Should investors buy an investment trust or a fund?

11th August 2017 16:27

by Jennifer Hill from interactive investor

Share on

A recent comparison of open-ended funds versus closed-ended investment companies suggests the latter are losing their edge on charges, but compelling reasons remain to opt for investment trusts, writes Jennifer Hill.

Investment trusts have long been seen to offer superior performance to funds thanks to their ability to 'gear' investments, hold a fixed pool of assets to smooth returns and charge historically lower costs.

Over the longer term, this still holds true: investment trusts, which are closed-ended in nature, outperformed open-ended funds in 13 out of 16 comparable sectors over five years, and 11 out of 16 over 10 years, data from stockbroker Winterflood Securities shows.

However, over the shorter term, they no longer have the upper hand. Over one year, investment trusts outperformed their open-ended equivalents in just half of the 16 comparable sectors. The data is based on investment trust share prices, which can trade at a discount or premium to their underlying net asset value (NAV), and Winterflood stated widening discounts had negatively impacted several sectors in the 12 months to the end of February.

Tony Yousefian, an investment trust specialist at FundCalibre, the investment research and rating service, questions the validity of comparing the share price performance of investment trusts to the NAV performance of open-ended funds. "The one-year period is a very short timeframe to make such an analysis and really it isn't a like-for-like comparison," he says.

"Over 12 months costs of vehicles [fund or trust] will also be almost irrelevant - it's the compounding of higher costs over a number of years that can really impact performance and what investors get back - so I don't think this is a turning point or even a sign of one."

QuotedData, the investment trust research firm, points to another pitfall in the data: the asset allocation of some trusts means they don't fit neatly into the sector to which they have been assigned. Take, for example, the Europe sector, which saw the largest underperformance for trusts over one year compared with the Europe excluding UK fund sector.

, which has a big allocation to UK companies, returned 3.2% in share price terms against an average for the rest of the closed-ended sector of 20.1%. "If we were comparing apples with apples - comparing NAV returns - the European closed-ended fund sector excluding Jupiter European would have beaten the open-ended sector on average, returning 25.6% versus 23.7%," says QuotedData research director James Carthew.

Tilney, the wealth manager, believes structural advantages of investment trusts remain. These include the effective use of gearing (borrowing money to invest alongside shareholders' capital) to help enhance returns in rising markets and their greater suitability for accessing more illiquid asset classes; and that investment managers can be fully invested without having to worry about being forced to sell assets to meet redemption requests from open-ended fund investors.

However, Tilney's analysis of 47 pairs of mirror trusts and open-ended funds with similar mandates and the same teams found that trusts are no longer cheaper than funds now that commission has been stripped out of the latter and lower-cost 'clean' shares classes have been introduced.

So just when does it makes sense to choose a trust over a fund and vice versa? Below we look at seven pairs of mirror trusts and funds and whether investors should favour the fund or the trust in the current environment.

Temple Bar versus Investec UK Special Situations

Where mirror funds exist, Bristol based wealth manager Kohn Cougar has a preference for the investment trust and this is particularly true of . Like its open-ended sister fund, , it is managed by Alastair Mundy using a contrarian approach to stock-picking that focuses on companies that have declined by at least 50% from their peaks.

Both aim to provide income and capital growth; are benchmarked against the ; have nine out of 10 largest holdings in common; and have similar sector weightings with financials, services and industrials occupying the top three spots.

"The only notable differences is Temple Bar has around 10% in overseas stocks, whereas the fund has a short position on the S&P 500, which decreases the net equity exposure to just under 83%," says Kohn Cougar managing director Roddy Kohn.

Over one, five-, 10-and 20-year periods, Temple Bar has outperformed. The trust yields 3.2% and has an ongoing charge of 0.48%, while the fund yields 1.6% and charges 0.84%. "Temple Bar is trading at a discount of around 6%, the yield is higher, the charges are lower," adds Kohn. Winner: Investment trust.

European IT versus EP European Opportunities

Stockboker and wealth management firm Charles Stanley is structure-agnostic, and seeks the best way to express an investment idea, whether it is active, passive, open- or closed-ended.

It rates Edinburgh Partners' disciplined approach to investing in European equities, which pertains to both its and sister open-ended investment company (Oeic), EP European Opportunities.

Partner Craig Armour runs the portfolios without reference to a benchmark and typically has a value and contrarian style bias. They look incredibly similar: both are concentrated (with 30-40 stocks), their top 10 holdings have 90% commonality. The trust is ungeared.

Two big differences come in size and cost. The trust, with assets of £433 million, charges 0.62% per annum, while the Oeic, at £75 million, has ongoing annual charges of 0.88%. In this instance, the choice for Charles Stanley comes down to cost. "We harbour concerns about the high level of ongoing charges investors are paying to access the Oeic product," says collectives analyst Adam Carruthers. Winner: Investment trust.

Jupiter European Opportunities IT versus Jupiter European

These two funds have the same manager in the form of Alexander Darwall. The charges are similar (0.98% for the trust and 1.03% for the fund), the yields are broadly comparable (0.78% and 0.4% respectively) and the portfolios are 76% correlated.

