ISAs versus SIPPs: Which is best over 40 years?

18th September 2017 11:22

When it comes to drawing an income in retirement, there is one stark difference between an ISA and a SIPP: withdrawals from an ISA are tax-free, while only 25% of your pension pot can be taken as tax-free cash.

The more your pension fund grows over the years, the more tax you'll pay when accessing it. Typically, you will pay more in tax than you received in tax relief when making contributions.

Is there an argument therefore for focusing on an ISA when you're younger - because you could get 40 or 50 years' growth and it would all be tax-free and uncapped when withdrawn - but then switching focus to a SIPP closer to retirement, to build up contributions rather than capital growth? We asked an expert to crunch some numbers.

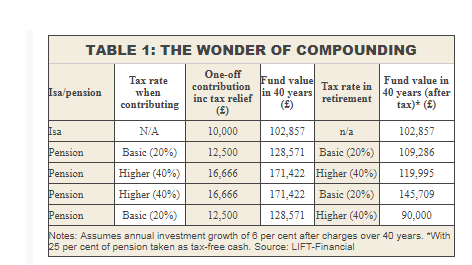

Jonathan Halsall, a chartered financial planner at LIFT-Financial, says: "There would almost certainly be more tax paid on the way out than relief received on the way in. For example, someone paying higher-rate tax both during their working life and in retirement would receive upfront tax relief of £6,666 on a £10,000 contribution and pay tax of £51,427 on the way out 40 years later, if the investment grew by 6% a year. But importantly, the remaining fund is £119,995, which is £17,138 ahead of the ISA (see table 1).

"Even though an ISA would be tax-free at the end of your working life, the fact that it is depleted in relative terms at the beginning means it still loses out in monetary terms to a pension taxed on withdrawals."

Anne McClean, a chartered financial planner at Charles Stanley, says: "This demonstrates the miracle of compound interest at work - what Albert Einstein allegedly referred to as the eighth wonder of the world. The growth of the enhanced contribution in the first instance makes it hard to catch up."

Tipping the balance

An important consideration in any analysis is the tax status of the investor at each stage.

The Institute for Fiscal Studies estimates that six out of seven higher-rate taxpayers will be basic-rate taxpayers in retirement, and in such cases the net benefit from a £10,000 contribution over 40 years with 6% growth a year is even more favourable, at £145,709.

"Someone receiving higher-rate tax relief when funding their pension, who is then able to withdraw funds as a basic-rate taxpayer, will benefit even more from the pension," says Guy Kelland, managing director at financial planner Kellands. "The bottom line is that it's hard to better a pension from a tax perspective."

For someone whose tax rate is the same when making contributions and taking withdrawals, it is the ability to take 25% of the pension fund tax-free that swings the balance in its favour. Tables 1 and 2 contrast the final fund values with and without the impact of the tax-free lump sum.

Halsall believes this would be "politically difficult to get rid of ", and says: "The impact of the taxfree cash is to make the pension option better for anyone paying the same rate of tax in retirement as they did in their working life. However, anyone paying a lower rate of tax in retirement than they did when working would be better off in a pension, even without factoring in the tax-free cash."

One exception

The exception to the rule is that the pension does not work as well where someone is paying a higher rate of tax in retirement than they paid when they made their contributions. In this case the ISA trumps the pension. The ISA produces £102,857 per £10,000 investment over 40 years, while a pension delivers just £90,000 with tax-free cash or £77,143 without.

"Most people pay the same or a lower rate of tax in retirement, but for someone younger and still building their career, who receives basic-rate relief to start with but pays higher-rate tax later on and into retirement, the contributions they would pay while a basic-rate taxpayer would be more eff ective in an ISA," says Halsall. It can therefore make sense to invest in an ISA until the time is right to switch to a pension.

"ISAs are great in early years, as they are fl exible and allow access if you need cash, although this is a huge downside if you dip into the money regularly and don't leave it to grow," says Geordie Bulmer, an independent financial adviser at AISA Professional. "Pensions are great to switch to as you approach retirement, particularly if you have become a higher-rate taxpayer."

It works like this: say you're a basic-rate taxpayer who invests £10,000 in an ISA. You will have £13,382 after five years, assuming annual growth of 6%, figures from Charles Stanley show. Now a higher-rate taxpayer, you take the money out of the ISA tax-free and invest it in a pension. Your contribution, is now worth £22,303 with 40% tax relief. Invested for a further 15 years it would be worth £53,450 - considerably more than you would get if you put your initial investment into a pension when you were a basic-rate taxpayer (£40,089), or left it in an ISA (£32,071).

It's important to note that the figures in tables 1 and 2 are based on someone drawing on their pension at a sustainable rate. If someone was to take their whole pension in one go or take more signifi cant amounts, they could face paying pay higher sums in tax in retirement than when they were contributing to their pension.

"This is where an ISA is more advantageous, as no tax is due, even if you take the entire fund," says Halsall.

Pick 'n' mix

For most people, building up both ISA and pension funds is the best solution. That way, the ISA funds can be used if larger lumps sums are needed over and above the tax-free cash available from a pension.

ISAs can be accessed at any time and are great for financing big-ticket expenses in life, such as school fees or a wedding, or for clearing a mortgage. Pension assets are typically tied up until age 55, but they are better for supercharging your retirement savings. They are also useful for passing wealth on to the next generation.

Pensions can now be paid tax-free if you die before the age of 75; if you die thereafter, your benefi ciaries will pay tax on any withdrawals at their marginal rate of income tax. ISAs can be passed tax-free to a spouse on death but are otherwise liable to 40% inheritance tax.

"The fact that your pension pot typically sits outside your estate for inheritance tax purposes is very attractive, especially for older investors, though you can now make your ISA tax-free too by investing in some Aim-listed companies," says Ben Yearsley, a director at Shore Financial Planning.

Brian Bradley, a chartered financial planner at Clarke & Partners, recommends that his clients aim for a £500,000 pension pot and a £250,000 ISA fund at age 60, which should make "retirement pretty secure".

Finally, remember that tax rules change constantly - and sometimes frequently. Keep your plans under review and be prepared to change tack if necessary.

Tips for a tax-free retirement

By using a mixture of tax wrappers, you can achieve a completely tax-free income in retirement. Look at the example someone who retires at 60, but won't qualify for the state pension until age 66 and receives no other taxable income.

You could take your entire personal allowance of £11,500 from your pension and start to withdraw your 25% tax-free cash entitlement in phased amounts, rather than as a one-off lump sum. This would result in a withdrawal of £15,333.33 completely free of tax this year.

If that's insufficient to fund retirement, it could be supplemented with tax-free income from an ISA.You would still be able to withdraw 25% of the remaining value of your pension as tax-free cash and potentially 25% of any growth in value.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks