A mid-cap portfolio to beat the FTSE 250

23rd August 2017 11:27

by Graeme Evans from interactive investor

Share on

For all the turbulence facing the UK economy, it's interesting to note that the domestic-leaning outpaced the more in terms of earnings upgrades during the summer results season.

Research from UBS has found that about 60% of the 150 FTSE 250 companies in the results spotlight since the start of July saw their share price rise on the day, with a quarter achieving a gain of more than 3%.

Of particular note is the large proportion of the top 20 performers that are UK exposed, including , , , , and .

The weaker pound and higher commodity prices will have helped the earnings per share (EPS) momentum in some cases, but UBS warns that these tailwinds are annualising and that investors will need to be more selective in backing UK winners.

Having said that, UBS has made no changes to its UK Mid-Cap First XI, which features high-conviction ideas from across its UK research team.

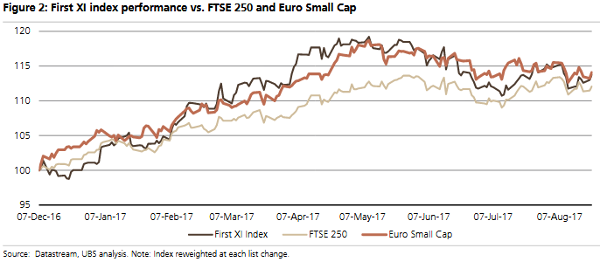

The First XI is up on average 14% since its inception in early December and continues to outperform the wider FTSE 250, which is up by 12%. However, the outperformance has narrowed in recent weeks, predominately due to a sharp fall at .

The top performers since the last update on 21 June have been (up 8.4%), (up 6.1%), (up 5.4%) and (up 4.5%). Other positives came from Ladbrokes Coral, and , while is also higher despite an 8% fall on results day.

UBS said Vesuvius, which provides engineering services to the steel and foundry industries, and (not in the first XI) were harshly de-rated on their results, creating a further buying opportunity.

The other two members of the UBS mid-cap first XI - and - were lower by 5% and 10.4% respectively. The 19% slump for Dixons Carphone came despite a lack of actual trading news in the period, with uncertainty over the consumer backdrop likely to be one reason for the heavy fall.

UBS forecasts UK GDP growth of 1.4% in 2017 and 0.7% in 2018, with both these figures below consensus. In a previous note, it said that the UK macro outlook, earnings outlook and, arguably, the political outlook were all deteriorating relative to Europe.

The FTSE 250 has on average outperformed the FTSE 100 between 2009 and 2016. After a setback for the Brexit vote, this trend continued with a rise of 9% over the last 12 months, compared with 6% for the FTSE 100.

Food and beverages; technology; and financial stocks have been the strongest-performing sectors over the year to date, with autos the worst performing.

The UK accounts for 57% of the average geographic exposure in the FTSE 250, compared with 42% for the FTSE 100. UBS noted that the pound is 13% lower against the US dollar, down 15% against the euro and 10% cheaper versus the Japanese yen since the UK referendum vote in June 2016.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.