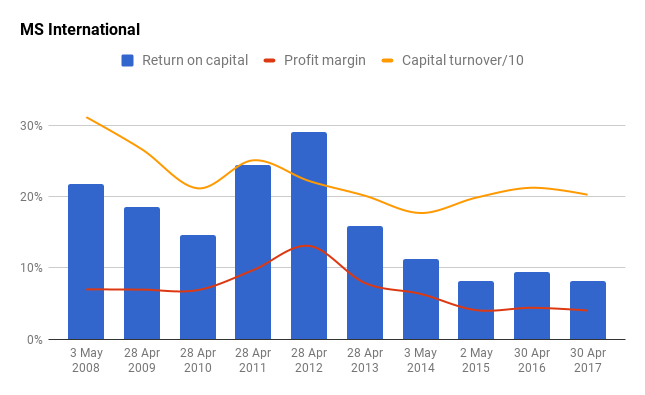

If I were to sum you up in a picture, it would be this one. You're complicated, confusing, up and down a lot...

OK, the chart doesn't show that the profitable businesses are making more money than the unprofitable ones are losing so, on the whole, you're a viable, partner, just.

Over the last few years you've earned an after tax return on capital of 8%, which is just about the bare minimum for me, but if our relationship is to continue for the long-term you've got to shape up.

Things have got to be more like they used to be back when return on capital routinely exceeded 10% and sometimes exceeded 20%. Remember how it was back then?

You're defensive

It's not so long ago you were fulfilling a large 30mm gun order for the US Navy. I understand. It's a much tougher market now. There are mitigating circumstances, and you deserve credit. Your performance might have been better in the financial year to April had an order not been delayed beyond the end of the financial year.

You have an installed base that needs maintaining, which guarantees some revenue in future. You're back earning a reasonable profit margin from cannon and other military hardware.

Some positives then. Perhaps I should be patient. But you're hostage to variable defence budgets at a time, or perhaps during an era, when cuts are a fact of life.

It makes me uneasy that the past may not be a particularly good guide to the future for your biggest and most profitable business.

Fickle

But if we're going to talk about fickle businesses, Forgings gives me the heebie-jeebies. You forge steel and alloys into many shapes for all manner of applications, although your MSI-Forgings website doesn't say what those applications might be.

You describe MSI-Forks, part of the division, as a world-leading manufacturer of fork arms, the blades that fork-lift trucks use to lift things. You also describe the forgings market as highly competitive, and I see that your leading position hasn't protected you from losses when farmers and mining companies, for example, are buying fewer fork-lift trucks. Yours is a capital intensive industry, which, unless you are very unusual, means heavy investment will drag on profit.

Perhaps that's what happened in the year to April 2017? Your annual report describes a "superb and substantial" new fork arm production facility in South Carolina. The cost of building and commissioning it may have contributed to the division's loss, and once you are up to full production maybe we can expect profit again. Through the cycle, though, Forgings is your lowest margin business.

I wonder if it's being carried by the others.

And a bit smelly

I'll get straight to the point here. Petrol Station Superstructures is the second biggest, second most profitable, but hitherto most stable division in MS International. It constructs canopies and stores for oil companies and supermarkets. But petrol stations? Will my children's children even know what they are?

You seem upbeat. You have a strong order book. Your investment in Petrol Sign, a Dutch supplier of signage and branding for petrol stations, should enable you to cross-sell. Hopefully, the new Petrol Station Branding division is only making a loss because of start-up costs in the UK and Germany. It was profitable when you bought it.

But by your own admission, the number of petrol stations has been in decline for decades in the UK. I think that's because supermarkets have filled their tanks deeply to sell petrol cheaply, and since we're prepared to drive there to buy it, we don't need a petrol station around every corner.

In future, won't the petrol station become an endangered species as more and more people plug their electric vehicles in at home?

We argue about money

I've been critical of your executive pay. Your highest paid executive earned £467,000 in the year to April 2017, which is high for a firm with revenues of £50 million. Back when MS International was growing revenue and profit, bonuses were high too.

You employed a kind of multiplier effect by basing pension contributions on salary and bonus, which is unusual. You still do, but most of your executives are over 65 now, and you don't pay into their pensions any more. That's a relief.

But I'm sticking with you

I'm no Elizabeth Barrett Browning, and I'm hardly head over heels in love with you, so enough of the poetic parody.

I'm sticking with you for now, despite everything I've said. You see, you're not a bad company. You're profitable, cash generative and you don't have any debt. You've stayed profitable when your markets have turned against you.

You're investing heavily, which is a good thing as long as your businesses are worth investing in. Net capital expenditure his risen from £600,000 in 2015 to £2 million in 2016, and £4 million in the year to April 2017. That could be exaggerating the slump in profitability.

The surge in excess 'progress payments' in 2017, which your broker confirms are advanced payments for work that has yet to be commenced, may be a sign that business is picking up.

Companies can do well in declining industries and they can do well in competitive industries. But in all your communications with me over the last five years, you have never given me reason to believe your businesses are special. That they have advantages that will allow them to earn more than an 8% return on capital reliably in future.

While I don't think you're a bad company, I can't be confident you're a really good one either.

Long-term there's may be a better place for my money. Short-term though, the shares are on the cheap side and I think things are more likely get better than worse.

You've turned me into a speculator. I hate you MS International.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise.The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.