However, there are some fundamental differences: Darwall has used the closed ended structure to good effect to invest in more illiquid areas, according to Diane Weitz, a director of Ashlea Financial Planning. The trust has more than 15% in biotechnology stocks and gearing of 16%.

"Exposure to higher-risk areas seems to have worked well for Jupiter European Opportunities Trust, which has consistently outperformed its mirror fund," says Weitz. However, she also points to its greater volatility: the trust has an FE risk score of 138 (relative to a risk rating of 100 on the UK's leading 100 shares), while Jupiter European scores far closer to the index at 104.

For that reason, Weitz suggests the fund is better suited to investors with a lower risk profile and the trust to those with a higher tolerance for risk and volatility. Winner: Both.

UK Commercial Property IT versus Standard Life Inv UK Real Estate

Property is arguably the least liquid of asset classes - something that was highlighted last summer when the EU referendum saw a string of open-ended property funds pull down the shutters amid mass redemption requests.

Investment trusts have a finite number of shares in circulation; if you want to sell, a stockbroker must first find a willing buyer, meaning managers will never be forced to shift assets at knock-down prices. Poor sentiment post-referendum led to discounts in the sector widening to 17.2% as demand plummeted, but the sector swiftly bounced back and now trades on a premium of around 6%.

"If you managed to buy a property trust on a discount last year, you will have outperformed open-ended funds by some margin," says Ben Willis, head of research at Whitechurch Securities.

To provide liquidity, open-ended property funds tend to include a cash buffer, which acts as a cash drag on performance. Willis prefers , part of the Investments stable. Run by Will Fulton, it yields around 4% and trades on a premium of 4.1%, lower than the peer group average. Winner: Investment trust.

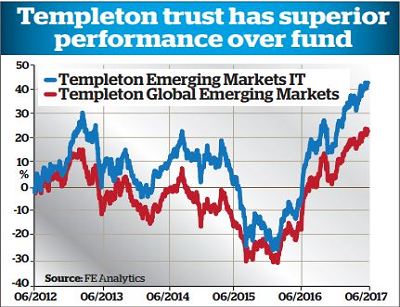

Templeton Emerging Market IT versus Templeton Global Emerging Markets

Seven Investment Management (7IM) uses closed-ended funds to access less liquid strategies - infrastructure, property, debt, private equity - and likes the greater freedom of investment trust managers to hold less liquid stocks.

It prefers to its open-ended mirror. London-based lead manager Carlos Hardenberg, assisted by Mumbai-based research analyst Chetan Sehgal, runs comparable portfolios with a bias towards China and tech stocks.

However, having rarely used gearing in its 28-year history, Hardenberg has recently started deploying a new multi-currency borrowing facility for the trust and initiated its first positions in frontier markets Kenya and the Philippines.

Simon Moore, senior investment manager at 7IM, points to its far superior performance: the trust has almost doubled the return of the fund over the past 12 years "presumably because the open-ended fund has to have some cash or larger, more liquid stocks to be able to meet potential daily redemption requests", he says. Winner: Investment trust.

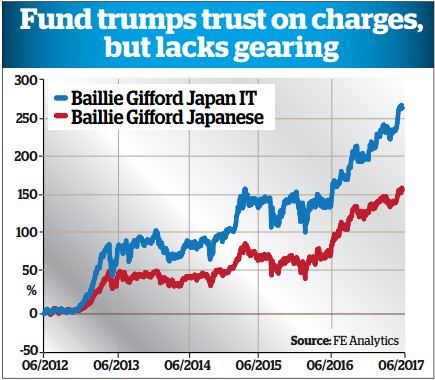

Baillie Gifford Japan IT versus Baillie Gifford Japanese

Baillie Gifford is generally regarded as one of the best managers of Japanese equities thanks to the strong track record of team leader Sarah Whitley. She runs the and its open-ended sister, , the latter alongside Matthew Brett.

"Both are run by the same reputable team, who have bags of experience of investing in these markets," says Willis at Whitechurch. The fund has done slightly better over the past year, but the trust is the stand-out performer over three- and five-year periods, with returns being supercharged by gearing of 16% and its far greater focus on medium and smaller sized companies.

However, the fund trumps the trust in some respects. This is one instance where the fund is cheaper, with ongoing charges of 0.68% versus 0.88% for the trust. The trust is also among the most expensive in its sector, trading at a premium of almost 5%. Willis says whether you favour the trust of fund will depend on your outlook for Japanese equities. Winner: Both.

Impax Environmental Markets IT versus Impax Environmental

was launched in 2002 with the aim of investing in companies that offer the prospect of cleaner, more efficient delivery of water, waste and energy. Its open-ended sister fund was launched in 2004 and, at present, the two portfolios have 91% commonality.

The fund is based off shore in Ireland, presumably to allow it to be marketed in Europe, which helps to explain why there is no clean share class at present. It levies ongoing charges of 1.5% per annum, higher than the 1.13% charged by the trust. This helps to explain the difference in performance.

"The investment trust provides consistently higher returns," says Weitz at Ashlea Financial Planning. "Interestingly, when looking at their respective 10-year performance records, the trust suffered more than the fund during the financial crisis, probably due to its discount widening."

Investors can currently buy into this trust at an 11% discount. This, coupled with the illiquidity of underlying investments, makes the trust the better longer-term option. Winner: Investment trust.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.