Commercial property: Why investment trusts win hands down

14th August 2017 14:26

by David Budworth from interactive investor

Share on

In June 2016 property fund managers went into crisis mode. After the UK voted to leave the EU on 23 June, a wave of investors demanded their money back from property funds amid fears that commercial property prices would crash.

Seven large open-ended funds holding more than £15 billion of investors' cash were suspended, as concern grew that they would not be able to meet redemption requests.

Worrying parallels were drawn with the 2008 property crash, when fire-sales of assets by fund managers added to downward pressure on property prices. In the end, the more doom-laden predictions circulating at the time proved far-fetched.

By the end of 2016 the UK property fund sector had returned to a semblance of normality. All the suspended funds had reopened and the markets appeared calm.

However, the suspension saga has reignited a long-running debate about whether open-ended funds are suitable for investments, such as physical commercial property, that can't be sold in a hurry.

Open-ended property funds let investors withdraw cash daily, even though it takes months to buy and sell the shops, offices and factories that make up fund portfolios.

Most of the time this isn't a problem, as managers hold a portion of investment capital in liquid assets - cash, or shares in real estate investment trusts - to meet redemptions. But when there is a run on a fund and many investors try to sell at the same time, the cash buffer can quickly disappear.

Last year wasn't the first time suspensions or restrictions have had to be imposed to lock investors in until the market stabilised and enough cash could be raised through property sales to meet redemptions. Although the post Brexit vote crisis did not last long, the threat of a liquidity crisis is an ongoing problem for the property sector.

The Financial Conduct Authority is in the middle of reviewing the way open-ended property funds work, to see if improvements can be made. However, a blanket ban on such funds has been ruled out.

Closed-end benefit

Property funds structured as closed-ended investment trusts do not face the same problems. They have a fixed level of capital and issue shares, so when an investor wants to leave a fund, they have to sell their shares.

That does not mean closed-ended funds are immune to property crises: a rush to the exits will push share prices down, so investors may not be offered an attractive price if they try to sell.

As a buyer, though, it can be a time to pick up bargains. This was clearly seen after the Brexit vote when property investment trusts dipped to very steep discounts. Investment trust shares can trade at a lower price (a discount) or higher price (a premium) than their net asset value - the underlying value of the portfolio. When they are out of favour, their discount widens. This is an added complication.

However, closed-ended funds do not face the same pressure to sell properties to meet redemptions at times of market stress, so the fund's shares can continue to trade on the stockmarket as usual.

Many advisers prefer property investment trusts, and not just because they won't pull up the drawbridge in adversity. Alan Brierley, director of the investment companies team at Canaccord Genuity, says: "Investment companies give investors higher exposure to an asset class and more at tractive dividends, and they have delivered superior total returns over most timeframes."

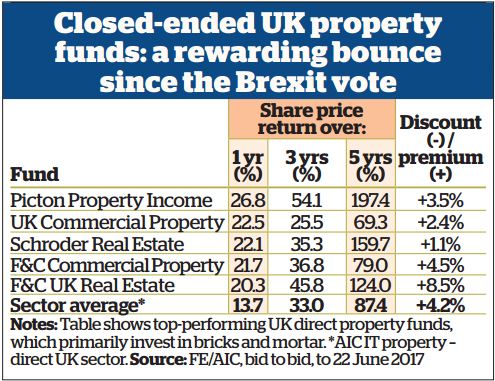

Investment trusts have certainly delivered better performance since the Brexit vote, as our table shows. Over the 12 months since the 23 June 2016 referendum, the average UK investment trust in vesting directly in commercial property has re turned 13.7%, compared with an average of 9.8% from their open-ended fund rivals.

But closed-ended UK property funds have also tended to outperform over longer periods. Over five years the average investment company total return of 87.4% compares with an average of 52% from open-ended funds - note that the figures for the open-ended property fund sector may be inflated by the fact that the sector includes overseas property funds. In addition, the sector includes funds that primarily buy shares in property companies, such as housebuilders.

Maximum exposure

What explains this outperformance? Or to put it another way, why do open-ended funds tend to underperform?

It is largely to do with market exposure. The requirement for open-ended funds to keep a pile of cash instead of fully investing compromises their ability to produce re turns. It's a handicap that has been exacerbated by the Brexit vote shock, which made fund managers fearful of further volatility and particularly risk-averse, increasing their holdings in cash.

Closed-ended funds can invest more of investors' money in property. Moreover, investment trusts can, within limits, employ gearing (borrow money to invest). This heightens risk: if the market falls, gearing will enhance losses. But when the market moves in your favour, gearing can boost returns and revenue.

Investment companies also offer superior income characteristics, according to research by Canaccord Genuity. It found that only one open-ended fund, , offered a yield that could match that of the (3.5% on 31 March 2017). Investment companies offered yields that were consistently higher. The yields from property funds are one of their main attractions and are expected to remain key components of total returns over the next few years, marking a shift in the property cycle.

Brexit vote burden

From 2013 onwards property funds benefited hugely from rising commercial property prices, offering not just decent yields but attractive growth. However, growth in capital values fell dramatically in 2016. Simon Evan-Cook, multi-asset portfolio manager at Premier Asset Management, says: "Coming into Brexit, there was already a lot of selling pressure on property funds."

Data from the Investment Association shows outflows from open-ended funds of £658 million in the first five months of 2016. However, the Brexit vote added rocket fuel to the fire: there was £1.5 billion of net sales in June 2016, and £790 million exited the sector in July 2016.

Since then confidence has been slow to recover. Overall, this year, net sales are roughly flat. Given that more than 12 months after the referendum vote, we are still not much clearer about what shape Brexit will take, what does the resulting ongoing uncertainty mean for commercial property investments?

Evan-Cook is ambivalent about the outlook. He says: "To guess what will happen to commercial property is a fool's errand. But property is reason ably attractive again, though it is not a bargain." He believes UK commercial property is in no better or worse a situation than other UK asset classes as a result of Brexit uncertainty.

The consensus view is that annual total returns from property will average 5.2% over the next five years. "If we are facing some sort of crisis, UK property, equities and corporate bonds are all at risk of capital depreciation," he says. "It is sensible to be diversified."

Evan-Cook holds , , and Media X in his multi-asset portfolios - although he warns that they are all on a premium to NAV.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.